Oil prices dip amid Russia-Ukraine ceasefire talks

By MG News | March 24, 2025 at 11:09 AM GMT+05:00

March 24, 2025 (MLN): Oil prices slipped on Monday as investors assessed the outlook for ceasefire talks aimed at ending the Russia-Ukraine war, which could lead to an increase in Russian oil to global markets.

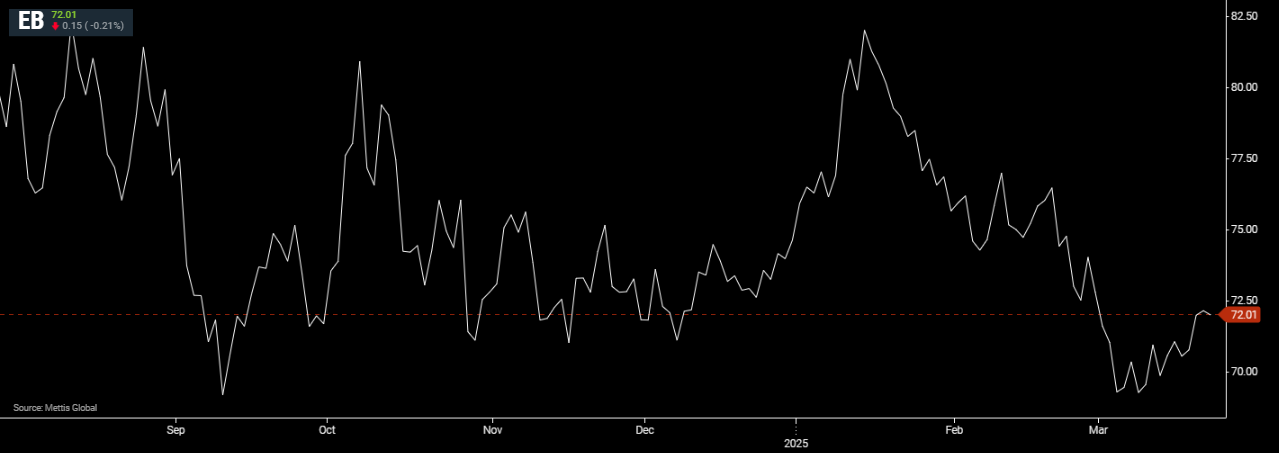

Brent crude futures decreased by $0.15, or 0.21%, to $72.01 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.15, or 0.22%, to $68.13 per barrel by [11:05 am] PST.

Both benchmarks settled higher on Friday and recorded a second consecutive weekly gain as fresh U.S. sanctions on Iran and the latest output plan from the OPEC+ producer group raised expectations of tighter supply., as Reuters reported.

A U.S. delegation will seek progress toward a Black Sea ceasefire and a broader cessation of violence in the war in Ukraine when it meets for talks with Russian officials on Monday, after discussions with diplomats from Ukraine on Sunday.

"Expectations of progress in peace negotiations between Russia and Ukraine and a potential easing of U.S. sanctions on Russian oil pressured prices lower," said Toshitaka Tazawa, an analyst at Fujitomi Securities.

"But investors are holding back on large positions as they evaluate future OPEC+ production trends beyond April," he added.

OPEC+, the Organization of the Petroleum Exporting Countries and its allies, including Russia, issued a new schedule on Thursday for seven member nations to make further oil output cuts to compensate for exceeding agreed levels.

These cuts will more than offset the monthly production increases the group plans to introduce next month.

OPEC+ has been cutting output by 5.85 million barrels per day, equal to about 5.7% of global supply, agreed in a series of steps since 2022 to support the market.

It confirmed on March 3 that eight of its members would proceed with a monthly increase of 138,000 bpd from April, citing healthier market fundamentals.

Market participants are also monitoring the impact from new Iran-related U.S. sanctions announced last week.

Market sentiment toward oil prices has improved recently due to heightened supply risks from U.S. sanctions on Iranian exports and optimism that U.S. reciprocal tariffs may be less severe than expected.

However, the broader demand-supply outlook remains mixed, IG's Yeap said.

"Ukraine-Russia ceasefire talks raise the prospects of increased Russian exports on an eventual resolution, while the OPEC+ production hike as early as April points to further supply additions, which may be difficult to be fully absorbed by demand factors," said Singapore-based IG strategist Yeap Jun Rong.

Iranian oil shipments to China are set to fall in the near term after new U.S. sanctions on a refiner and tankers, driving up shipping costs.

However, traders expect buyers to find workarounds to keep at least some volume flowing.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

FX Reserves

FX Reserves

CPI

CPI