Oil prices rebound on hopes of U.S.-China trade breakthrough

MG News | May 08, 2025 at 12:10 PM GMT+05:00

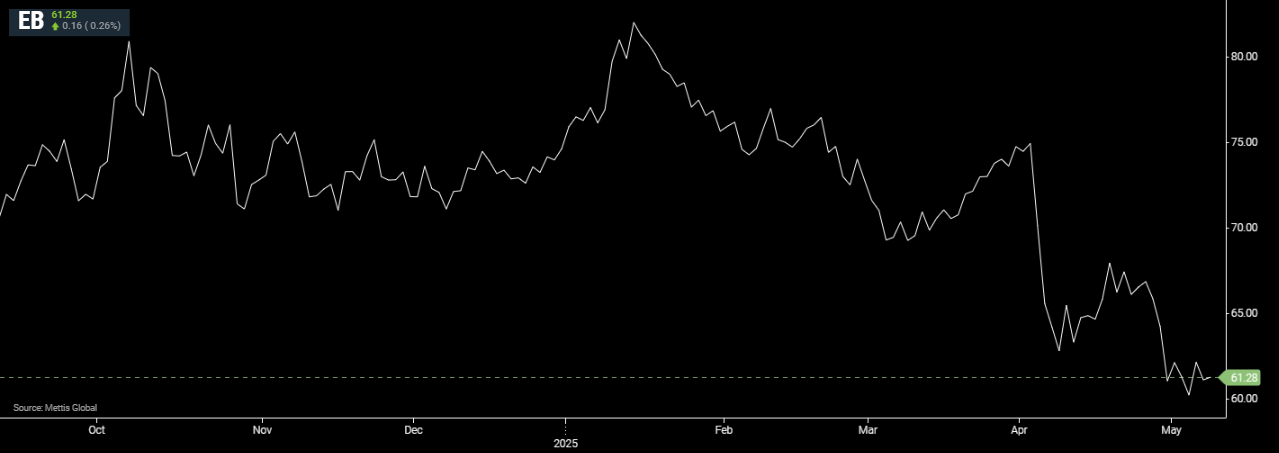

May 08, 2025 (MLN): Oil rose on Thursday after falling more than $1 in the previous session, supported by hopes of a breakthrough in looming trade talks between the U.S. and China, the world's two largest oil consumers.

Brent crude futures increased by $0.16, or 0.26%, to $61.28 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.26, or 0.45%, to $58.33 per barrel by [12:10 pm] PST.

"Optimism around the U.S. and China trade talks this weekend is a primary factor supporting the rebound in the oil market," said independent market analyst Tina Teng.

"Signs of a de-escalating trade war improved market sentiment, triggering a rebound in oil prices in an oversold market."

U.S. Treasury Secretary Scott Bessent will meet with China's top economic official on May 10 in Switzerland for negotiations over a trade war that is disrupting the global economy.

The countries are the world's two largest economies and the disruptions from their trade dispute are likely to lower crude consumption growth.

U.S. President Donald Trump on Wednesday suggested China initiated the trade talks, adding he was not willing to cut U.S. tariffs on Chinese goods to get Beijing to negotiations.

Bessent said the upcoming talks are a start, not 'advanced' discussions, as Reuters reported.

Weak demand concerns capped oil price gains after the Federal Reserve held interest rates steady but warned about rising economic uncertainties.

The Fed signalled that rates will likely remain on hold until the effects of tariffs become clearer.

This boosted the U.S. dollar, which added to headwinds facing the broader commodity markets, said ING analysts in a report on Thursday.

A stronger U.S. currency makes dollar-denominated oil more expensive for holders of other currencies and dampening demand.

Adding to the concerns of weaker demand, U.S. gasoline inventories rose last week, stoking concerns among analysts that consumption is not building as the U.S. enters the summer demand period later this month.

At the same time, the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, will increase its oil output, adding to pressure on prices.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 174,453.94 378.71M | -2.87% -5149.79 |

| ALLSHR | 104,971.25 768.15M | -2.82% -3049.94 |

| KSE30 | 53,198.53 164.55M | -2.97% -1629.79 |

| KMI30 | 246,378.79 122.98M | -2.77% -7017.29 |

| KMIALLSHR | 67,606.67 353.71M | -2.49% -1723.51 |

| BKTi | 49,956.50 81.12M | -3.77% -1956.89 |

| OGTi | 34,148.45 27.47M | -2.58% -904.57 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,950.00 | 70,170.00 67,325.00 | 115.00 0.17% |

| BRENT CRUDE | 68.37 | 68.62 68.37 | -0.28 -0.41% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -2.25 -2.29% |

| ROTTERDAM COAL MONTHLY | 105.05 | 105.05 105.05 | 0.20 0.19% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.55 | 63.87 62.49 | 0.66 1.05% |

| SUGAR #11 WORLD | 13.55 | 13.57 13.42 | 0.07 0.52% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260212114015138_13c55d.jpg?width=280&height=140&format=Webp)