Pakistan's bullion prices break all-time records this week

Rafay Malik | April 06, 2024 at 08:39 PM GMT+05:00

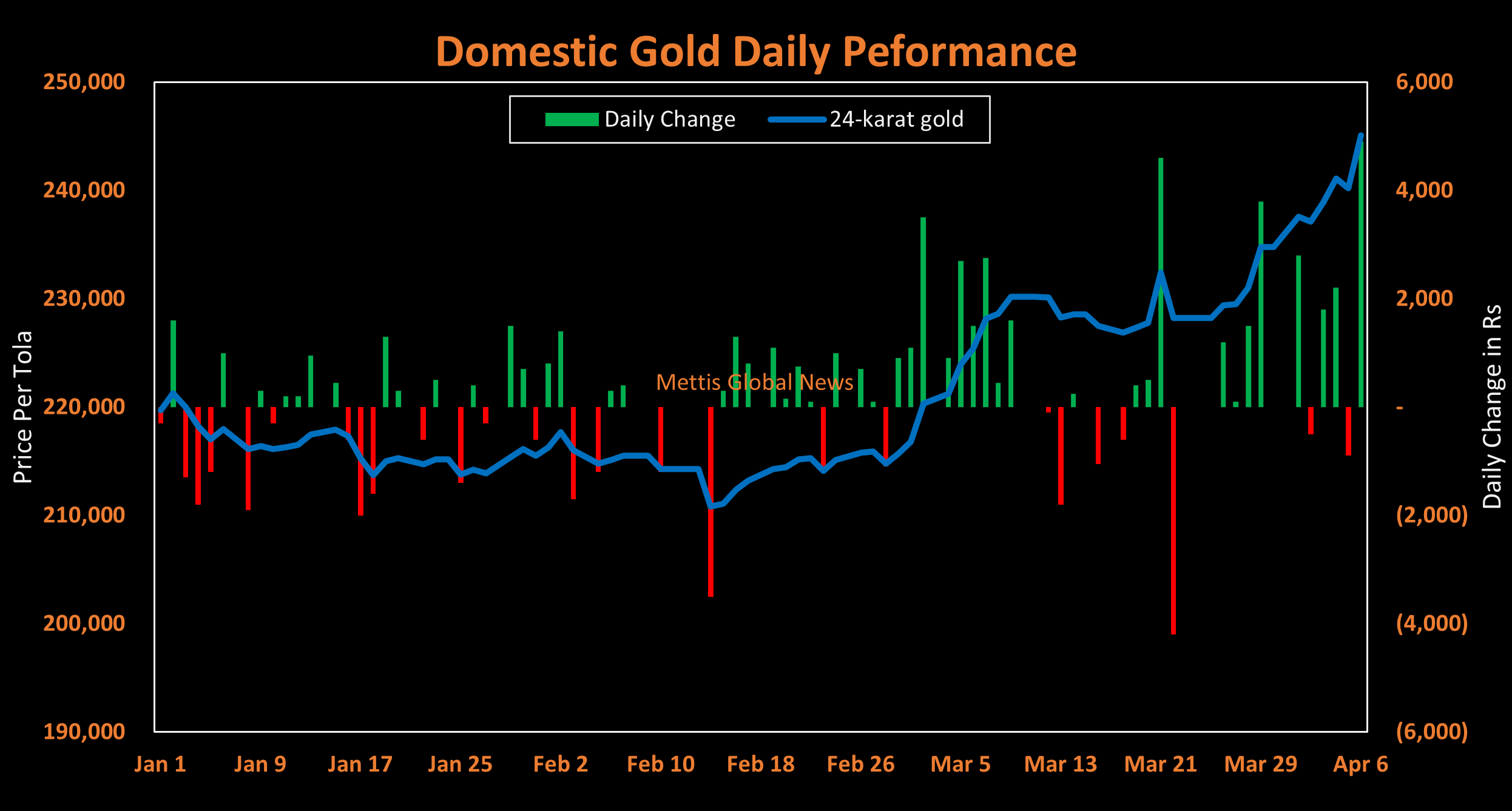

April 06, 2024 (MLN): Gold prices in Pakistan rallied this week, surging past their previous all-time high to reach a new peak, driven by a massive rise in international rates.

The key benchmark of the local gold market closed at a record high of Rs245,100 per tola, reflecting an increase of Rs10,300 compared to the previous week's closing.

The rally currently being witnessed in the domestic bullion extends from March in which the yellow metal gained a substantial Rs19,100 per tola.

It is crucial to note that the previous highest price for 24-K gold earlier this week was Rs240,000, observed on May 10, 2023.

The Karachi Sarafa Association further reported that the price of 24-karat gold reached Rs210,134 per 10-gram, up Rs8,831 WoW.

Similarly, the price of 22-karat gold was quoted higher at Rs192,62 per 10-gram.

On the global front, international spot gold continued to build on gains and settled at a new all-time high of $2,330.16, up 4.35% WoW.

This marked the third consecutive weekly rise for the yellow metal due to strengthened optimism for interest rate cuts, further buoyed by rising Middle East tensions this week.

Lower borrowing costs tend to spark gold prices as they reduce the opportunity cost of holding the safe-haven asset.

Likewise, in an environment of war and economic crisis, the appeal of the yellow metal among investors rises, exerting a bullish impact on prices.

Fed officials on Wednesday stated that there is a need to focus more on data points before shifting towards monetary easing, which market participants expect to occur in June.

However, the latest data for non-farm payrolls in the U.S. dampened market expectations as the unemployment rate edged down to 3.8% compared with a predicted 3.9%.

Moreover, US employers added 303,000 jobs in March, higher than the figures for January and February and what was anticipated by the market participants, showcasing a strengthened labor market.

Impact of Domestic Currency

The Pakistani rupee (PKR) inched up slightly by 2 paisa against the US dollar during the week as the currency settled the trade at PKR 277.93 per USD, compared to previous week's closing of PKR 277.95 per USD.

As the home currency held its ground stable against the U.S. Dollar, the domestic gold remained shielded on the currency front and joyed the rally driven by the international market.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,635.00 | 69,670.00 65,685.00 | 340.00 0.50% |

| BRENT CRUDE | 99.40 | 119.50 96.05 | 6.71 7.24% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -13.60 -12.04% |

| ROTTERDAM COAL MONTHLY | 132.00 | 134.20 132.00 | 5.05 3.98% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 95.38 | 119.48 91.63 | 4.48 4.93% |

| SUGAR #11 WORLD | 14.62 | 14.64 14.25 | 0.52 3.69% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Business Confidence Survey

Business Confidence Survey