PKR finds stable ground at 174.5 per USD

MG News | February 08, 2022 at 05:19 PM GMT+05:00

February 08, 2022 (MLN): Despite getting $1billion each from Sukuk proceeds and IMF loan, the Pakistani rupee (PKR) remained steady in an interbank market today as it closed the trade at PKR 174.5 against the US Dollar (USD), depreciating by a marginal three paisa.

The local unit had closed yesterday’s session at 174.47 per USD.

The rupee endured a relatively dull trading session with very little intraday movement, trading in a range of 23 paisa per USD showing an intraday high bid of 174.58 and an intraday low offer of 174.45.

According to Asad Rizvi, the former Treasury Head at Chase Manhattan Bank, “Remittance and exports have inched up while $ 3.4bn deposits in Roshan Digits Account (RDA) is encouraging.”

Nevertheless, higher oil prices are surly hurting, he noted.

With thin fiscal space, high inflation and effort to keep the interest rate unchanged, it is a tough ask to execute and perform to get the remaining $3bn IMF loan due to commitment, he mentioned recently on his Twitter.

Highlighting the need for Agri policy, he said, “Why don’t we adapt to changing needs and stop blaming international market prices?

Within the Open Market, PKR was traded at 175/176 per USD.

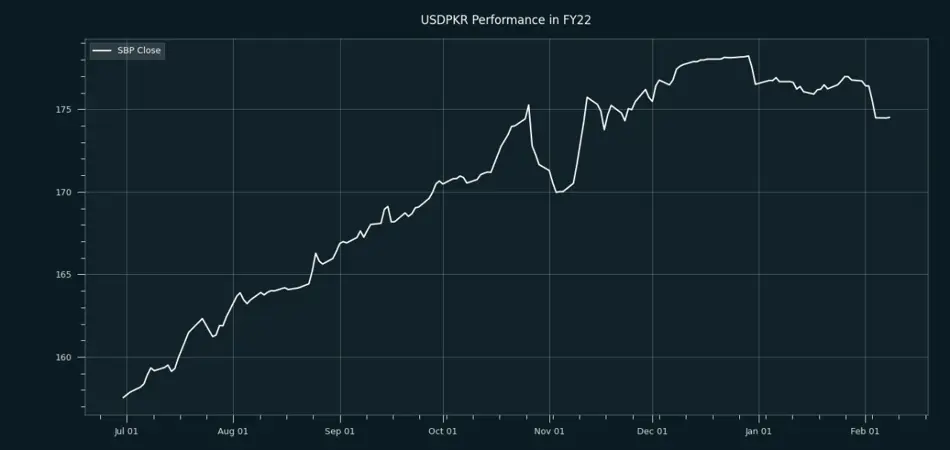

From July’21 to date, the local unit has lost PKR16.96 against the USD, whereas, the rupee appreciated by PKR2 in CY22, with the month-to-date (MTD) position showing a gain of 1.27%, as per data compiled by Mettis Global.

While comparing the performance of PKR against other currencies, the local unit witnessed a massive depreciation of 11% against CNY in the fiscal year to date. It weakened by 9.72% against AED. Similarly, PKR has also lost ground against JPY, CHF, GBP and EURO by 5.73%, 9.59%, 7.79%, 5.88%, respectively, in FY22 so far.

Meanwhile, the currency lost 16 paisa to the Pound Sterling as the day's closing quote stood at PKR 236.4 per GBP, while the previous session closed at PKR 236.24 per GBP.

On the other hand, PKR's value strengthened by 51 paisa against EUR which closed at PKR 198.97 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 9.70/9.80 percent, whereas the 1-week rate was 9.80/9.90 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 161,210.68 402.54M | 3.49% 5433.46 |

| ALLSHR | 96,097.29 718.60M | 3.34% 3102.77 |

| KSE30 | 49,781.74 146.66M | 3.95% 1890.99 |

| KMI30 | 230,597.11 158.11M | 4.81% 10582.05 |

| KMIALLSHR | 62,183.27 382.16M | 3.79% 2272.55 |

| BKTi | 46,523.21 43.62M | 2.50% 1134.61 |

| OGTi | 32,678.22 24.62M | 6.68% 2046.87 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 73,095.00 | 73,600.00 72,020.00 | -350.00 -0.48% |

| BRENT CRUDE | 82.36 | 84.74 81.50 | 0.96 1.18% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 0.00 0.00 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 75.78 | 78.09 74.97 | 1.12 1.50% |

| SUGAR #11 WORLD | 13.71 | 13.80 13.68 | -0.02 -0.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

MTB Auction

MTB Auction