Inflation likely to hit 3.17% in May

MG News | May 29, 2025 at 01:25 AM GMT+05:00

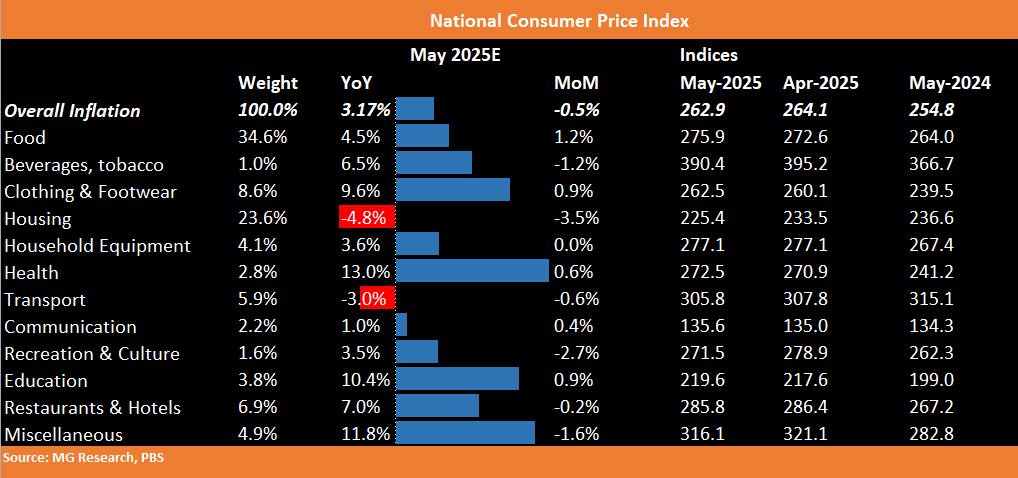

May 29, 2025 (MLN): The headline inflation rate is expected to be 3.17% YoY in May 2025, easing significantly from 11.8% in the same month last year. However, the figure marks a rebound from April’s multi-year low of 0.3%, indicating that the base effect driving recent disinflation is beginning to fade.

Consumer prices are projected to decline by 0.5% MoM, led by a notable drop in food and energy-related costs.

Average CPI inflation for the first 11 months of the fiscal year is estimated at 4.7%, sharply down from 24.91% in the corresponding period of FY24.

Food inflation in May is expected to rise by 1.2% MoM and 4.5% YoY, with key contributors including a 20% surge in egg prices and a 4.11% increase in chicken prices.

The housing index is likely to drop 3.5% MoM, driven by lower electricity tariffs stemming from reduced Quarterly Tariff Adjustments (QTA).

Meanwhile, the transport index is forecast to decline by 0.6% MoM and 3% YoY, following recent cuts in petroleum product prices.

Going forward, inflation is expected to remain contained, assuming food prices remain stable, energy markets avoid renewed volatility, and the stable currency.

On the interest rate front, the State Bank of Pakistan’s recent 100 basis point rate cut to 11% has pushed the country’s real interest rate to 7.8%, with the estimated inflation for May 2025 at 3.17%.

The cut, announced during the latest Monetary Policy Committee (MPC) meeting, marked the seventh reduction in the current easing cycle, bringing the cumulative decline to 1,100 basis points from a peak of 22%.

The central bank’s decision was primarily driven by a sharp drop in inflation readings, creating room for monetary easing to support economic activity. However, real rates remain significantly positive, among the highest in the region, indicating continued monetary tightness in real terms.

Looking ahead, the MPC expects inflation to gradually rise in the coming months and settle within the 5–7% target range.

The forecast remains vulnerable to a number of risks, including fluctuations in food and wheat prices, the timing and extent of energy tariff adjustments, global commodity market swings, and potential supply chain disruptions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 156,218.18 198.21M | 0.03% 41.06 |

| ALLSHR | 93,652.33 360.88M | 0.03% 29.25 |

| KSE30 | 47,981.02 105.46M | -0.13% -62.04 |

| KMI30 | 224,482.02 92.04M | -0.26% -587.56 |

| KMIALLSHR | 60,758.87 193.98M | -0.18% -107.14 |

| BKTi | 45,062.00 46.42M | -0.09% -40.25 |

| OGTi | 32,604.18 6.88M | -1.56% -518.30 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 69,955.00 | 70,440.00 69,550.00 | -240.00 -0.34% |

| BRENT CRUDE | 88.16 | 91.05 86.24 | 0.36 0.41% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.60 -15.04% |

| ROTTERDAM COAL MONTHLY | 121.00 | 129.25 118.95 | -11.50 -8.68% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 84.28 | 88.59 81.79 | 0.83 0.99% |

| SUGAR #11 WORLD | 14.32 | 14.57 14.17 | -0.27 -1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Auto Numbers

Auto Numbers