Oil markets weaken ahead of possible OPEC+ output increase

MG News | May 30, 2025 at 01:50 PM GMT+05:00

May 30, 2025 (MLN): Oil prices were on track to end the week down more than 1% on Friday amid whipsawing tariff rulings in the U.S. and as the market braced for a potential OPEC+ output hike.

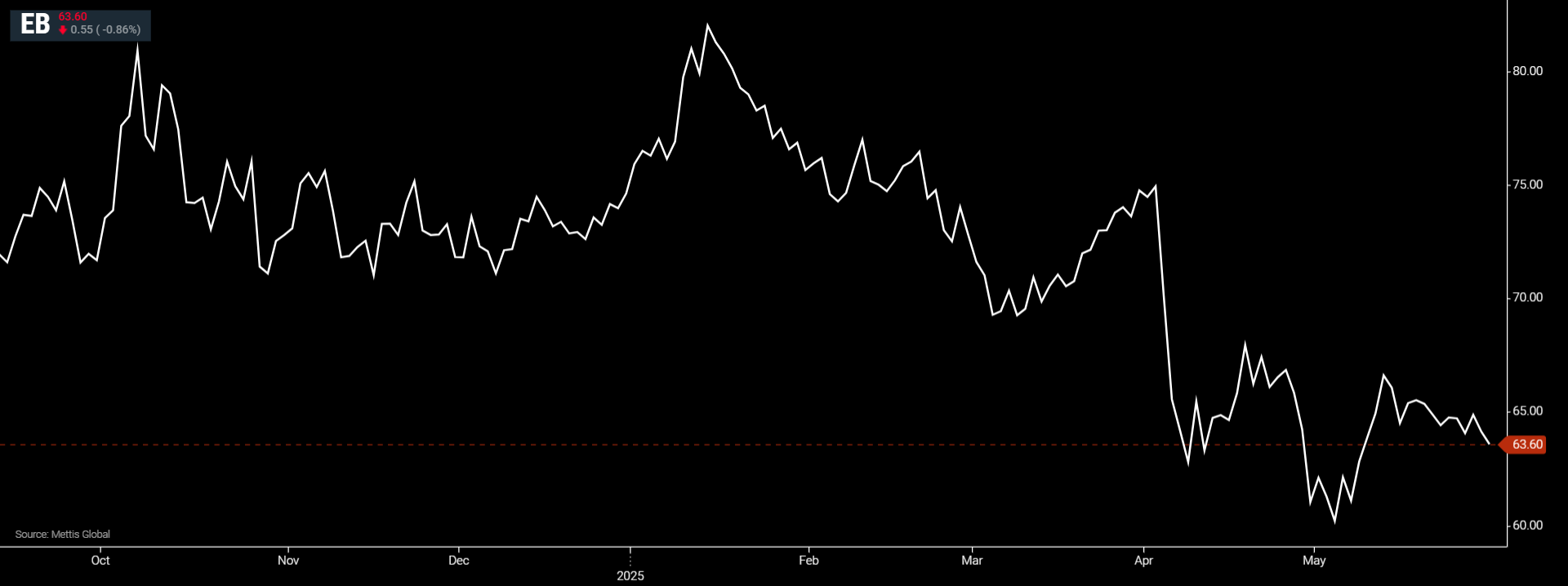

Brent crude futures decreased by $0.55, or 0.86%, to $63.6 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.36, or 0.59%, to $61.3 per barrel by [1:45 pm] PST.

In the U.S., President Donald Trump’s tariffs were to remain in effect after a federal appeals court temporarily reinstated them on Thursday, reversing a trade court’s decision on Wednesday to put an immediate block on the most sweeping of the duties.

The block had sent oil prices falling more than 1% on Thursday as traders weighed its effects. Analysts said uncertainty would remain as the tariff battles worked their way through the court system.

Members of the Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, are expected to decide on a July oil production hike when they meet on Saturday.

At the same time, OPEC is trying to ensure that some countries that have been producing above their agreed levels, such as Kazakhstan, cut their output, as CNBC reported.

“The standoff between OPEC and Kazakhstan became even more apparent this week,” Westpac’s head of commodity and carbon research Robert Rennie said in a note.

Kazakhstan has informed OPEC that it does not intend to reduce its oil production, according to a Thursday report by Russia’s Interfax news agency citing Kazakhstan’s deputy energy minister.

Kazakhstan’s energy minister on Thursday dismissed complaints from other members over Kazakhstan’s overproduction, saying that the country’s share in global production is less than 2% and that an oil price above $70-$75 per barrel is likely to be suitable for all countries.

“The stage is set for another bumper production increase,” Rennie said, potentially higher than the 411,000 barrels per day hike decided on at the previous two meetings.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,860.00 | 68,450.00 66,565.00 | 655.00 0.97% |

| BRENT CRUDE | 71.72 | 72.34 71.06 | 0.06 0.08% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.41 | 67.03 65.81 | 0.01 0.02% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account