Maple Leaf earnings top forecast

MG News | September 11, 2024 at 09:52 AM GMT+05:00

September 11, 2024 (MLN): Maple Leaf Cement Factory Limited (PSX: MLCF) posted better-than-expected quarterly earnings on Wednesday, while unveiling plans to invest up to Rs2 billion investment as loans/advances to its holding and associated companies.

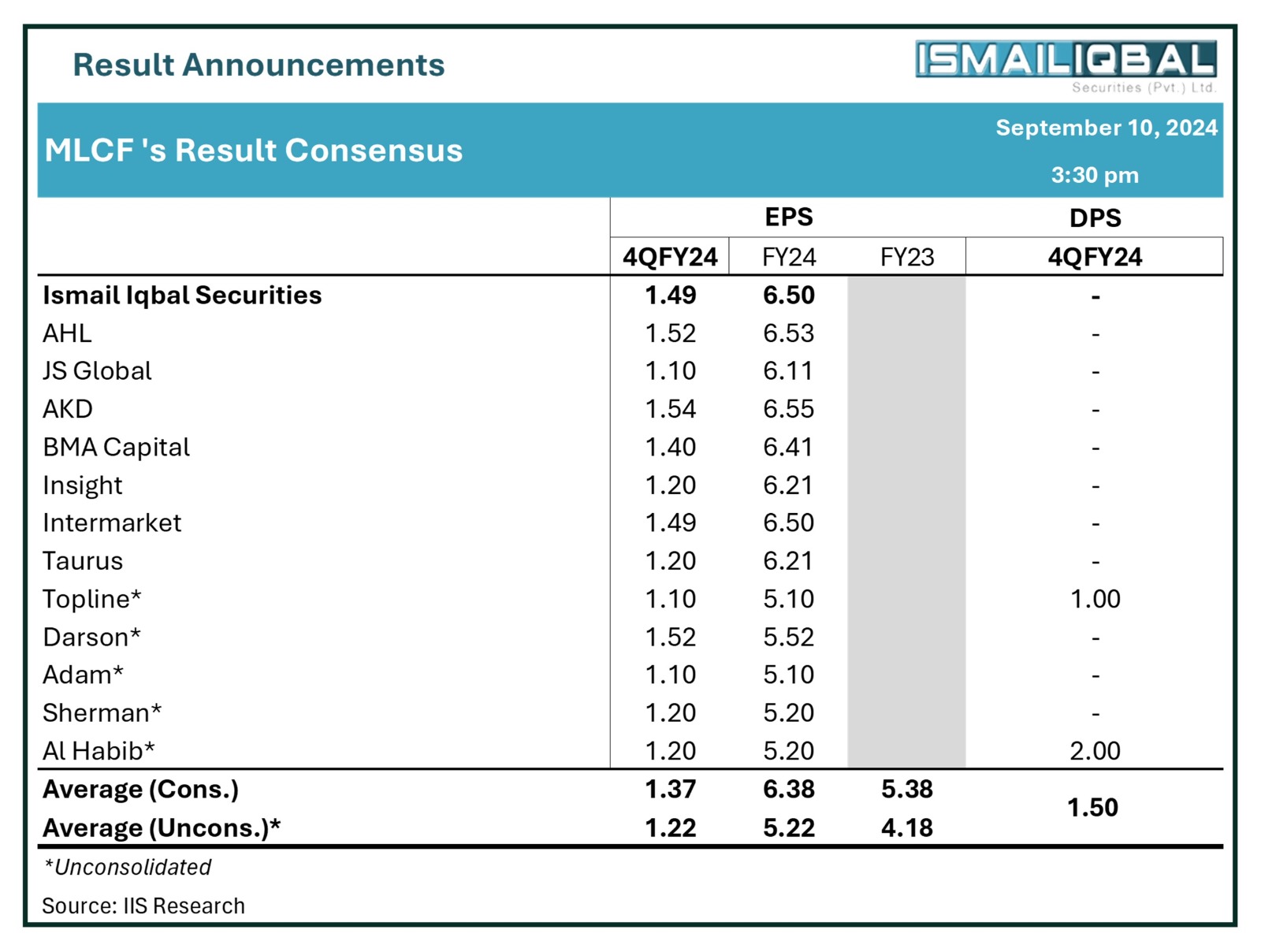

During the quarter ending June 2024, the company earned a consolidated profit after tax of Rs1.55 billion, translating into earnings per share of Rs1.50.

This compares with industry expectations of Rs1.37 per share and a loss per share of Rs0.38 for the same period last year.

Along with the results, the company said the board has approved investment upto Rs1bn as loans/advances to Kohinoor Textile Mills Limited (KTML), a holding company of the company, to meet the working capital requirements of KTML

A similar nature of reciprocal facility of loans/advances of Rs1bn for working capital requirements of the company would be recommended by the Board of KTML subject to approval of the shareholders of KTML.

The board of directors also approved investment upto Rs1bn as loans/advances to Maple Leaf Capital Limited (MLCL), an associated company of the company, to meet the working capital requirements of MLCL, subject to approval of the shareholders of the company.

Going by the consolidated results, the company's sales revenue grew by 4.9% to Rs15.72bn as compared to Rs14.99bn in SPLY.

Moreover, the cost of sales fell by 10.3%, improving the gross profit by 44.0% YoY to Rs6.04bn in Q4 FY 2024.

During the period under review, other income rose by 98.1% to stand at Rs110.84m in Q4 FY 2024 as compared to Rs55.97m in SPLY.

The company’s finance cost fell by 4.5% and stood at Rs848.21m as compared to Rs888m in SPLY.

On the tax front, the company paid a lower tax worth Rs1.58bn against the Rs2.38bn paid in the corresponding period of last year, depicting a fall of 33.9% YoY.

| Consolidated (un-audited) Financial Results for quarter ended June 30, 2024 (Rupees in '000) | |||

|---|---|---|---|

| Jun 24 | Jun 23 | % Change | |

| Sales | 15,723,660 | 14,985,623 | 4.92% |

| Cost of sales | (9,688,366) | (10,795,378) | -10.25% |

| Gross profit/ (loss) | 6,035,294 | 4,190,245 | 44.03% |

| Selling and distribution expenses | (1,360,247) | (797,054) | 70.66% |

| Administrative expenses | (543,345) | (345,512) | 57.26% |

| Net impairment loss on financial assets | (357,191) | (191,421) | 0.00% |

| Other income | 110,842 | 55,968 | 98.05% |

| Other operating expenses | 83,722 | (55,807) | - |

| Finance cost | (848,214) | (887,997) | -4.48% |

| Profit/ (loss) before taxation | 3,120,861 | 1,968,422 | 58.55% |

| Taxation | (1,575,249) | (2,381,324) | -33.85% |

| Net profit/ (loss) for the period | 1,545,612 | (412,902) | - |

| Basic earnings/ (loss) per share | 1.50 | (0.38) | - |

Amount in thousand except for EPS

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 154,616.69 153.49M | -0.80% -1241.79 |

| ALLSHR | 92,610.50 297.73M | -0.83% -775.32 |

| KSE30 | 47,392.55 92.07M | -0.96% -458.98 |

| KMI30 | 222,035.67 82.73M | -0.75% -1683.41 |

| KMIALLSHR | 59,972.25 154.08M | -0.94% -569.28 |

| BKTi | 44,279.05 25.63M | -1.65% -743.47 |

| OGTi | 31,804.57 7.10M | -2.03% -659.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 69,750.00 | 71,145.00 69,345.00 | -1075.00 -1.52% |

| BRENT CRUDE | 96.25 | 101.59 96.00 | 4.27 4.64% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -10.20 -9.31% |

| ROTTERDAM COAL MONTHLY | 121.50 | 121.50 120.50 | -0.35 -0.29% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 90.97 | 95.97 88.61 | 3.72 4.26% |

| SUGAR #11 WORLD | 14.22 | 14.53 14.18 | -0.16 -1.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Auto Numbers

Auto Numbers