PKR marches on IMF tranche, Sukuk

MG News | February 03, 2022 at 05:10 PM GMT+05:00

February 03, 2022 (MLN): Pakistani rupee (PKR) witnessed a sharp recovery against the US dollar in today’s interbank session as the currency settled the trade at PKR 176.41 per USD, appreciating by 89 paisa owing to the approval of the IMF tranche and inflow of $1bn against International Sukuk.

The local unit kicked off the trading session on a positive note as it managed to gain 35 paisa during the first hour and traded within a very narrow range of 16 paisa per USD showing an intraday high bid of 176.14 and an intraday low offer of 175.35 throughout the day.

On IMF approval for a $1billion tranche under the Extended Fund Facility (EFF) program, Finance Minister Shaukat Tarin said, IMF loan revival is very welcoming for Pakistan’s economy, indicating that IMF agrees to our economic strategy.

“This approval will bring stability in our economy and currency,” he added.

Apart from IMF tranche and Sukuk, PKR has made notable gain on the back of shrinking trade deficit resultantly lower imports and higher exports witnessed during January 2022.

As per money market experts, PKR will continue to remain stable in the medium term as the macroeconomic condition of Pakistan is quite sustainable for local currency in the interbank.

In a recent development, Finance Minister also informed that Pakistan is planning to raise $1 billion through an ESG-compliant Eurobond in March, which would follow a similar amount of Sukuk last week, to end its dependence on multilateral lenders by reducing the deficit for sustainable economic growth which will also help PKR to gain further ground.

Similarly, the PKR has observed less volatility during the past 30 days due to the prevailing certainty on the macroeconomic front.

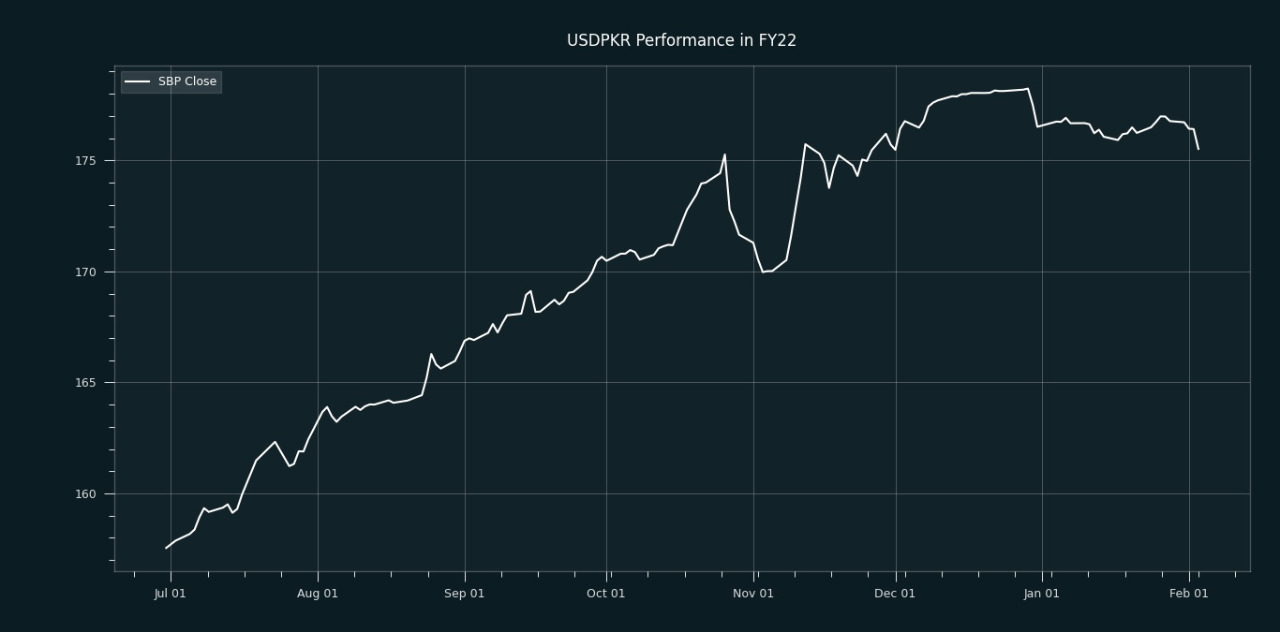

Meanwhile, the local unit has lost Rs17.97 against the USD from July’21 to date, Whereas, the rupee appreciated by 99 paisa in CY22, with the month-to-date (MTD) position showing a gain of 0.68%, as per data compiled by Mettis Global.

The domestic unit performed comparatively better against USD, CNY, AED and SAR by 0.68% during the month to date. On the flip side, the currency lost its ground against CHF, EUR and GBP by 0.48%, 0.40%, and 0.17%.

According to the ECAP, PKR witnessed no change in the open market as the currency closed at PKR 176.50 and PKR 177.50 for buying and selling, respectively.

The currency gained 95 paisa against the Pound Sterling as the day's closing quote stood at PKR 237.89 per GBP, while the previous session closed at PKR 238.84 per GBP.

Similarly, PKR's value strengthened by 90 paisa against EUR which closed at PKR 198.21 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation (OMO) in which it injected Rs81 billion into the market for 1 day at 9.87 percent.

The overnight repo rate towards the close of the session was 9.75/9.90 percent, whereas the 1-week rate was 9.85/9.95 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,925.00 | 120,695.00 116,090.00 |

-3310.00 -2.75% |

| BRENT CRUDE | 68.79 | 69.41 68.60 |

-0.42 -0.61% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.66 | 67.13 66.22 |

-0.32 -0.48% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|