February inflation likely to drop to 1.9% YoY

MG News | February 28, 2025 at 11:39 PM GMT+05:00

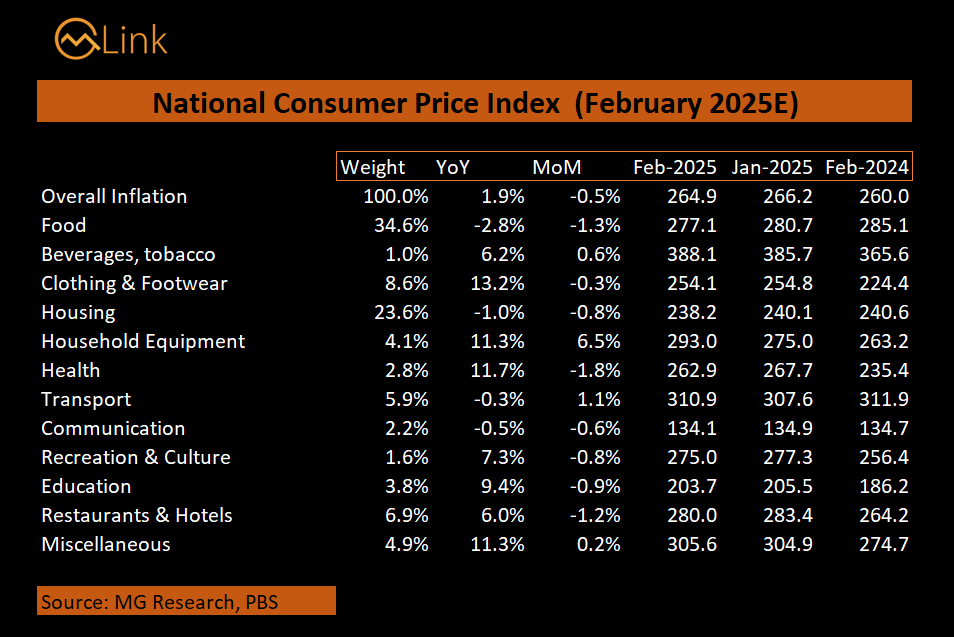

February 28, 2025 (MLN): The Consumer Price Index (CPI) for February 2025 is estimated at 1.9% YoY, compared to 2.4% YoY recorded in January 2025. On a sequential basis, inflation is expected to decrease by 0.5% compared to the previous month's decline of 0.2%.

This reduction will bring the average inflation for the first eight months of FY25 to 6%, significantly lower than the 28% recorded in the same period of FY24.

The YoY drop is primarily attributed to the base effect and a decrease in the food index.

Food Inflation is expected to decline by 1.3% MoM and 2.8% YoY, mainly due to a 55% decrease in tomato prices, a 26% decline in onion prices, and a 23% drop in potato prices compared to the previous month.

Additionally, egg and pulse prices have witnessed reductions of 8.8% and 8%, respectively.

Housing Index is anticipated to decrease by approximately 0.8% MoM due to a 7% decline in LPG prices and a 1% decrease in electricity prices, amidst higher negative fuel cost adjustments (FCA).

Transport Segment is expected to see a 1.1% MoM increase in prices due to rises in petrol and diesel prices by 1% and 2.3%, respectively. However, it remains 0.3% lower on a YoY basis, reflecting the high base from last year.

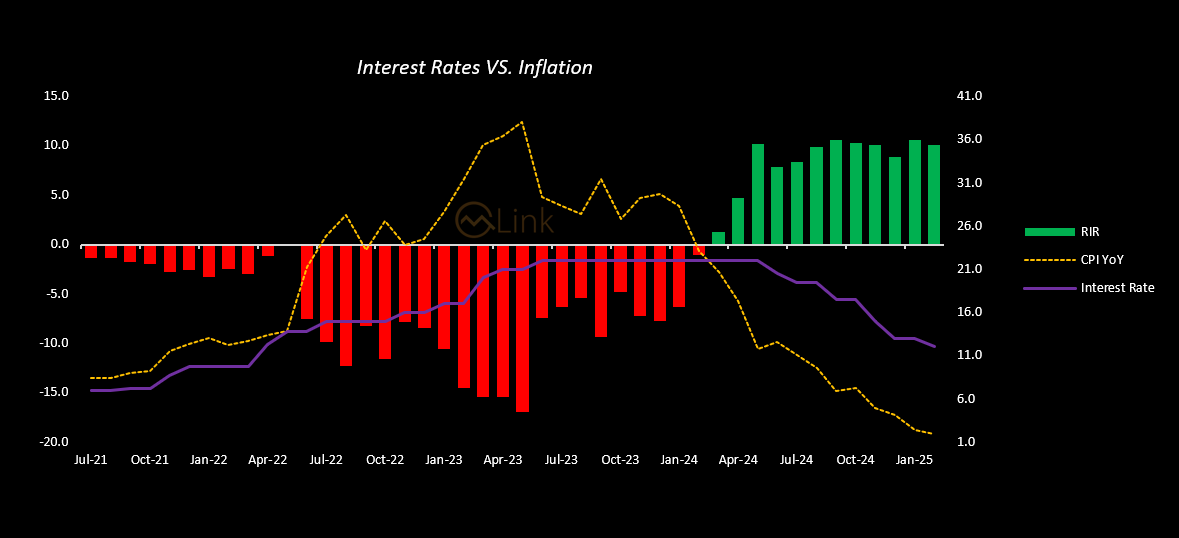

Real Interest Rate:

With inflation expectations at 1.9% for February 2025, real interest rates will be 10.1%.

On the interest rate front, the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) reduced the policy rate by 100 basis points to 12%, effective January 28, 2024, in line with market expectations.

The reduction was the sixth in a row, bringing the total decrease since June 2024 to 1,000bps as a slowdown in inflation gives policymakers room to continue monetary easing in a bid to spur growth.

For FY25, the MPC has revised the target of headline inflation to average between 5.5% – 7.5% from an earlier range of 11.5-13.5%.

Regarding its outlook, the SBP is of the view that the inflation outlook is subject to several risks, including volatile global commodity prices and protectionist policies in major economies.

Additionally, the timing and magnitude of administered energy tariff adjustments, fluctuations in perishable food prices, and any further measures to meet revenue targets could also impact the inflation trajectory.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 172,015.48 159.71M | -0.09% -154.81 |

| ALLSHR | 103,244.43 334.59M | -0.22% -232.22 |

| KSE30 | 52,697.98 63.04M | 0.07% 39.19 |

| KMI30 | 240,820.56 51.01M | 0.13% 309.27 |

| KMIALLSHR | 66,015.38 173.26M | 0.04% 27.34 |

| BKTi | 50,853.16 27.48M | -0.31% -159.74 |

| OGTi | 33,850.02 8.58M | 0.85% 284.55 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,100.00 | 68,155.00 66,880.00 | 895.00 1.33% |

| BRENT CRUDE | 72.15 | 72.18 71.59 | 0.49 0.68% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.89 | 66.92 66.31 | 0.49 0.74% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account