CPI review: Fade to black

MG News | February 01, 2022 at 05:35 PM GMT+05:00

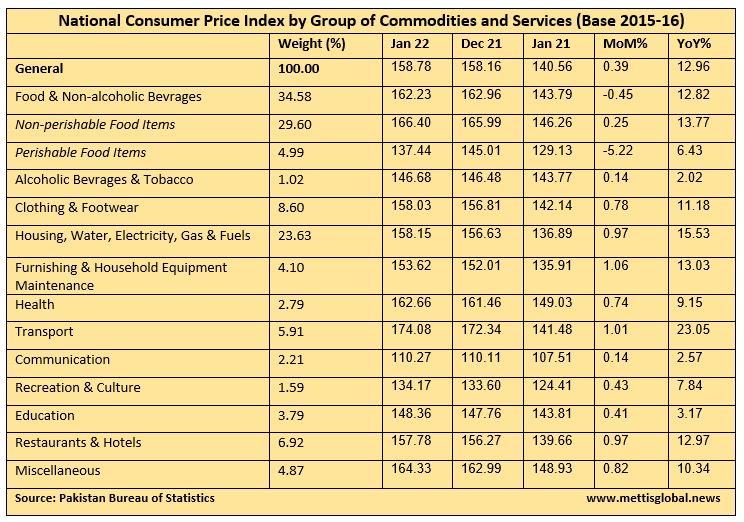

February 1, 2022 (MLN): The grey clouds of inflation are slowly turning black wiping every clue for the common man to meet both ends as the latest inflation numbers unveiled by the Pakistan Bureau of Statistics (PBS) showed the Consumer Price Index (CPI) to clock in at 13% YoY in January 2022, compared to 12.3 percent in December 2021 and 5.7 percent in January 2021.

The uneven overheated economy has encouraged the inflation monster to keep stirring which has taken the 7MFY22 average inflation to 10.3% YoY compared to 8.2%YoY from the corresponding period last year on the back of soaring food, housing and electricity indices.

On a sequential basis, the prices of essential items rose by 0.4 percent in January 2022 as compared to a decline of 0.02 percent in December 2021 and a drop of 0.2 percent in January 2021.

On the yearly basis, food prices moved up by 12.82% YoY mainly due to a rise in the prices of wheat, rice, meat, chicken, milk, ghee & oil and pulses by 23 % YoY, 9.4 % YoY, 21 % YoY, 9.5 %YoY, 48 % YoY and 9% YoY, respectively compared to January 2021 price levels.

Moving on, the housing, water and electricity index has also moved up 15.53% mainly on the higher fuel adjustment and power charges which keep pushing the economy towards cost-push inflation.

To note, the food index witnessed a notable decline of 0.45% MoM due to a drop in the prices of perishable food items as the prices of tomatoes, potatoes and condiments, spices have decreased by 5.22%. Whereas, the price of non-perishable food items increased by 0.25% during the month.

At the same time, core inflation- measured by Non-Food Non-Energy (NFNE) in cities climbed up by 8.2% YoY in January 2022 as compared to an increase of 8.3% in the previous month and 5.4% in January 2021. On monthly basis, urban areas observe a slight increment in the prices by 1.1% in January 2022 as compared to the reported increase of 1.1% in the previous month, and an upsurge of 0.9% in the corresponding month of last year.

Similarly, rural core inflation jumped by 9% YoY in the first month of CY22 as compared to an increase of 8.9% in the previous month and 7.8% in January 2021. While on a sequential basis, the prices of NFNE inched up by 1.2% compared to an increase of 1.1% in December 2021, and a surge of 1.1% in the corresponding month of CY20.

The Wholesale Price Index (WPI) for January 2022 increased by 0.65% over December 2021. It has jumped by 23.96% over the corresponding month of the last year i.e. January 2021. The surging gap between CPI and WPI created an alarming situation which indicates that cost-push inflation will likely hit the remaining months of FY22.

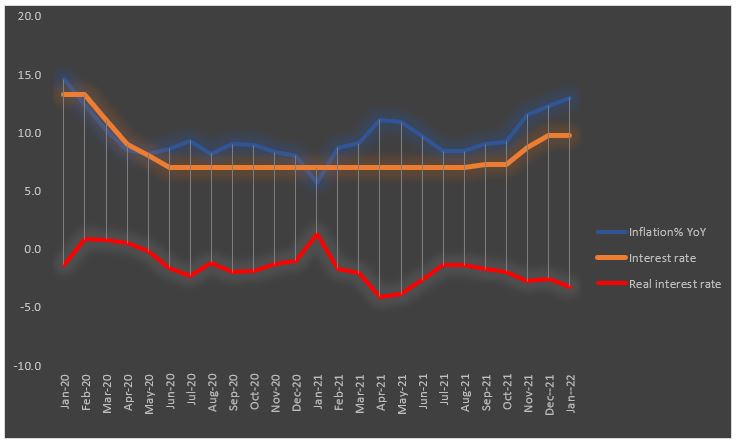

In order to cool down the unevenly heated economy, SBP has been increasing the policy rate by 275 basis points from September 2021, but the real interest rate is still hovering in the negative territory at 3.3%.

Taking a pause in the hike in the policy rate in its recent monetary policy meeting, the SBP has guided that it will no longer aim for positive real interest rates and is likely to increase the policy rates only moderately in the near future.

MPC statement noted that the current real interest rates on a forward-looking basis are appropriate to guide inflation to the medium-term range of 5-7 percent, support growth, and maintain external stability. If future data outturns require a fine-tuning of monetary policy settings, the MPC expected that any change would be relatively modest.

Outlook:

Going forward, inflation is expected to remain elevated given the rising oil prices in the international commodity market and measured being taken in the name of fiscal consolidation through mini-budget.

"CPI will likely normalize to around 11% until June and touch 13% in the summer months. But, by that time average CPI for the next 12mth (FY23) is expected to be 8-9% – partly due to the high base effect and assuming global crude oil prices peak around US$100 per bbl," Saad Hanif, Head of Research at Intermarket Securities noted.

This will justify the present monetary policy, where the policy rate may remain at 9.75% until the end of FY22, he added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 185,098.83 381.92M | 2.01% 3642.50 |

| ALLSHR | 111,509.35 956.25M | 2.13% 2327.02 |

| KSE30 | 56,737.75 167.91M | 2.00% 1112.07 |

| KMI30 | 260,872.72 165.83M | 2.57% 6529.72 |

| KMIALLSHR | 71,488.31 461.39M | 2.50% 1744.73 |

| BKTi | 53,691.60 50.03M | 1.27% 672.83 |

| OGTi | 38,672.45 45.54M | 4.90% 1805.03 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 95,660.00 | 96,060.00 94,395.00 | 305.00 0.32% |

| BRENT CRUDE | 64.20 | 64.77 63.44 | 0.44 0.69% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -1.95 -2.20% |

| ROTTERDAM COAL MONTHLY | 97.90 | 98.10 97.70 | 0.55 0.57% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.22 | 60.05 58.81 | 0.14 0.24% |

| SUGAR #11 WORLD | 14.99 | 15.00 14.60 | 0.42 2.88% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

%20(1)_20260116105337097_4b6493.jpg?width=280&height=140&format=Webp)

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=280&height=140&format=Webp)

RDA

RDA