Oil rises on hopes of U.S.-China trade progress

MG News | May 12, 2025 at 11:25 AM GMT+05:00

May 12, 2025 (MLN): Oil edged higher after the US and China both reported “substantial progress” following two days of talks aimed at de-escalating a trade war, signaling a potential resolution to the conflict that threatens demand in the two biggest crude consumers.

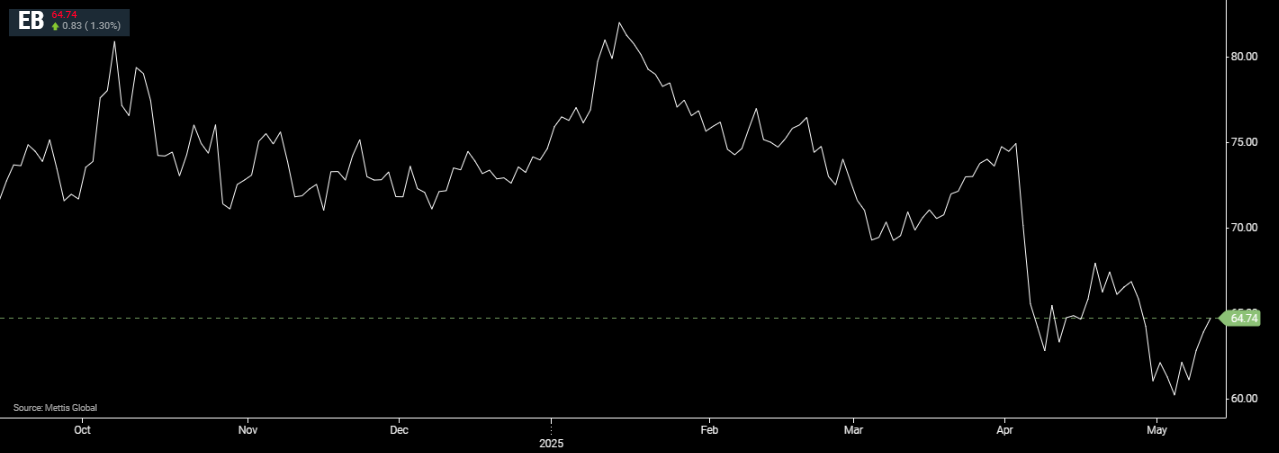

Brent crude futures increased by $0.83, or 1.3%, to $64.74 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.86, or 1.41%, to $61.88 per barrel by [11:20 pm] PST.

After negotiations in Geneva, US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer said that they were upbeat on progress and would share more information on Monday, with the positive sentiment echoed by their Chinese counterparts.

Crude has recouped some ground after plunging at the start of last month on concerns President Donald Trump’s trade war will dent economic growth, even as OPEC+ boosts production.

Futures are still down more than a fifth from a mid-January peak as the prospect of lower demand and higher supply increase the likelihood of a glut later in the year.

Geopolitical tensions remain. The US and Iran will continue talks over the Islamic Republic’s nuclear program, after discussions on Sunday that were described as encouraging by Washington and “difficult but useful” by Tehran.

The US last week sanctioned a third oil refinery in China it accused of facilitating the Iranian oil trade.

Meanwhile, efforts to secure peace in Ukraine are reaching a decisive moment with Ukraine’s Volodymyr Zelenskiy challenging Vladimir Putin to engage in talks this week, as Bloomberg reported.

Market metrics are mixed. The difference between Brent’s two nearest contracts is in solid backwardation, a bullish structure where near-term prices are higher than those further out, while contracts further down the curve display the opposite contango pattern.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,655.00 | 90,840.00 89,800.00 | 1055.00 1.18% |

| BRENT CRUDE | 63.80 | 63.94 63.72 | 0.05 0.08% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.29 60.05 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes