PKR nearing 208 per USD in interbank market

MG News | June 16, 2022 at 04:56 PM GMT+05:00

June 16, 2022 (MLN): The ongoing chaos amidst melting foreign exchange reserves has further pushed the Pakistani rupee (PKR) to lose its value by 1.2 rupees in today’s interbank session as the local unit glided to PKR 207.67 against the US dollar compared to yesterday's closing of PKR 206.46 per USD.

While in the open market, the domestic unit was traded at 207.50/209 per USD.

During the day, within the interbank market, PKR witnessed a volatile trading session with quotes being recorded in a range of 1.85 rupees per USD showing an intraday high bid of 207.85 and an intraday low offer of 206.50.

Speaking to Mettis Global, Ahsan Mehanti, Director Arif Habib Group said, the demand for the dollar against almost all major currencies is increasing after Fed’s decision to increase the policy rate by 75 bps. Resultantly, PKR also took a beat against the USD.

“Moreover, the state of fast depleting reserves has created panic among local importers and they are increasing their cover by demanding more dollars,” he added.

It is said that exporters remain in the sweet spot due to PKR depreciation but in the present scenario, exporters can not reap the due benefits owing to the Russia-Ukraine tension. The export market become very confined for Pakistan, he noted.

In addition to it, domestic policies have also hit industrial activity.

Zafar Paracha, President of Exchange Companies Association of Pakistan (ECAP) told Mettis, “No significant measure by the government to halt the continues drop in PKR indicates that currency depreciation may be a part of IMF agreement.”

He said that under the given circumstances, PKR should not be more than 190-192 per USD.

In order to arrest the freefall of rupees, he suggested that government should tag imports with exports. There must be a condition for importers to show some of their exports to get an import permit from the government. He was also of the view that the Pakistani government should curtail its unnecessary expenditures to prevent the country from further debts.

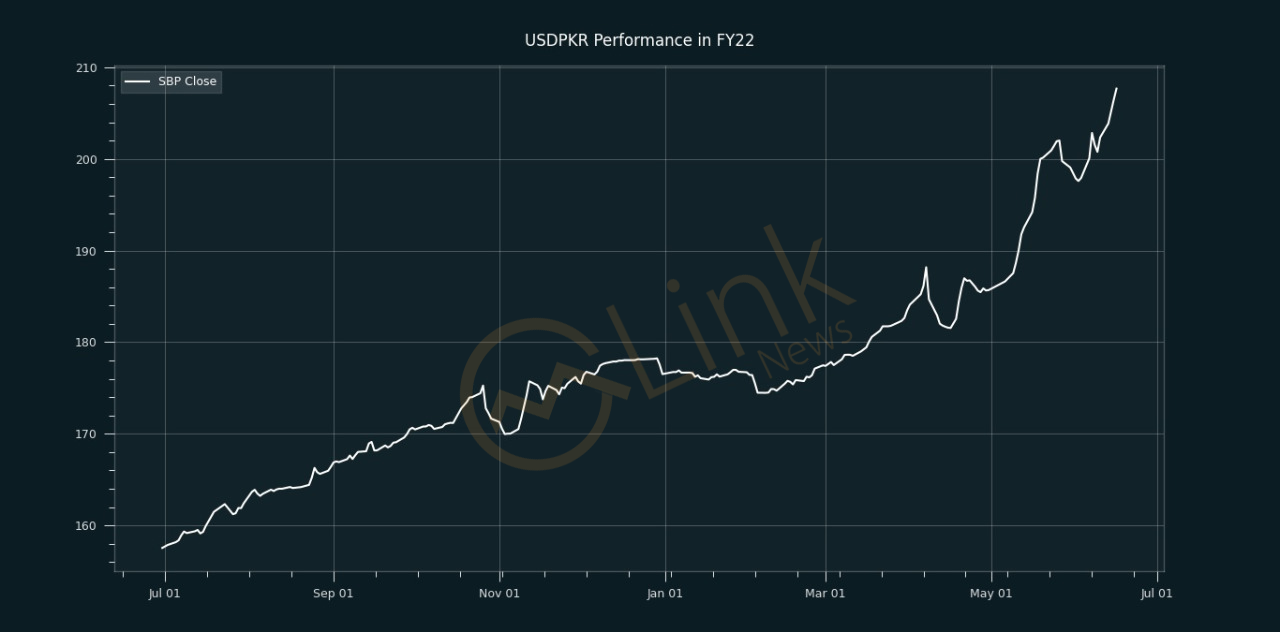

From July’21 to date, the local unit has lost Rs50.12 against the USD. Similarly, the rupee fell by Rs31.16 in CY21, with the month-to-date (MTD) position showing a decline of 4.44%, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 24.52% against the greenback while reaching its lowest at 207.67 today, and the highest of 156.74 on June 17, 2021.

Furthermore, the local unit has weakened by 13.52% since its high on July 02, 2021, against EUR while, it has dropped by 13.62% against GBP since its high on July 02, 2021.

Meanwhile, the currency lost 2.1 rupees or 0.84% to the Pound Sterling as the day's closing quote stood at PKR 251.52 per GBP, while the previous session closed at PKR 249.41 per GBP.

Similarly, the local unit weakened against CHF, JPY, CNY, AED, and SAR by 2.05%, 1.30%, 0.64%, 0.59%, and 0.58%, respectively.

On the other hand, PKR's value strengthened by 51 paisa or 0.24% against EUR which closed at PKR 215.98 at the interbank today.

.jpeg)

On another note, within the money market, the overnight repo rate towards the close of the session was 14.25/14.50 percent, whereas the 1-week rate was 13.85/13.95 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,570.00 | 123,615.00 118,675.00 |

2040.00 1.72% |

| BRENT CRUDE | 69.08 | 71.53 69.05 |

-1.28 -1.82% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.83 | 69.65 66.80 |

-1.62 -2.37% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|