Oil prices steady amid rising global tensions

Hafiz Muhammad Abdullah Hashim | December 02, 2025 at 03:26 PM GMT+05:00

December 02, 2025 (MLN): Oil prices held steady in early Asian trading on Tuesday, as investors evaluated escalating geopolitical tensions from Ukrainian drone strikes hitting Russian energy facilities to rising friction between the United States and Venezuela alongside mixed expectations for U.S. fuel inventory data.

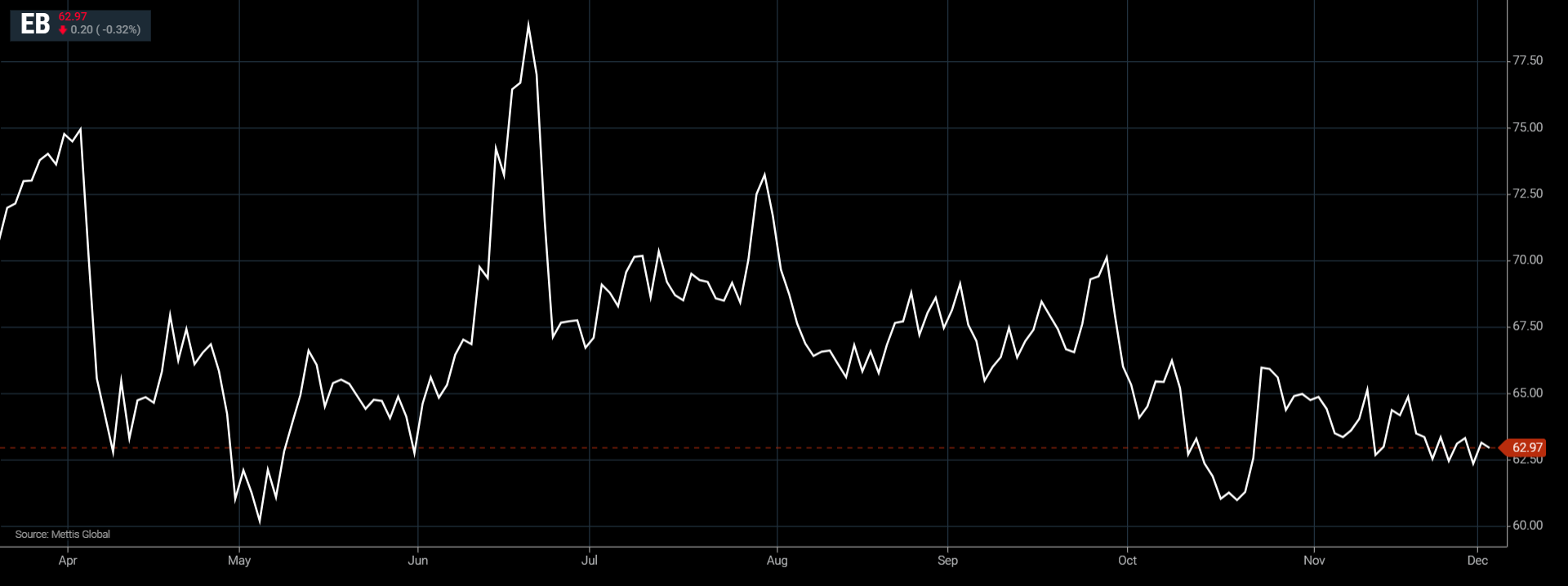

Brent crude futures went down by $0.20, or 0.32%, to $62.97

per barrel, according to data reported by Mettis Global.

West Texas Intermediate (WTI) crude futures decreased by $0.11,

or 0.19%, to $59.21 per barrel by [3:15 pm] PST.

Both Brent and WTI gained more than 1% on Monday, with WTI

edging close to a two-week high.

Analysts at Saxo Bank noted that crude “maintained its

upward momentum as traders monitored potential U.S. actions on Venezuela and

assessed the damage caused at the Black Sea export terminal,” according to CNBC.

The Caspian Pipeline Consortium confirmed that shipments had

restarted from one mooring point at its Black Sea terminal after a significant

Ukrainian drone strike on November 29.

According to Russian outlet Kommersant, crude loadings

resumed through Single Point Mooring 1 (SPM-1), while SPM-2 remains out of

operation due to damage.

Ritterbusch and Associates said the latest military

developments strengthen the case that “a near-term peace agreement is unlikely”

and that tightness in diesel and gasoil supply could help lift the broader oil

complex.

Ukrainian President Volodymyr Zelenskyy reiterated on Monday

that Kyiv’s negotiating priorities remained protecting sovereignty and securing

firm security guarantees. He added that territorial matters continue to be the

toughest element of any future talks.

U.S. envoy Steve Witkoff is expected to brief Russian

officials on Tuesday.

DBS energy strategist Suvro Sarkar said that “the only

additional emerging factor” influencing the oil market is the increasing “noise

coming out of Venezuela.”

He warned that while a large-scale conflict is unlikely,

“the evolving situation could heighten internal instability and ultimately

impact the country’s oil output and exports.”

U.S. President Donald Trump recently held discussions with

senior advisers over Washington’s pressure strategy toward Caracas. Over the

weekend, Trump declared Venezuelan airspace “entirely closed,” without offering

further clarification.

OPEC+ on Sunday reaffirmed its modest production increase

for December and confirmed a pause in further hikes during the first quarter of

next year amid concerns over a potential oversupply.

“The group’s continued emphasis on coordination and supply

discipline remains supportive for oil prices in the near term,” Sarkar added.

Market sentiment was tempered by uncertain expectations for U.S. stockpiles. A preliminary Reuters poll of four analysts suggested a decline in crude inventories but an increase in gasoline and distillate stocks for the week ended November 28.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 152,142.75 195.55M | 0.11% 169.75 |

| ALLSHR | 91,137.26 339.73M | -0.05% -41.60 |

| KSE30 | 46,602.13 91.53M | 0.60% 275.66 |

| KMI30 | 212,261.23 91.71M | 0.04% 91.06 |

| KMIALLSHR | 58,274.04 182.74M | -0.19% -108.34 |

| BKTi | 44,808.68 24.39M | 1.13% 502.65 |

| OGTi | 29,086.47 8.16M | -0.07% -20.33 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance