Oil prices rise amid tariff threats on Mexico, Canada

MG News | January 31, 2025 at 12:30 PM GMT+05:00

January 31, 2025 (MLN): Oil prices rose on Friday as markets weigh the threat of tariffs by U.S. President Donald Trump on Mexico and Canada, the two largest crude exporters to the U.S., that could take effect this weekend.

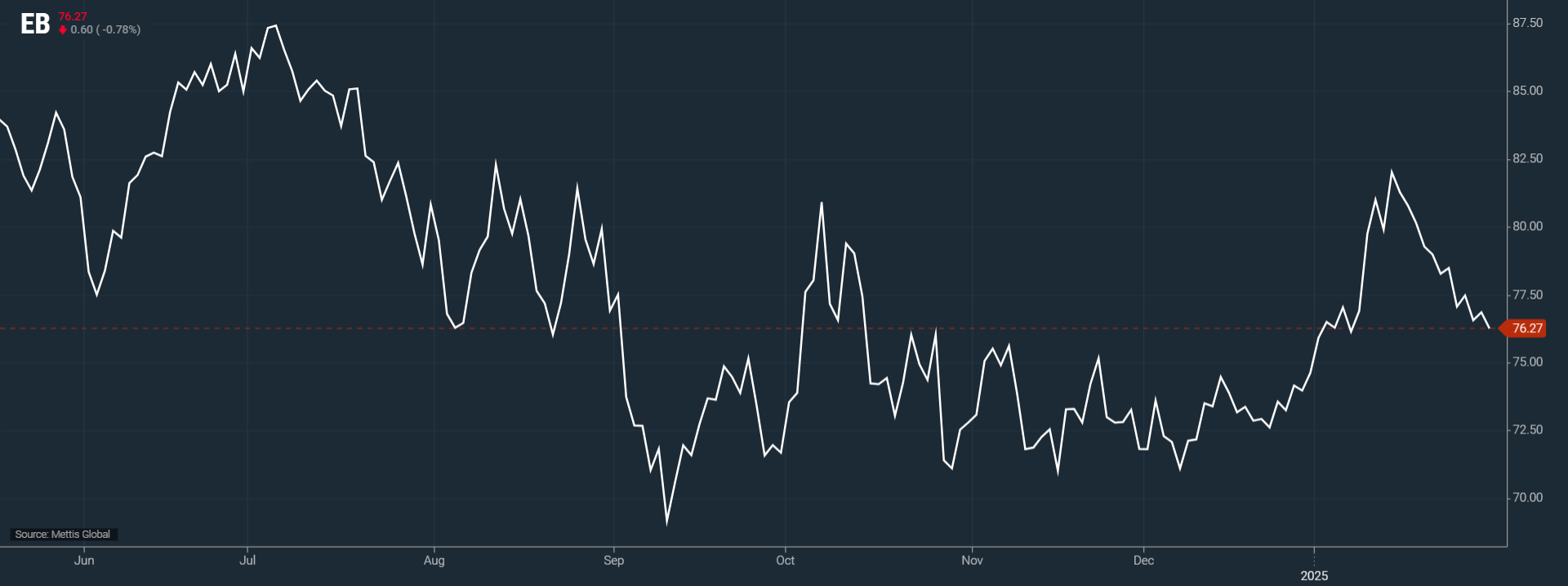

Brent crude futures decreased by $0.60, or 0.78%, to $76.27 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.58, or 0.80%, to $73.31 per barrel by [12:10 pm] PST.

For the week, Brent is set to fall 1.6% while WTI has declined 2%.

However, for the month of January Brent is set to gain 3.6%, its best months since June, and WTI is set to climb 2%.

Trump has threatened to impose a 25% tariff as early as Saturday on Canadian and Mexican exports to the United States if those two countries do not end shipments of fentanyl across U.S. borders, as Reuters reported.

It is unclear if the tariffs would include crude oil. On Thursday, Trump said he would soon decide whether to exclude Canadian and Mexican oil imports from the tariffs.

"Crude oil prices fluctuated as investors contemplated the likelihood of US tariffs alongside a flurry of executive orders and policy announcements," ANZ Bank analyst Daniel Hynes said.

In 2023, the last full year of data, Canada exported 3.9 million barrels per day of crude to the U.S., out of a total of 6.5mn bpd of U.S. imports.

Meanwhile, Mexico exported 733,000 bpd, according to the Energy Information Administration, the statistical arm of the Department of Energy.

The increased risk of supply disruptions from the foreign policies of the new Trump administration has kept prices elevated, Hynes said.

"Sanctions on Russia, stopping purchases of Venezuelan oil and maximum pressure on Iran will increase the geopolitical risk premium on oil," said Hynes.

"This could be compounded by the refilling of the strategic petroleum reserve, adding oil demand," he said.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,765.19 190.20M | 0.98% 1352.94 |

| ALLSHR | 86,595.54 345.72M | 1.04% 892.57 |

| KSE30 | 42,717.84 79.20M | 1.10% 463.00 |

| KMI30 | 197,101.44 81.28M | 1.54% 2991.85 |

| KMIALLSHR | 57,488.84 149.73M | 1.37% 775.17 |

| BKTi | 37,958.58 12.16M | 0.34% 127.24 |

| OGTi | 28,419.19 34.96M | 3.57% 978.56 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,565.00 | 119,785.00 117,905.00 | 1945.00 1.65% |

| BRENT CRUDE | 72.53 | 72.82 72.16 | -0.71 -0.97% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.16 | 70.41 69.80 | 0.16 0.23% |

| SUGAR #11 WORLD | 16.49 | 16.52 16.45 | 0.04 0.24% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey