Oil prices dip amid U.S. inventory build, Iran-U.S. talks

MG News | May 22, 2025 at 11:45 AM GMT+05:00

May 22, 2025 (MLN): Oil prices eased on Thursday as unexpected builds in U.S. crude and fuel inventories raised demand concerns, while investors stayed cautious, focusing on renewed Iran-U.S. nuclear talks.

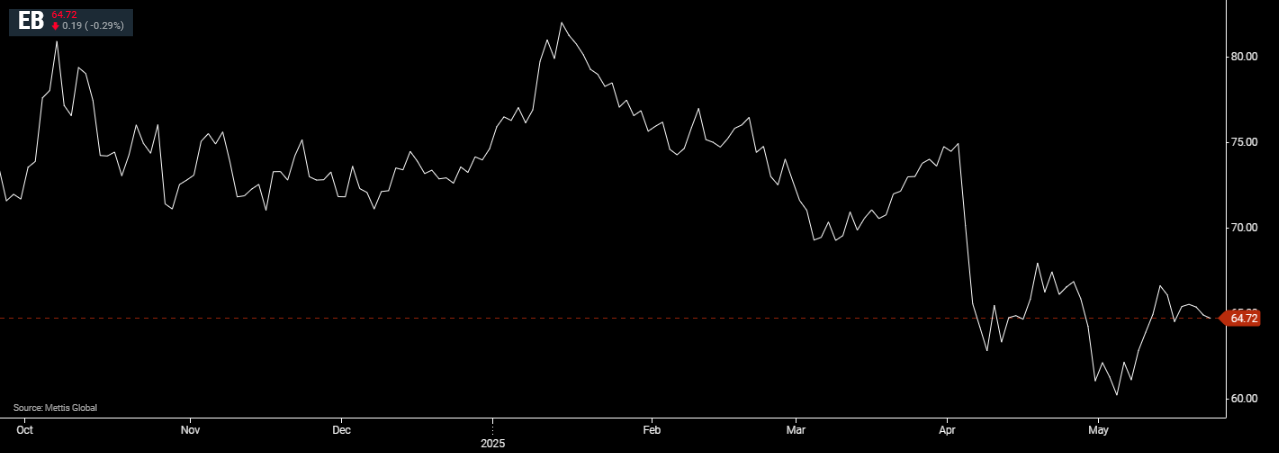

Brent crude futures decreased by $0.19, or 0.29%, to $64.72 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.2, or 0.33%, to $61.09 per barrel by [11:40 am] PST.

U.S. crude and fuel inventories posted surprise stock builds last week, the Energy Information Administration said on Wednesday, as crude imports hit a six-week high and gasoline and distillate demand slipped.

Crude inventories rose by 1.3 million barrels to 443.2m barrels in the week ended May 16, the EIA said. Analysts in a Reuters poll had expected a 1.3m barrel draw, as CNBC reported.

“While rising U.S. inventories have raised concerns, some investors expect the summer driving season starting after Memorial Day weekend to draw down stocks, limiting further downside,” said Hiroyuki Kikukawa, chief strategist of Nissan Securities Investment, a unit of Nissan Securities.

“Traders remain cautious, avoiding large positions as they assess conflicting signals over U.S.-Iran nuclear talks and a media report of potential Israeli strikes on Iranian nuclear facilities,” he added, predicting WTI to trade between $55 and $65 for the time being.

The fifth round of nuclear talks between Iran and the United States will take place on May 23 in Rome, Oman’s foreign minister said on Wednesday.

CNN reported on Tuesday that U.S. intelligence suggests Israel is preparing to strike Iranian nuclear facilities, citing multiple U.S. officials and adding that it was not clear whether Israeli leaders have made a final decision.

Iran is the third-largest producer among members of the Organization of the Petroleum Exporting Countries and an Israeli attack could upset flows from the country.

U.S. and Iran have held several rounds of talks this year over Iran’s nuclear program, while U.S. President Donald Trump has revived a campaign of stronger sanctions on Iranian crude exports.

Meanwhile, Kazakhstan’s oil production has risen by 2% in May, an industry source said on Tuesday, defying OPEC+ pressure to reduce output.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 178,853.10 424.99M | 3.29% 5702.68 |

| ALLSHR | 107,335.86 693.28M | 2.85% 2972.30 |

| KSE30 | 54,676.69 210.97M | 3.52% 1860.41 |

| KMI30 | 250,620.93 139.36M | 2.14% 5257.28 |

| KMIALLSHR | 68,647.30 398.45M | 1.89% 1273.91 |

| BKTi | 52,773.10 107.33M | 7.09% 3494.44 |

| OGTi | 35,032.42 34.95M | 0.79% 274.54 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,450.00 | 68,570.00 66,910.00 | -415.00 -0.61% |

| BRENT CRUDE | 69.06 | 69.37 67.36 | 1.64 2.43% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 105.50 105.50 | -0.10 -0.09% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.81 | 64.08 62.04 | 1.55 2.49% |

| SUGAR #11 WORLD | 13.57 | 13.69 13.47 | 0.09 0.67% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account