Oil prices fall as Trump delays tariff decision

By MG News | February 04, 2025 at 11:16 AM GMT+05:00

February 04, 2025 (MLN): Oil prices retreated on Tuesday as U.S. President Donald Trump paused for a month a decision on steep tariffs on Mexico and Canada, the United States' biggest foreign oil suppliers, while prospects of higher OPEC+ supplies from April also weighed.

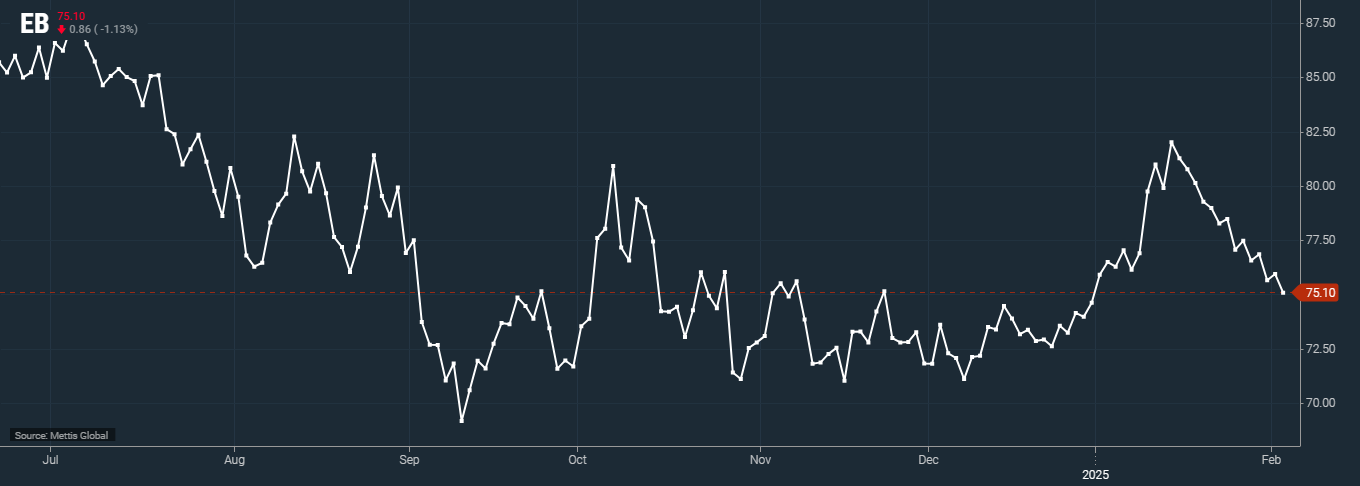

Brent crude futures decreased by $0.86, or 1.13%, to $75.10 per barrel.

West Texas Intermediate (WTI) crude futures fell by $1.31, or 1.79%, to $71.85 per barrel by [11:05 am] PST.

Both Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum said they had agreed to strengthen border enforcement efforts.

This was in response to Trump's demand to crack down on immigration and drug smuggling, as Reuters reported.

That would pause for 30 days tariffs of 25%, with a 10% tariff on energy imports from Canada, that had been set to take effect on Tuesday.

"The dominant theme for global markets has been all about US tariffs," IG market strategist Yeap Jun Rong said in an email.

While the tariff delay for Mexico and Canada has given room for risk sentiment to improve and contributed to an unwinding in the U.S. dollar, oil prices have struggled to regain the upside, Yeap added.

"The prospect of higher oil supplies (OPEC+) returning to markets from April could be a key overhang for prices ... especially with oil prices still at Oct. 2024 levels."

The Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, discussed a call by Trump to raise production on Monday.

However, they agreed to stick to their policy of gradually increasing oil output starting in April.

However, ING analysts warned that Canada would stay vulnerable to trade wars unless it expanded its export options beyond the United States, with more pipelines from oil fields to ports.

"It would take several years to build this infrastructure, but it would provide Canadian producers more flexibility and the potential for more destinations for Canadian oil," ING said.

Trump plans to speak with Chinese President Xi Jinping as soon as this week, the White House said, as a 10% duty on all China goods is set to take effect later on Tuesday.

On the demand side, investors will be looking out for weekly U.S. oil stockpile data for the week of Jan. 31.

Analysts polled by Reuters expected that crude inventories would rise, while gasoline and distillate inventories probably fall.

US crude inventories are expected to increase by 10.8 million barrels for the week ending January 31.

Meanwhile, gasoline inventory builds are likely to be at 500,000 barrels, according to Macquarie energy strategist Walt Chancellor.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI