FBR collects net revenue of Rs 1,337 billion from July to October

MG News | November 02, 2020 at 05:11 PM GMT+05:00

November 02, 2020 (MLN): The Federal Board of Revenue has collected Rs. 1,337 billion in net revenue from July to October of the current financial year, as against Rs. 1,288 billion collected in the same period of last year.

This amount includes Income tax revenue of Rs. 470 billion, sales tax revenue of Rs. 643 billion, federal excise duty of Rs. 81 billion, and customs duty of Rs. 206 billion.

The FBR has collected gross revenue of Rs. 1,400 billion in the first four months of the financial year as against Rs. 1323 billion in the first four months of the previous financial year. Thus, from July to October this year, the gross revenue has increased by Rs. 77 billion.

In October, revenue collection was Rs. 333 billion as against Rs. 325 billion in the previous year.

Refunds of Rs 128 billion have been issued from July to October this financial year as against Rs. 52 billion issued last year. Refunds of Rs 15 billion were issued in October as against Rs 4.5 billion in the same month of last year. Despite the increase in refunds, the FBR has collected more revenue in October this year as compared to October last year. Economic activity has improved due to the increase in refunds.

Despite the 2% reduction in revenue at the import level due to the government's tax relief, the FBR has performed admirably and achieved a 13% increase in local collections, reflecting the confidence of taxpayers in the government's revenue measures.

Also, smuggled goods worth Rs 21.48 billion have been seized in the first four months of the current financial year as against Rs 13.40 billion in the first four months of last year.

The FBR is constantly striving to facilitate automation, e-audit, and procedures to facilitate trade. The FBR has taken effective measures to curb corruption, harassment, and abuse of power.

This year, for the convenience of traders, income tax returns have been introduced in a very simple and one-page manner. In addition, tax returns have been uploaded in Urdu and regional languages for traders and salaried class. The FBR has appealed to the taxpayers to avail these facilities and submit their annual income tax returns by December 8, 2020

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

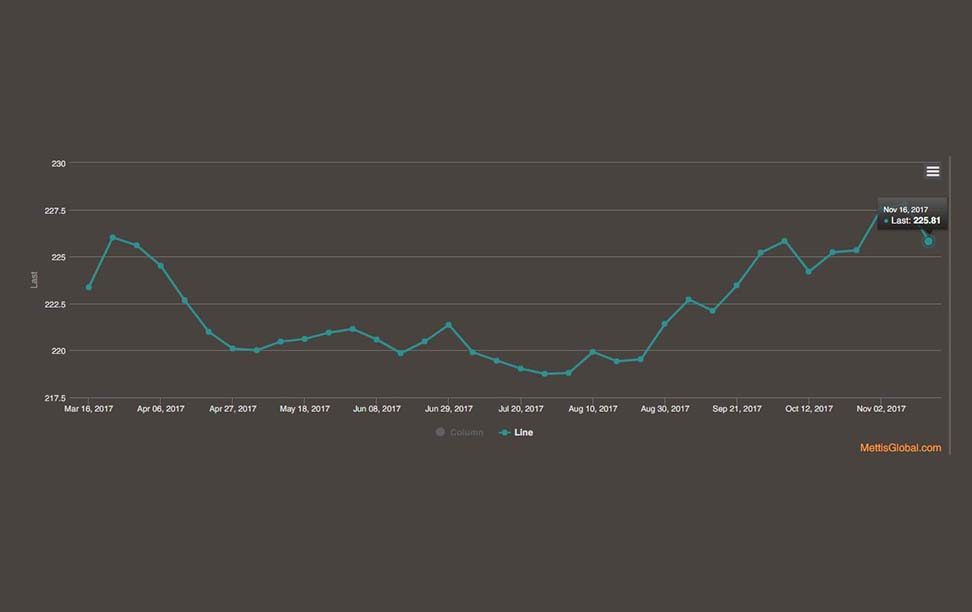

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|