PKR nearing 227/USD, nosedives by 1.9 rupees

By MG News | July 21, 2022 at 04:53 PM GMT+05:00

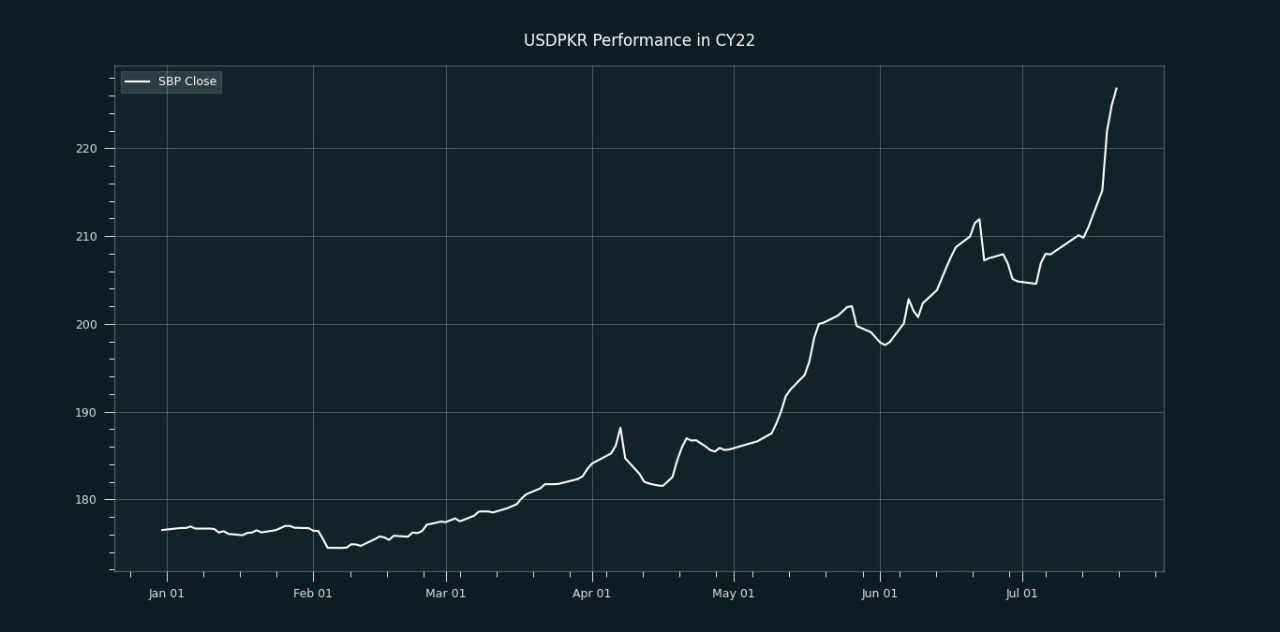

July 21, 2022 (MLN): The melting foreign exchange reserves in the absence of an IMF tranche, and the political turmoil have forced the Pakistani rupee (PKR) to further lose its ground by 1.9 rupees against the US dollar. In today’s session, the currency closed the trade at PKR 226.81 per USD compared to the previous closing of PKR 224.92 per USD.

The rupee endured a volatile trading session with quotes being recorded in a range of 2.81 rupees per USD showing an intraday high bid of 227.25 and an intraday low offer of 226.44 while in the open market, PKR was traded at 225/228 per USD.

Business forums such as the Pakistan Business Council (PBC) and the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) have raised their concerns pertaining to the economic challenges being faced by the country.

President FPCCI, in the press conference on Thursday, said, “The continuous depreciation of PKR has now turned into a national security issue.”

If timely measures would not taken, Pakistan will be no different than Sri Lanka, he warned. He further indicated that businessmen are facing a dollar shortage in the market due to speculative elements.

He also claimed that commercial banks are also involved in the speculation of the dollar. He called for the intervention of the Competition Commission of Pakistan (CCP) to resolve this issue.

Thus, the cost of doing business has increased significantly and businessmen/industrialists will have to shut their businesses down if the situation remains unchanged.

Government should incentivize export-led industries and focus on import substitution otherwise, the rupee will remain under freefall.

Earlier today, PBC emphasized the unity of all the political parties of the country in challenging times wherein the economy is going through its roughest patch.

On the IMF front, the fund wants to ensure that Saudi Arabia will follow through with as much as $4 billion in funding to Pakistan to ensure that the government does not have a funding gap after the IMF loan.

Meanwhile, Amreen Soorani, Head of Research at JS Global is of the view, “An attempt to control the ongoing depreciation may invite another round of monetary tightening, which may continue to shift the preference of the smart money from cyclical to financials, albeit keeping credit cost as a key risk.”

In CYTD, the local unit plummeted by Rs50.29 or 22.18% against the USD while it registered a decline of 9.68% against the greenback in MTD, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 28.91% against the greenback while reaching its lowest at 226.81 on July 21, 2022, and the highest of 161.22 on July 26, 2021.

Furthermore, the local unit has weakened by 17.80% and 17.96% against EUR and GBP, respectively since its high on July 26, 2021.

The performance of the local unit remained bleak against other major currencies in one month as the currency lost its value by 6.76%, 6.62%, 5.96%, 5.80%, 4.57%, 3.80%, and 3.25% against AED, SAR, CHF, CNY, JPY, EUR, and GBP, respectively.

The currency lost 75 paisa to the Pound Sterling as the day's closing quote stood at PKR 270.52 per GBP, while the previous session closed at PKR 269.76 per GBP.

Similarly, PKR's value weakened by 88 paisa against EUR which closed at PKR 231.01 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 14.25/14.50%, whereas the 1-week rate was 14.15/14.25%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 110,100.00 | 110,525.00 107,865.00 |

-315.00 -0.29% |

| BRENT CRUDE | 67.87 | 67.96 67.22 |

-0.43 -0.63% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.12 | 67.18 65.40 |

-0.88 -1.31% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI