Oil prices hold steady amid weekly drop on tariff concerns

By MG News | March 07, 2025 at 10:32 AM GMT+05:00

March 07, 2025 (MLN): Oil prices were little changed on Friday but were set for their biggest weekly decline since October as the uncertainty around U.S. tariff policy is creating concerns about demand growth at the same time major producers are set to increase output.

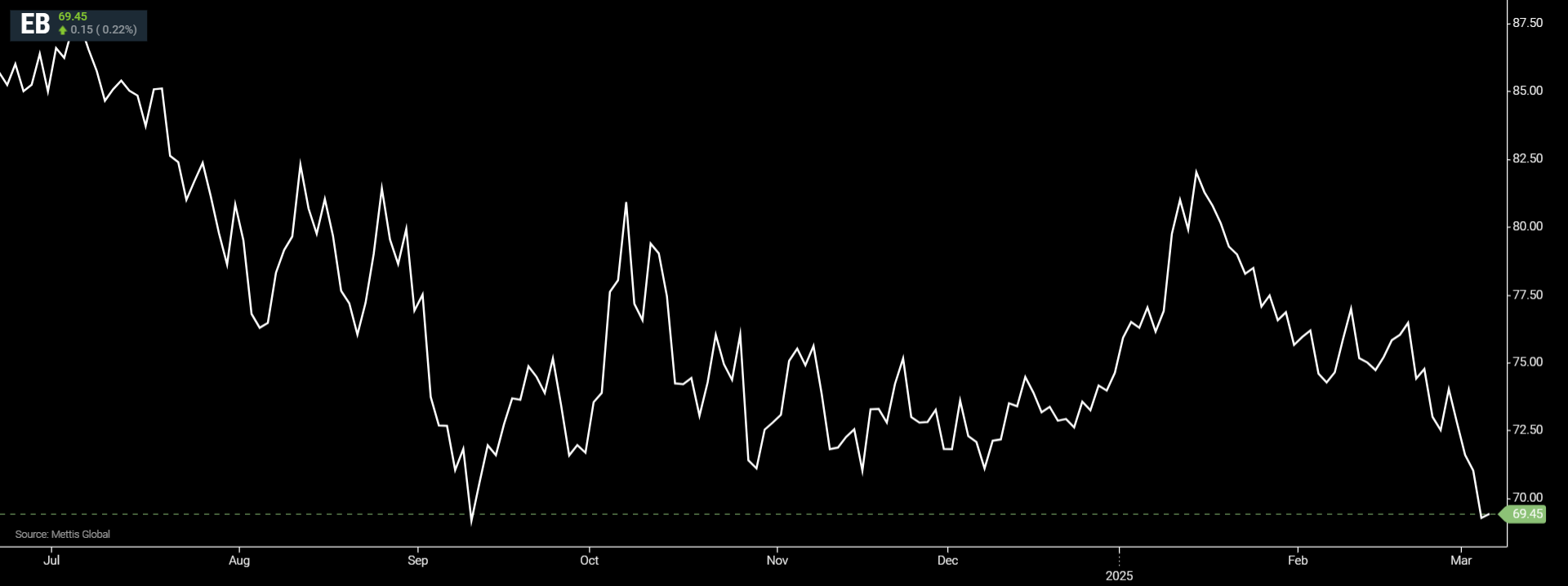

Brent crude futures increased by $0.15, or 0.22%, to $69.45 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.04, or 0.06%, to $66.40 per barrel by [10:20 am] PST.

Markets, including oil, have been whipsawed by the fluctuating trade policy in the U.S., the world's biggest oil consumer.

On Thursday, U.S. President Donald Trump suspended the 25% tariffs he had imposed on most goods from Canada and Mexico until April 2, although steel and aluminium tariffs would still go into effect on March 12 as scheduled.

The amended order does not fully cover Canadian energy products, which are under a separate 10% levy.

The tariffs themselves are considered a drag on economic growth and therefore oil demand growth, as Reuters reported.

But the uncertainty over the policy is also slowing business decisions, which is also impacting the economy.

Brent prices on Wednesday dropped to their lowest level since December 2021 after U.S. crude inventories increased.

This decline also followed the decision by the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, to raise their output quotas.

The group said on Monday that it had decided to proceed with a planned April output increase, adding 138,000 barrels per day to the market.

Some of the downward momentum in prices has eased as the U.S. is looking at steps to halt exports from key OPEC producer Iran.

Reuters reported on Thursday that Trump is considering a plan to inspect Iranian oil tankers at sea using an accord aimed at weapons of mass destruction, according to sources.

This move is part of the U.S. president's "maximum pressure" strategy to reduce Iranian oil exports to zero.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI