SBP slashes policy rate by 100 bps to 11%

By MG News | May 05, 2025 at 04:03 PM GMT+05:00

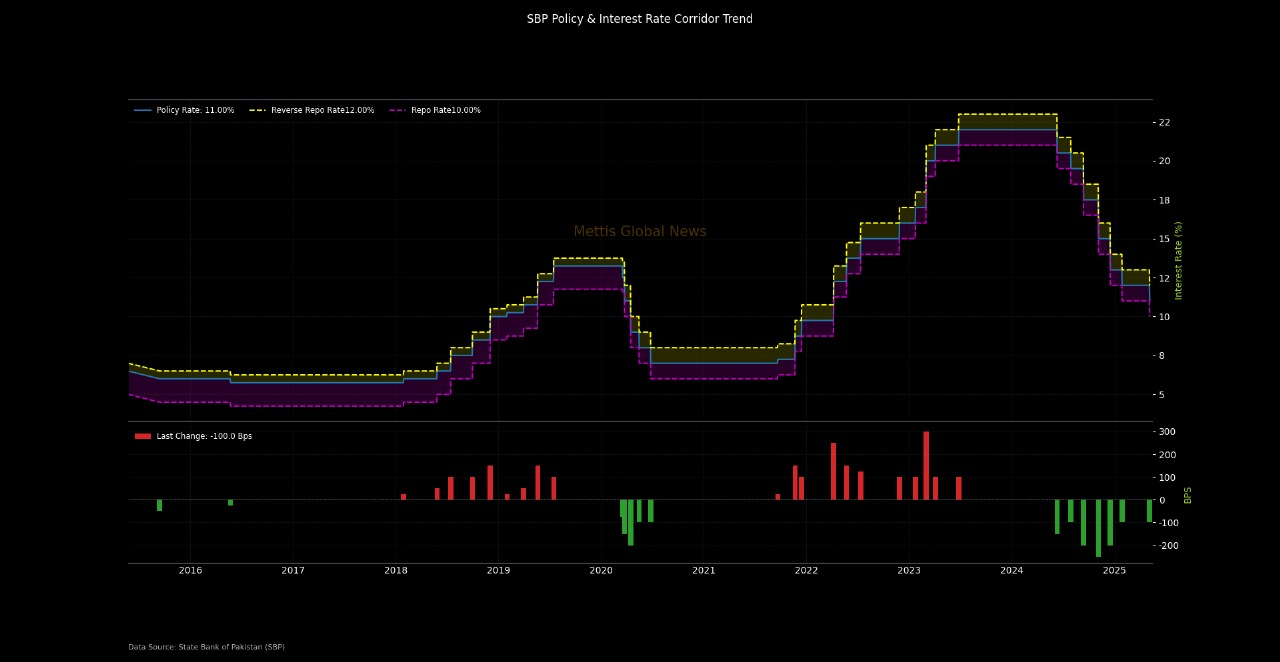

May 05, 2025 (MLN): The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) decided to cut the policy rate by 100 bps to 11 percent, effective from May 6, 2025, in contrast with market expectations.

The Committee noted that inflation declined sharply during March and April, mainly due to a reduction in administered electricity prices and a continued downtrend in food inflation.

Core inflation also declined in April, primarily reflecting favourable base effects amidst moderate demand conditions.

Overall, the MPC assessed that the inflation outlook has improved further relative to the previous assessment.

At the same time, the Committee viewed that the heightened global uncertainty surrounding trade tariffs and geopolitical developments could pose challenges for the economy.

In this backdrop, the MPC emphasized the importance of maintaining a measured monetary policy stance.

While reaching the decision, the Committee noted the following key developments since its last meeting.

First, provisional real GDP growth for Q2-FY25 was reported at 1.7 percent y/y, whereas Q1 growth was revised up to 1.3 percent from 0.9 percent.

Second, the current account recorded a sizable surplus of $1.2 billion in March, mainly due to record-high workers’ remittances.

This surplus and SBP’s FX purchases partially cushioned the impact of large ongoing debt repayments on the SBP’s FX reserves.

Third, recent surveys suggest further improvement in both consumer and business sentiments.

Fourth, shortfall in tax collection has continued to widen. Lastly, global uncertainty, particularly around tariffs, has led the IMF to sharply downgrade its 2025 and 2026 growth projections for both advanced and emerging economies.

The tariff uncertainty has also triggered heightened financial market volatility and a sharp decline in global oil prices.

On balance, considering the evolving developments and risks, the MPC viewed that the real policy rate remains adequately positive to stabilize inflation in the target range of 5 – 7 percent, while ensuring that the economy grows on a sustainable basis.

Real Sector

Real GDP growth was provisionally reported at 1.7 percent in Q2-FY25, bringing cumulative growth in H1-FY25 to 1.5 percent.

This was in line with the MPC’s expectation. Furthermore, incoming high-frequency indicators suggest that economic activity is maintaining momentum, as reflected by rising sales of passenger vehicles and petroleum products (excluding furnace oil), increasing electricity generation, and improving business and consumer confidence.

Nonetheless, the MPC observed that LSM outturns continue to remain below expectation.

This is driven by a sizable contraction in a few low-weight segments and construction-allied sectors, which are more than offsetting positive growth momentum in key segments, such as garments, textiles, pharma and automobiles. In agriculture, while wheat output turned out to be better than the target, it remained lower than last year.

The MPC kept its FY25 growth projection unchanged in the range of 2.5 – 3.5 percent and anticipates it to accelerate further in FY26.

This outlook is, however, subject to risks, particularly from global uncertainty and unfavorable weather conditions for the upcoming Kharif season.

External Sector

The substantial current account surplus in March 2025 – led mainly by record-high workers’ remittances, propelled the cumulative surplus to $1.9 billion during July-March FY25. The MPC observed that the moderation in import bill, mainly due to the reduction in global oil prices, along with the continued uptick in HVA-textile exports, also contributed to the current account surplus in March.

However, for April, PBS has reported the trade deficit to have risen sharply to $3.4 billion. On balance, supported by robust workers’ remittances, the MPC assessed the current account to remain in surplus during FY25.

The MPC observed that the net financial inflows have remained weak till March mainly due to large debt repayments and delays in the realization of official inflows.

Nonetheless, on the back of the expected realization of planned official inflows, the MPC expects SBP’s FX reserves to rise to $14 billion by June 2025.

Going forward, the MPC expects this build-up in FX reserves to continue in FY26, based on a moderate current account deficit and improved financial inflows.

At the same time, the MPC cautioned that this outlook is subject to risks, particularly those emanating from uncertain global economic and trade environment.

Fiscal Sector

FBR tax revenue recorded a sizable 26.3 percent y/y growth during July-April FY25, though it remained below the target. The MPC noted that the government raised PDL rates, which is expected to further propel non-tax revenues in the remaining months of FY25.

Moreover, estimates from the financing side suggest that overall expenditures remained relatively contained during July-March FY25.

On balance, the Committee reaffirmed its earlier assessment that while the overall fiscal deficit may remain close to the FY25 target, achieving the targeted primary surplus appears to be challenging.

In this context, the MPC highlighted the need for reforms to put the fiscal sector on a more sustainable footing, especially by expanding the tax net and reforming SOEs.

In this regard, the MPC acknowledged the recent legislations to increase agriculture income tax collection by the provinces, and emphasized on their effective implementation.

Money and Credit

The broad money (M2) growth accelerated to 13.3 percent y/y as of April 18 from around 11 percent at the time of the last MPC meeting.

This was driven by both NDA and NFA of the banking system. The acceleration in NDA growth was entirely due to uptick in credit to the private sector, which grew by 12.6 percent y/y, reflecting easing financial conditions and improving economic activity.

Specifically, firms in textile, refinery, and chemical and fertilizer sectors increased their borrowing for working capital during July-March FY25 as compared to the same period last year. Auto financing and personal loans have also risen this year.

On the liability side, the currency in circulation recorded Eid-related seasonal increase in March, and which has partially reversed so far. This has led to an uptick in reserve money growth to 13.1 percent by April 18.

Inflation

Continuing its downtrend, headline inflation fell to 0.3 percent y/y in April, driven primarily by food and energy prices. A sharp decline in wheat and allied product prices, moderation in global commodity prices and downward adjustment in electricity tariffs were the major drivers of this ease in food and energy prices.

These factors also contributed to the moderation in inflation expectations of consumers. Moreover, core inflation, after remaining sticky at around 9 percent over the past few months, declined to 8.0 percent y/y in April.

Going forward, the Committee anticipates inflation to gradually inch up in the coming months and stabilize within the target range of 5 – 7 percent.

This outlook is, however, subject to both upside and downside risks emanating from volatility in wheat and other food prices, timing and magnitude of energy price adjustments, potential global supply-chain disruptions and uncertain commodity price outlook.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI