MPS Preview: SBP seen lowering rates for first time in four years

Abdur Rahman | June 02, 2024 at 03:49 PM GMT+05:00

June 02, 2024 (MLN): The State Bank of Pakistan (SBP) is expected to cut its policy rate by 100 basis points (bps) on June 10 as price gains ease, while concerns over low economic growth continue to crawl.

The central bank has kept borrowing costs at a record 22% since June 2023. The reduction would be the first in almost four years after what has been the most aggressive fight against soaring inflation.

Consumer price gains in May are likely to have slowed far more than what economists earlier forecasted, prompting traders to ramp up bets that SBP will shift away from its “higher-for-longer” stance on interest rates.

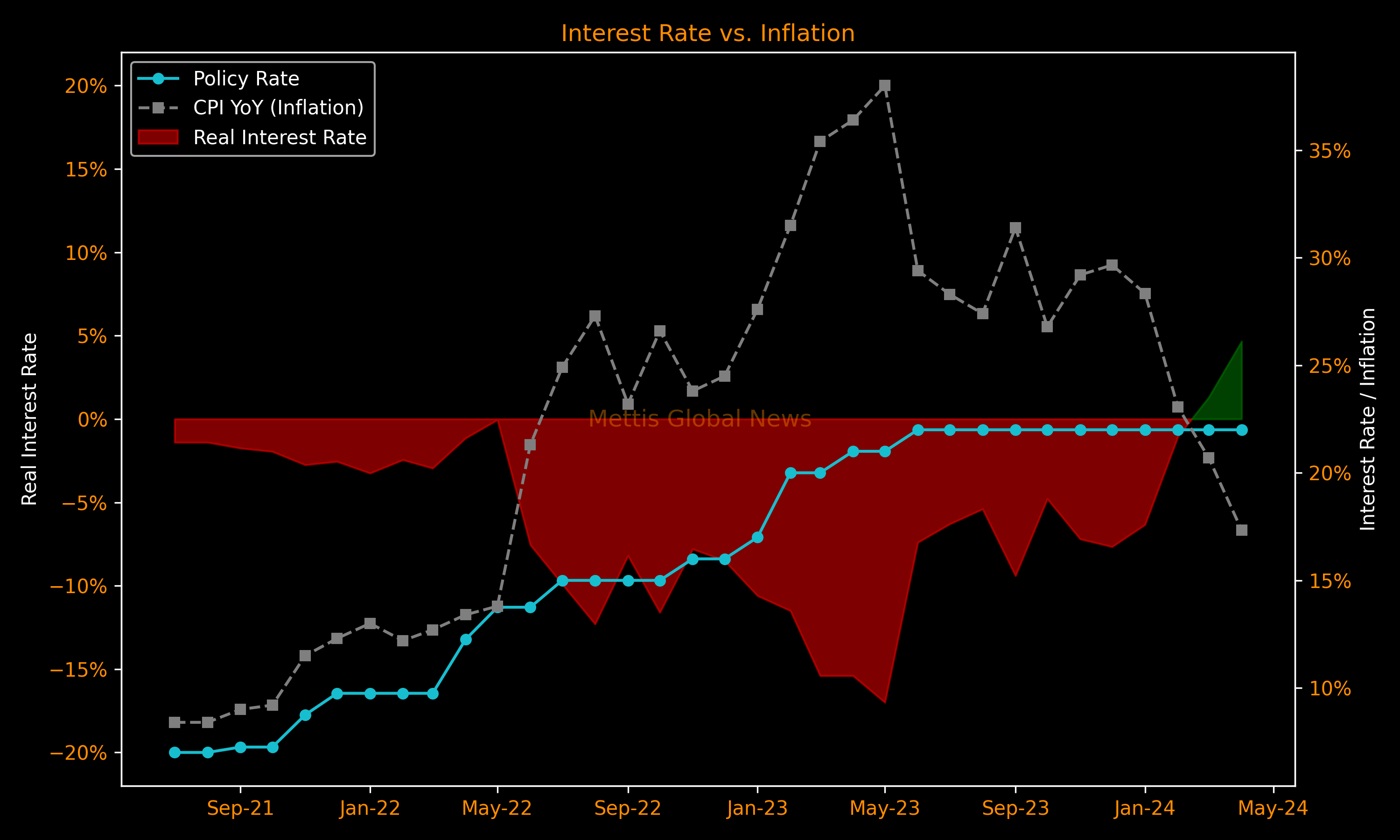

Official report due on Monday will likely show inflation eased to below 14% YoY, which would push real interest rates above 8%.

To recall, headline inflation fell to 17.3% in April compared to last year; taking the average inflation in ten months of current fiscal year to 26.2% as against 28.1% in 10MFY23.

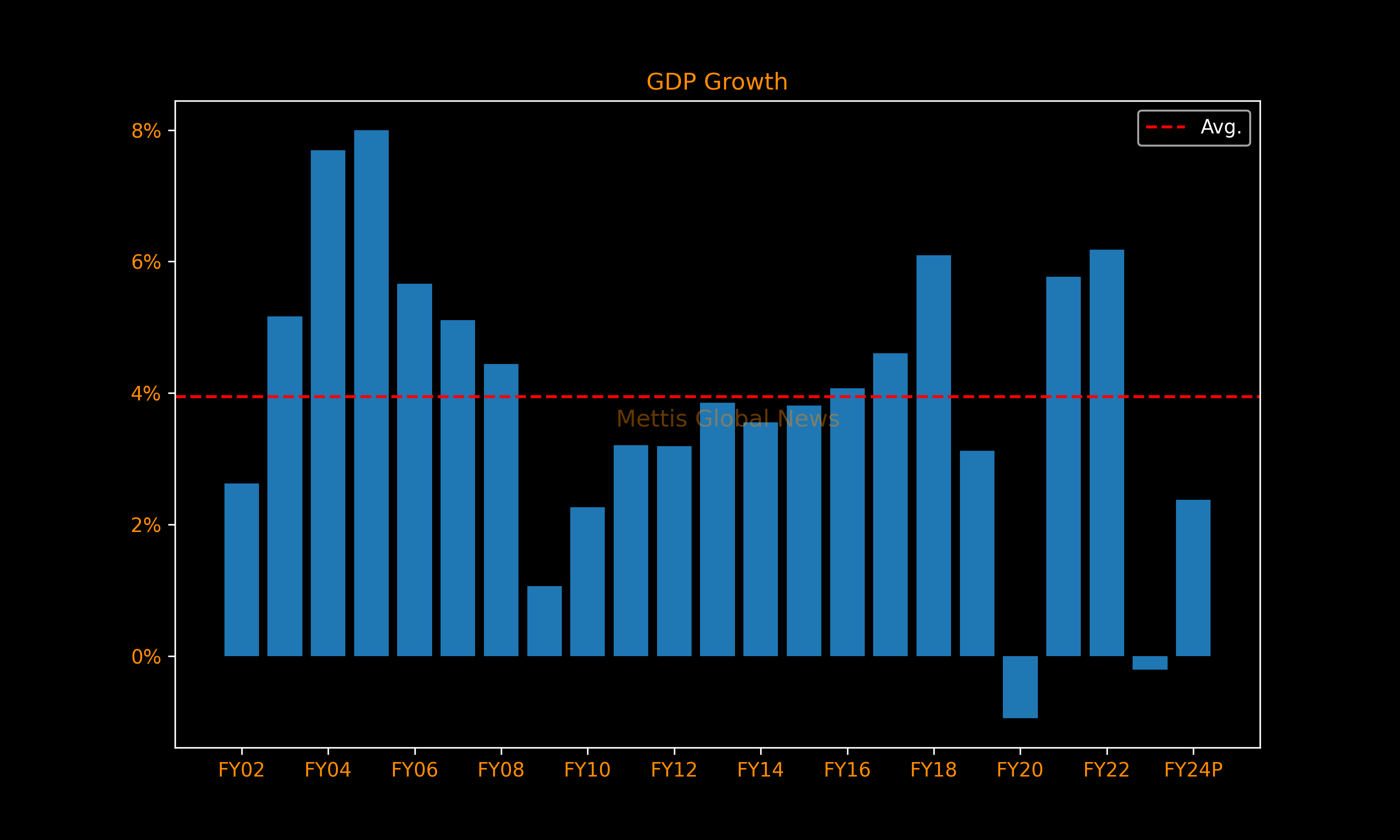

Meanwhile, Pakistan's economy grew at a slower pace this year than the budgetary projection. GDP growth has been provisionally estimated at a moderate 2.4% this year, compared to the 3.5% target.

The country has set a growth target of 3.6% for the next fiscal year, which would require some monetary easing to avoid falling short once again.

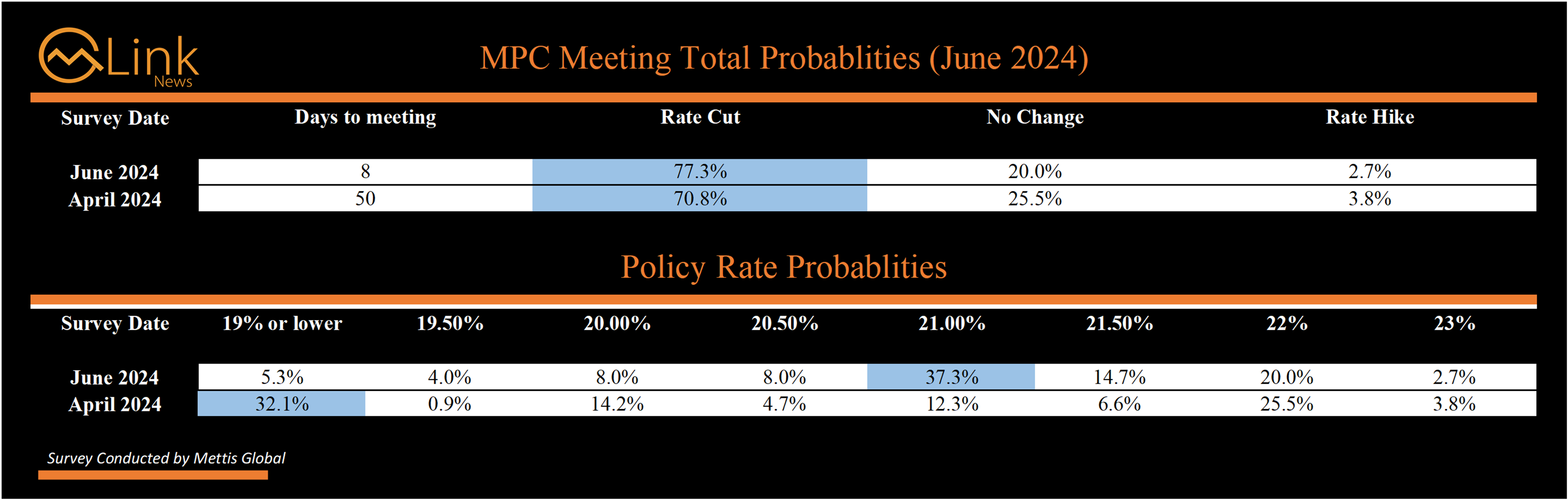

To gauge market sentiment, Mettis Global News conducted a survey regarding the upcoming central bank’s monetary policy decision.

The survey saw 77% of respondents expecting the central bank to lower the rates, with majority (37%) anticipating a 100bps reduction to 21%.

This is in line with the previous MPC survey conducted in April, where majority (71%) of participants anticipated a rate cut in June meeting.

However, the market is now more inclined towards slow and gradual decreases compared to last survey, wherein majority respondents expected a 300bps or higher rate cut in June.

Meanwhile, 20% of participants anticipate the central bank to hold its policy rate in June. Though less likely, this would not come as a surprise.

It is worth mentioning here that the core consumer price index — a measure that excludes food and energy to make it easier to see the underlying inflation trend — still remain sticky at 19.8% in 10MFY24 compared to 17.0% in same period last year.

Moreover, in the last scheduled meeting of April 2024, SBP maintained the policy rate unchanged at 22% citing that geopolitical events, as well as the upcoming budgetary measures may have implications for the near-term inflation outlook.

Money Market Yields

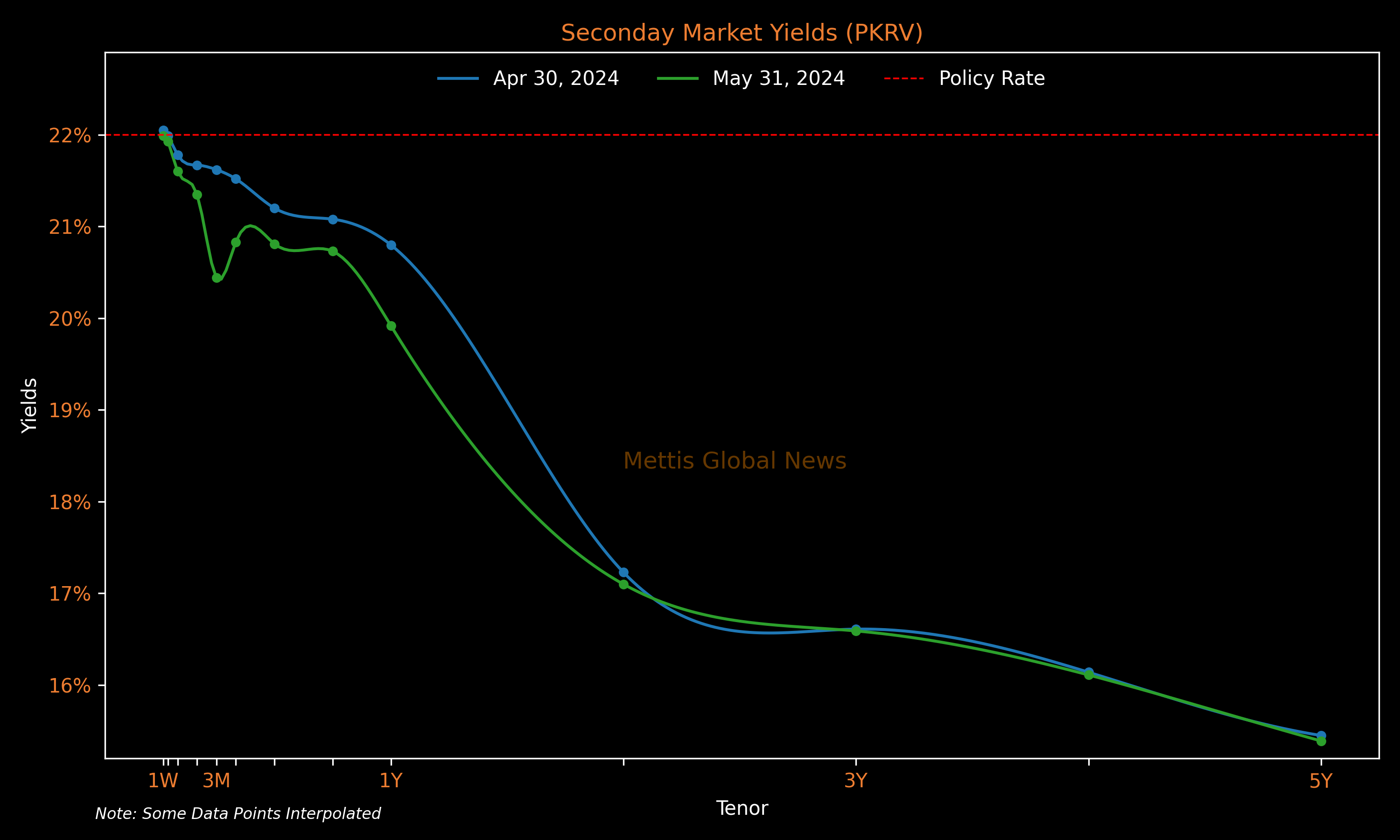

Since the last monetary policy meeting held on April 29, 2024, the secondary market has seen a sharp decrease in yields across all tenors.

The 3-month yields have fallen by a significant 118bps, the 6-month by 39bps, and the 12-month by 88bps, respectively.

In the primary market, Market Treasury bills (MTBs) yields have also witnessed a fall across all tenors.

Cut off yields fell 60bps for 3 months, 29bps for 6 months, and 31bps for 12 months.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 172,015.48 159.71M | -0.09% -154.81 |

| ALLSHR | 103,244.43 334.59M | -0.22% -232.22 |

| KSE30 | 52,697.98 63.04M | 0.07% 39.19 |

| KMI30 | 240,820.56 51.01M | 0.13% 309.27 |

| KMIALLSHR | 66,015.38 173.26M | 0.04% 27.34 |

| BKTi | 50,853.16 27.48M | -0.31% -159.74 |

| OGTi | 33,850.02 8.58M | 0.85% 284.55 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,100.00 | 68,155.00 66,880.00 | 895.00 1.33% |

| BRENT CRUDE | 72.15 | 72.18 71.59 | 0.49 0.68% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.89 | 66.92 66.31 | 0.49 0.74% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account