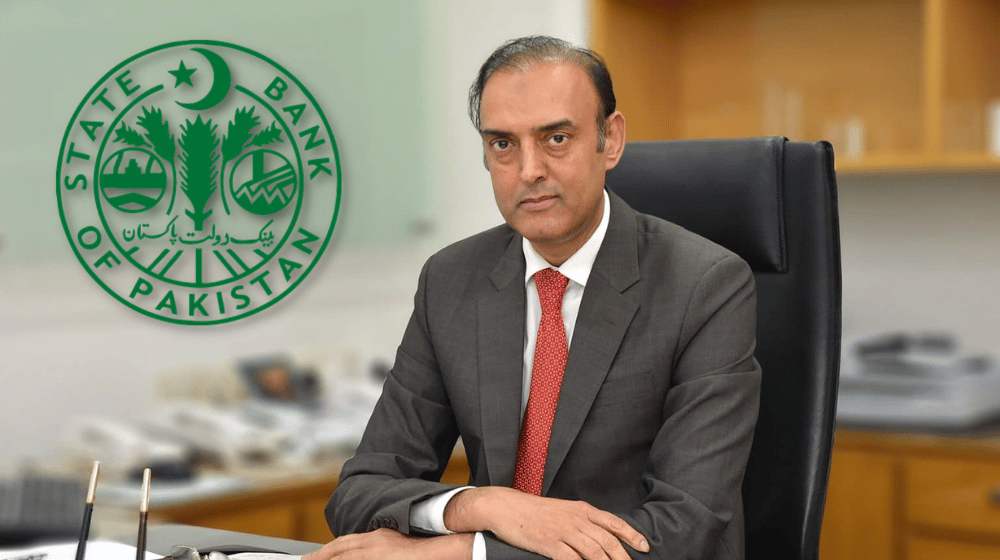

Debt management on track, outlook stable: Governor SBP

By Nilam Bano | May 06, 2025 at 10:50 AM GMT+05:00

May 06, 2025 (MLN): External debt repayments are firmly on track, with $16 billion of the $26bn due in FY25 to be rolled over, $8bn already repaid, and the remaining $1.3–1.5bn scheduled for settlement in the coming months, SBP Governor Jameel Ahmad stated during a post-MPS analyst briefing following a 100 bps policy rate cut to 11%, effective May 6, 2025.

“We are comfortably managing our obligations, and the external account is on a solid footing,” he assured.

Remittances to exceed $38bn

He also highlighted that remittance inflows continue to support the external balance, with $4.1bn recorded in the latest month alone. Monthly inflows are currently averaging $3bn and are expected to stay above this level in the final quarter of FY25.

Full-year remittances are projected to exceed $38bn, further strengthening the current account, which is now expected to post a surplus for FY25.

FX reserves to reach $19bn

The Governor also acknowledged a dip in foreign exchange reserves during the first quarter of 2025. However, with planned official inflows expected in May and June, SBP projects that total FX reserves, including those held by commercial banks, will reach $19bn, with SBP’s reserves hitting $14bn by June 2025.

Notably, SBP has successfully slashed its forward FX liabilities from a peak of $5.7bn to $2.6bn.

“Had we not reduced these obligations, our reserves would’ve been $3 billion higher,” the Governor noted.

Despite SBP’s continued interventions in the forex market, the rupee has remained broadly stable, and the central bank expects reserve buffers to continue improving into FY26.

GDP growth outlook maintained

Citing better-than-expected performance in the third quarter, the SBP maintained its GDP growth forecast at 2.5–3.5% for FY25. Growth during Q1 and Q2 stood at 1.3% and 1.7%, respectively.

The Governor also clarified that current import levels are in line with projections and deemed manageable.

Fitch’s recent upgrade of Pakistan’s credit rating reflects growing investor confidence and an improving macroeconomic backdrop.

Inflationary pressures have eased further, aided by lower electricity costs and food prices. The SBP now expects inflation to average 4.5–5.5% in FY25, and 5.5–6.5% in FY26, within its medium-term target range of 5–7%.

Even after the rate cut, real interest rates remain strongly positive, hovering around 400–500 basis points. This provides policy space to support growth while keeping inflation in check.

Auto Financing Cap

While responding to a question on the auto financing cap, the Governor said that the Rs3 million cap on car financing will remain for now, but the SBP may revisit this policy as the auto sector continues to grow.

On private sector credit, he was of the view that with reduced government borrowing needs, the SBP is placing greater focus on facilitating credit for the private sector.

US Tariff Impact

Governor Ahmad acknowledged that while recent U.S. tariffs may weigh on exports, the benefit from lower global commodity prices is likely to outweigh the impact, which will leave no immediate negative effect on the economy.

Overall, the Governor was of the view that Overall economic fundamentals have improved significantly, which supported the SBP’s latest policy move of slashing the interest rate by 100bps.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,475.00 | 110,105.00 109,405.00 |

-810.00 -0.73% |

| BRENT CRUDE | 68.52 | 69.00 68.49 |

-0.59 -0.85% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.88 | 67.50 66.85 |

-0.57 -0.85% |

| SUGAR #11 WORLD | 15.56 | 15.97 15.44 |

-0.14 -0.89% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)

Trade Balance

Trade Balance

CPI

CPI