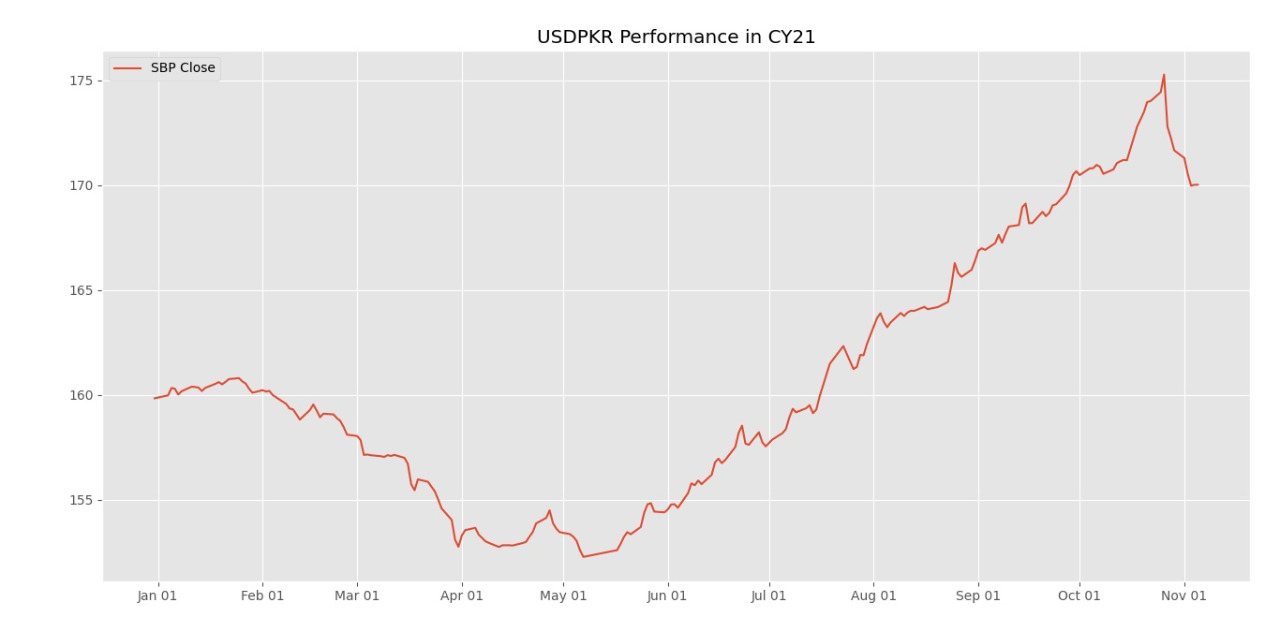

PKR gains 1.6 rupee over the week

MG News | November 05, 2021 at 05:02 PM GMT+05:00

November 05, 2021 (MLN): Pakistani rupee (PKR) managed to hold its ground against the greenback in today’s interbank market session as the currency closed the trade at PKR171.01.

The local unit took a breather today due to the weekend in the Middle East, as hinted by Asad Rizvi, the former Treasury Head at Chase Manhattan in his early morning Tweet.

During the week ended, SBP’s reserves increased by $52.9million to $17,199.6mn. The updated data did not include a $3 billion Saudi deposit, probably it will be shown in next week's update after receiving the credit in the SBP account, he added.

The rupee traded within a very narrow range of 23 paisa per USD showing an intraday high bid of 170.15 and an intraday Low offer of 169.90.

During the week, the currency has gained 1.6 rupees against the greenback, as the previous week was concluded at PKR 171.65 per USD.

Within the Open Market, PKR was traded at 170.00/171.70 per USD.

The domestic unit has depreciated by 7.34% or PKR 12.47 in the fiscal year-to-date against the USD. Similarly, the rupee has weakened by 5.99% or PKR 10.18 in CY21, with the month-to-date (MTD) position showing a decline of 0.94%, as per the data compiled by Mettis Global.

Alternatively, the currency gained 2.4 rupees against the Pound Sterling as the day's closing quote stood at PKR 229.5 per GBP, while the previous session closed at PKR 231.87 per GBP.

On the other hand, PKR's value weakened by 11 paisa against EUR which closed at PKR 196.52 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation in which it mopped up Rs.1.8 trillion for 7 days at 7.36 percent.

The overnight repo rate towards the close of the session was 7.40/7.50 percent, whereas the 1-week rate was 7.35/7.45 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves