PKR appreciates by 7 paisa against USD

MG News | November 15, 2024 at 04:10 PM GMT+05:00

November 15, 2024 (MLN): The Pakistani rupee (PKR) increased by 7.04 paisa or 0.03% against the US dollar in Friday's interbank session to settle the trade at PKR 277.67 per USD, compared to previous closing of 277.74.

Throughout the day, the currency saw an intraday high (bid) of 278.00 and a low (ask) of 277.90.

On a weekly basis, the local unit gained 7 paisa or 0.02% against USD.

In the open market, exchange companies quoted the dollar at 276.96 for buying and 278.74 for selling.

In comparison to major currencies, PKR decreased 42.55 paisa or 0.15% against the Euro, closing at 293.50 compared to the previous value of 293.07.

Against the British Pound, PKR appreciated by 89.45 paisa or 0.25% to 351.54 compared to 352.44 a day ago.

The local unit gained 7.93 paisa or 0.03% against Swiss franc to close at 312.99.

Against the Japanese Yen, PKR's value depreciated 0.34 paisa or 0.19% to close the session at 1.7856 versus 1.7822 a day ago.

Pakistani Rupee decreased 5.21 paisa or 0.14% against Chinese Yuan to close at 38.42 from 38.37.

The local currency decreased by 1.47 paisa or 0.02% against Saudi Riyal to 73.94. While it strengthened by 1.92 paisa or 0.03% against the U.A.E Dirham to close at 75.60.

During the current fiscal year, PKR has rose against the US Dollar by 67.15 paisa or 0.24%. While it has gained 4.19 rupees or 1.51% so far this calendar year.

In the Money Market, the benchmark 6 Month Karachi Interbank Bid and Offer rates increased by 8 bps to 13.35% and 13.60%.

The State Bank of Pakistan (SBP) conducted an auction on Wednesday in which it sold Market Treasury Bills (MTBs) worth Rs775.82 billion. Yields remained largely stable.

The government slashed the rate for three-month tenor by 20bps to 13.69% while the yield on benchmark six-month T-bills was kept unchanged at 13.5%.

Meanwhile, the yield on 12-month papers was increased by 10bps to 13.19%.

SBP conducted a reverse repo and Shariah Compliant Modarabah based Open Market Operation (OMO) today, in which it cumulatively injected a total of Rs3.09 trillion into the market.

Performance Summary

| Currency | Nov 15, 2024 | Nov 14, 2024 | 1D | 7D | 1M | FYTD | CYTD | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | 277.6697 | 277.7401 | 0.0704 | 0.03% | 0.0677 | 0.02% | 0.0726 | 0.03% | 0.6715 | 0.24% | 4.1910 | 1.51% |

| EUR | 293.4968 | 293.0713 | -0.4255 | -0.14% | 5.4459 | 1.86% | 9.5478 | 3.25% | 4.1892 | 1.43% | 18.0015 | 6.13% |

| GBP | 351.5437 | 352.4382 | 0.8945 | 0.25% | 8.0013 | 2.28% | 11.6737 | 3.32% | 0.3771 | 0.11% | 7.0535 | 2.01% |

| CHF | 312.9907 | 313.0700 | 0.0793 | 0.03% | 4.9140 | 1.57% | 9.4592 | 3.02% | -3.5851 | -1.15% | 22.0791 | 7.05% |

| JPY | 1.7856 | 1.7822 | -0.0034 | -0.19% | 0.0344 | 1.93% | 0.0776 | 4.35% | -0.0558 | -3.12% | 0.2039 | 11.42% |

| SAR | 73.9368 | 73.9221 | -0.0147 | -0.02% | 0.0023 | 0.00% | 0.0430 | 0.06% | 0.2579 | 0.35% | 1.2260 | 1.66% |

| AED | 75.5985 | 75.6177 | 0.0192 | 0.03% | 0.0164 | 0.02% | 0.0177 | 0.02% | 0.1819 | 0.24% | 1.1442 | 1.51% |

| CNY | 38.4233 | 38.3712 | -0.0521 | -0.14% | 0.3658 | 0.95% | 0.6153 | 1.60% | -0.1181 | -0.31% | 1.2081 | 3.14% |

52 Week Performance

| Currency | High | Low | Trading Band | % Since High | % Since Low | High Date | Low Date | Days Since High | Days Since Low |

|---|---|---|---|---|---|---|---|---|---|

| USD | 277.5179 | 288.1406 | 10.6227 | -0.05% | 3.77% | 04-Oct-24 | 15-Nov-23 | 42 | 366 |

| EUR | 293.0713 | 313.4962 | 20.4249 | -0.14% | 6.81% | 14-Nov-24 | 29-Nov-23 | 1 | 352 |

| GBP | 343.9880 | 372.1217 | 28.1337 | -2.15% | 5.85% | 23-Apr-24 | 30-Sep-24 | 206 | 46 |

| CHF | 304.0534 | 335.8529 | 31.7996 | -2.86% | 7.30% | 27-May-24 | 28-Dec-23 | 172 | 323 |

| JPY | 1.7211 | 2.0020 | 0.2809 | -3.61% | 12.12% | 03-Jul-24 | 28-Dec-23 | 135 | 323 |

| SAR | 73.8767 | 76.8293 | 2.9526 | -0.08% | 3.91% | 04-Oct-24 | 15-Nov-23 | 42 | 366 |

| AED | 75.5541 | 78.4505 | 2.8964 | -0.06% | 3.77% | 04-Oct-24 | 15-Nov-23 | 42 | 366 |

| CNY | 38.2611 | 40.0793 | 1.8182 | -0.42% | 4.31% | 22-Jul-24 | 21-Nov-23 | 116 | 360 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

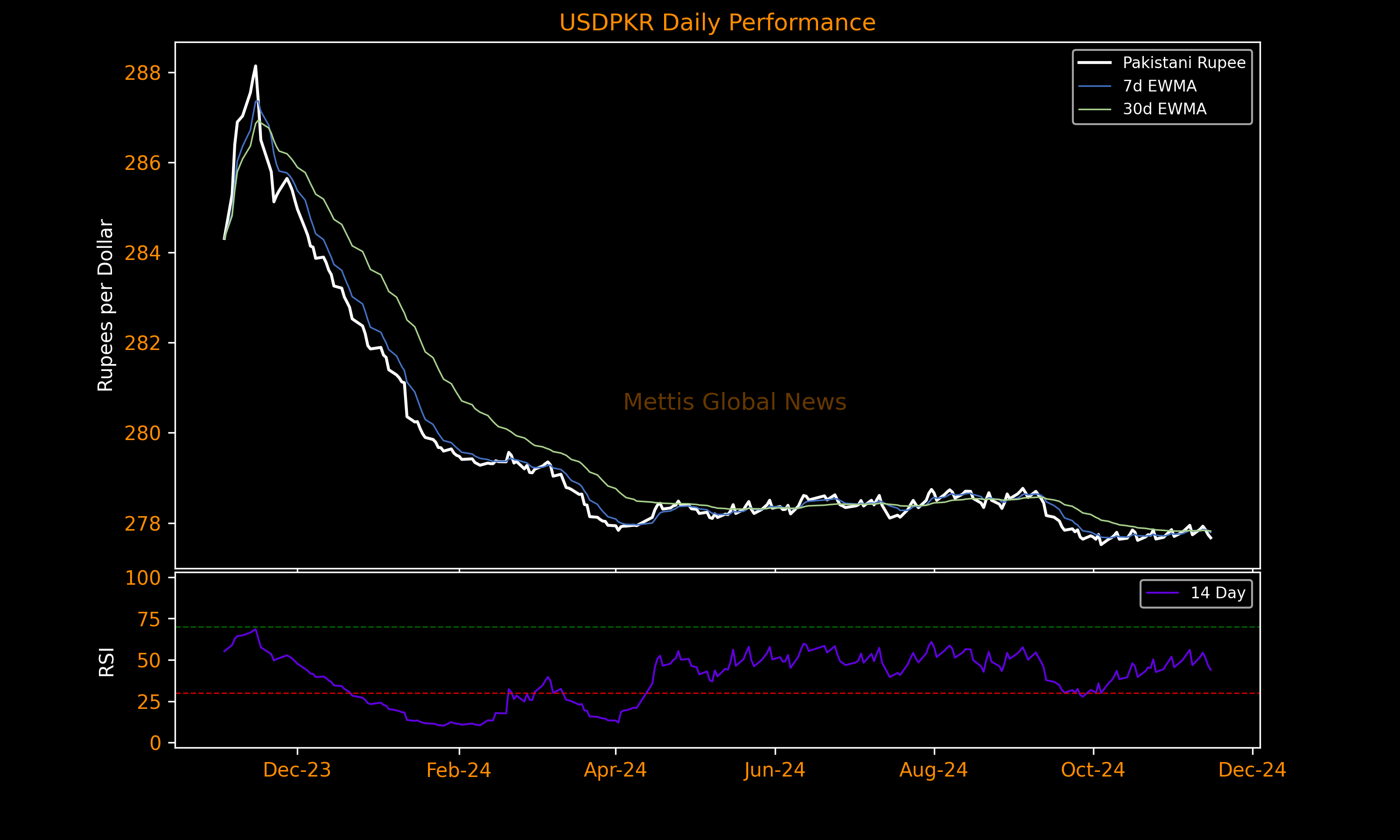

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves