Weekly Market Roundup

Nilam Bano | December 07, 2025 at 11:07 AM GMT+05:00

December 07, 2025 (MLN): The Pakistan Stock Exchange ended the week with a mild upward drift as the KSE-100 Index added 408 points, rising from last week’s close of 166,677.70 to 167,085.58, a WoW increase of 0.24%.

The benchmark spent most sessions oscillating within a narrow band, reflecting cautious optimism as investors positioned ahead of next week’s IMF Board meeting.

Despite inconsistent flows across sectors and continued foreign outflows, domestic liquidity remained strong enough to keep the index buoyant.

Market sentiments were supported by stable macro indicators, soft inflation, and external support flows, helping the benchmark maintain its upward bias even in the face of profit-taking spells and sectoral volatility.

Market Cap:

In terms of market capitalization, the domestic valuation of the exchange improved from Rs4.893 trillion to Rs4.905 trillion, showing an addition of approximately Rs12 billion.

_20251207050340684_323ede.jpeg)

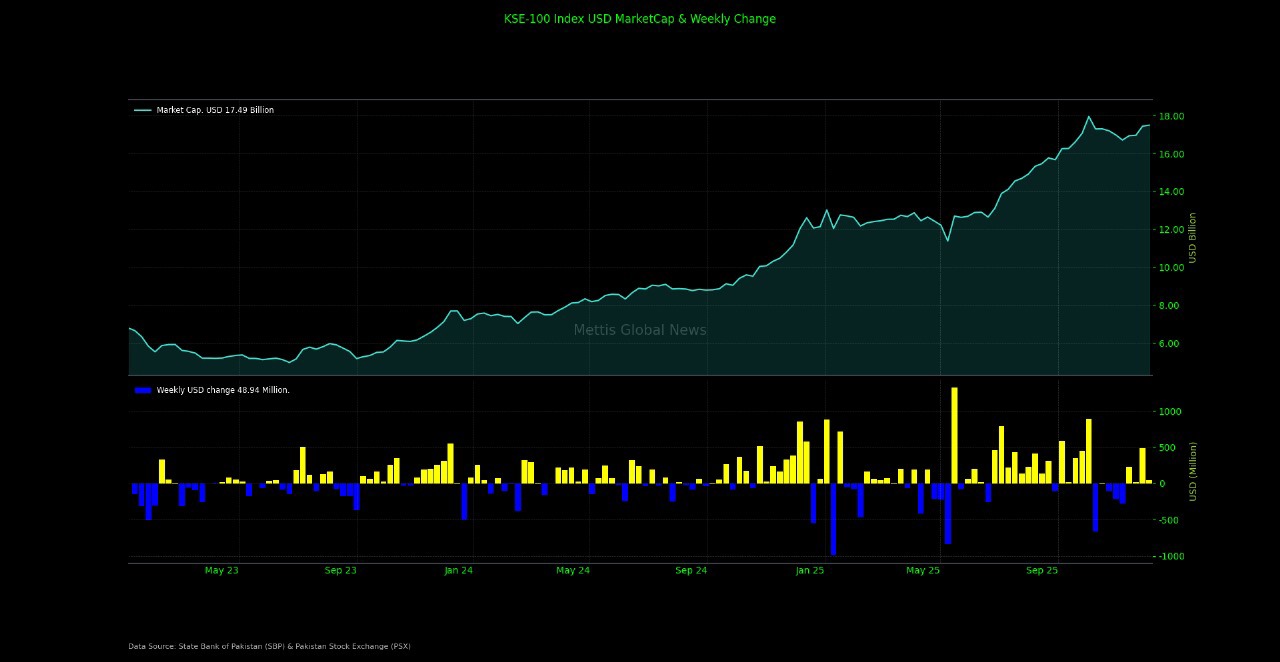

In USD terms, the market cap increased from $17.44 billion to $17.49 billion, reflecting not only the modest index appreciation but also a steady exchange rate that prevented erosion in dollar-denominated valuations.

USD-based returns for the KSE-100 have reflected persistent volatility. Weekly fluctuations ranged widely from steep drawdowns such as 6.29% on May 9, 2025, –4.90% on Feb 16, 2024, and –4.29% on Dec 20, 2024, to extraordinary surges like 11.66% on May 16, 2025, 7.61% on Dec 6, 2024, and 5.99% on July 4, 2025.

More recent weeks have been calmer, with the latest reading on Dec 5, 2025, coming in at a modest 0.28%, indicating relative stability in FX-adjusted returns as volatility in the PKR subsides.

_20251207050325797_1e5db1.jpeg)

During the week, Saudi Arabia extended its $3bn deposit with SBP by another year, now maturing in December 2026, strengthening confidence in external buffers.

Inflation for November 2025 clocked in at 6.1% YoY, broadly stable compared to 6.2% in October.

OMC sales dropped to 1.4mn tons in November, down 5% MoM and 10% YoY, although 5MFY26 sales rose 1% YoY.

Trade deficit contracted 11.86% month-on-month (MoM) from $3.239 billion in October to $2.855 billion in November, primarily due to a significant reduction in imports.

Pakistan’s cement exports fell for the third consecutive month in November, dropping 26.53% to 590,183 tons from 803,258 tons a year earlier.

The total debt of the central government rose by 11.38% YoY to Rs76.98 trillion in October 2025, compared to Rs69.11tr in October 2024.

The foreign exchange reserves held by the State Bank of Pakistan (SBP) increased by $14.1 million or 0.10% WoW to $14.57 billion during the week ended on November 28, 2025.

The PKR also inched up, appreciating 0.04% WoW with the rupee closing at 280.42 per USD, compared to 280.52 in the preceding week.

Index movers:

Sectoral contribution to the index was mixed, with Cement emerging as the single largest positive mover, adding over 535 points to the benchmark.

Oil & Gas Exploration Companies followed with a sizeable 351-point contribution, driven by strength in OGDC and PPL.

Technology & Communication provided another 77 points, while Oil Marketing Companies and Power Generation & Distribution added 62 points and 51 points, respectively.

Refinery names also delivered a solid 36-point uplift, supported by strong volumes of over 60.9 million shares.

Real Estate Investment Trusts added 18 points, Pharmaceuticals contributed 16 points, and the Property sector posted an almost 13-point gain.

On the downside, Fertilizers weighed heavily on the index, erasing nearly 538 points, followed by Commercial Banks, which subtracted 265 points amid weak flows.

Investment Banks/Securities, Automobile Assemblers, Chemicals, and Insurance collectively shaved off over 240 points, reflecting broad-based selling in cyclical sectors.

_20251207050349363_ec8550.jpeg)

Among individual names, LUCK stood out as the week’s star performer, contributing nearly 260 points to the index. OGDC followed closely with a 206-point impact, supported by strong foreign flows and improving sector sentiment.

SRVI added 168 points, while PPL and PTC delivered 155 points and 112 points, respectively. Other notable gainers included PIOC (95 points), FABL (92 points), PSO (90 points), and BWCL (72 points).

Meanwhile, heavyweights weighed the index down. FFC remained the largest drag, eroding 545 points, reflecting pressure in the fertilizer sector.

MEBL pulled back 178 points, while ENGROH, SYS, and UBL contributed declines of 106, 90, and 80 points, respectively. Several banking names, such as HMB, AKBL, NBP, BAHL, and MC,B also remained weak.

_20251207050306106_2b4b5c.jpeg)

FIPI/LIPI:

Foreign investors remained net sellers for the week, offloading $9.65 million worth of equities. Outflows were led by foreign corporates, which sold $6.81 million, followed by overseas Pakistanis with net selling of $2.84 million.

Only foreign individuals showed negligible net buying.

Local investors, however, fully absorbed the foreign supply. Individuals emerged as the strongest buyers, injecting $17.82 million. Mutual funds followed with $11.97 million in net buying, while banks/DFIs accumulated $9.12 million.

NBFCs and companies also posted mild net buying, collectively cushioning the market from foreign pressure.

Insurance companies were the only major local net sellers, offloading a substantial $32.4 million.

_20251207050436324_a5fa2f.jpeg)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 151,973.00 479.70M | -9.57% -16089.17 |

| ALLSHR | 91,178.86 800.22M | -9.20% -9239.97 |

| KSE30 | 46,326.47 200.60M | -9.73% -4995.92 |

| KMI30 | 212,170.17 176.87M | -9.84% -23154.95 |

| KMIALLSHR | 58,382.38 455.91M | -9.19% -5909.79 |

| BKTi | 44,306.03 79.95M | -9.79% -4809.39 |

| OGTi | 29,106.80 28.46M | -9.93% -3209.99 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance