Oil steadies with investors’ attention now on tight US election

By MG News | November 05, 2024 at 11:52 AM GMT+05:00

November 05, 2024 (MLN): Oil steadied on Tuesday as investors turned their focus to the US presidential election, after prices jumped yesterday on tensions in the Middle East and OPEC+’s move to extend supply curbs.

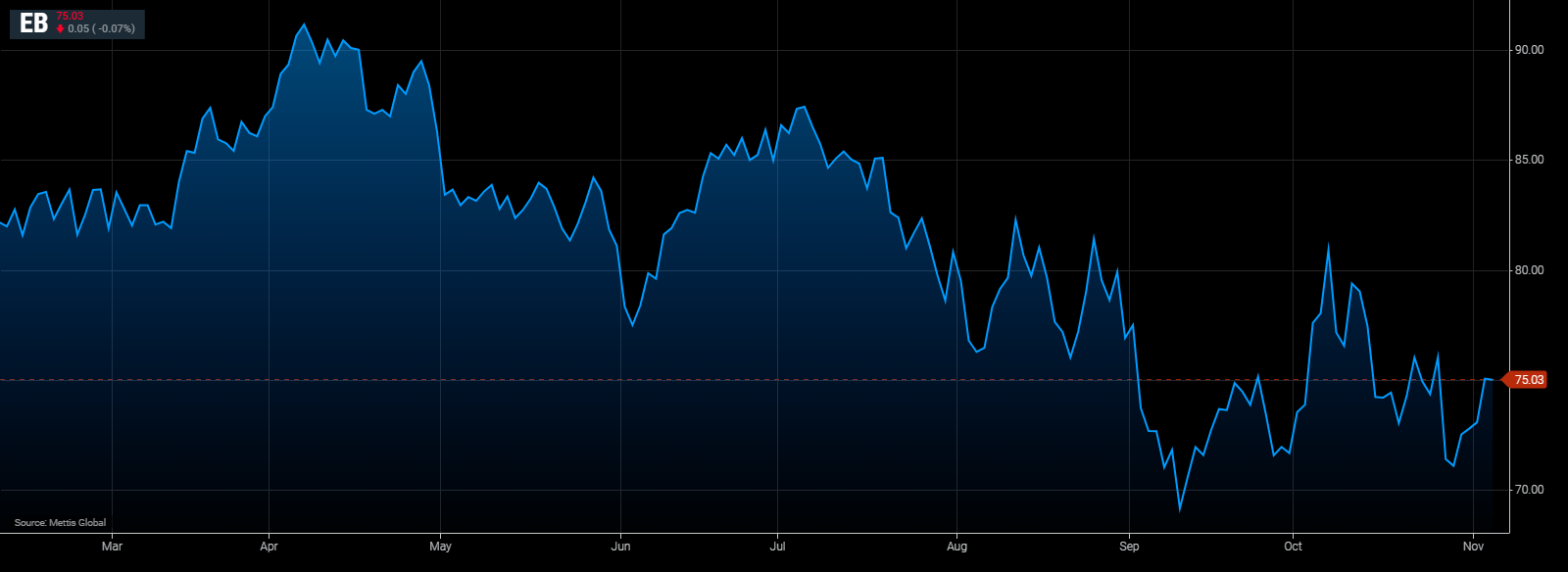

Brent crude traded near $75 a barrel after rising almost 3% on Monday.

While West Texas Intermediate crude (WTI) was at $71.4 per barrel.

Polls suggest the contest between Donald Trump and Kamala Harris remains close, Bloomberg reported.

Among potential consequences, South Korea is considering increasing energy imports from the US if Trump wins, to reduce the country’s trade surplus with America.

Crude’s tight trading pattern was matched by other major commodities, including gold, which was barely changed ahead of election day in the US. A gauge of the greenback steadied after falling in the week’s opening session.

The international oil benchmark has lost 13% since the end of June on disappointing Chinese demand and surging supply from the Americas, particularly the US, prompting the OPEC+ alliance to push back a plan to restore production.

Tensions in the Middle East, as Israel faces off with Iran, have also buffeted prices.

The action by OPEC+ “suggests that the group is more willing to support the market than many had expected,” said Warren Patterson, head of commodities strategy at ING Groep NV. “Tension in the Middle East and Gulf of Mexico storms provide some upside risk, while oil is also vulnerable to getting caught up in any broader market moves related to the US election.”

The US presidential election remains on a knife edge after months of intense campaigning. A second Trump administration may be more welcoming to the US shale industry, over renewables.

Separately, RBC Capital Markets LLC has said such an outcome may shift foreign policy, with the possibility of tighter sanctions against Iran but looser curbs on Moscow’s flows amid the war in Ukraine.

Meanwhile, Tropical Storm Rafael threatened disruptions at US offshore oil and natural gas platforms in the Gulf of Mexico. Among producers, Shell Plc said it would evacuate some non-essential personnel in the area.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,073.13 5.53M |

0.56% 729.10 |

| ALLSHR | 81,523.98 15.78M |

0.62% 499.99 |

| KSE30 | 40,156.45 3.82M |

0.62% 248.19 |

| KMI30 | 191,036.81 4.17M |

0.79% 1501.80 |

| KMIALLSHR | 55,167.16 10.34M |

0.70% 383.50 |

| BKTi | 35,110.59 0.16M |

0.49% 169.85 |

| OGTi | 28,704.66 1.35M |

1.44% 408.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,300.00 | 110,105.00 109,200.00 |

-985.00 -0.89% |

| BRENT CRUDE | 68.63 | 69.00 68.41 |

-0.48 -0.69% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.99 | 67.50 66.78 |

-0.46 -0.68% |

| SUGAR #11 WORLD | 15.56 | 15.97 15.44 |

-0.14 -0.89% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance

CPI

CPI