COVID-19 could mean a $211 bln loss for Asia-Pacific Economies, says S&P

MG News | March 06, 2020 at 10:44 AM GMT+05:00

March 6, 2020: Growth across Asia-Pacific will slow to 4.0% in 2020, the lowest since the Global Financial Crisis, due to the coronavirus outbreak. A U-shaped recovery should start later in 2020 but by then overall economic damage is likely to reach US$211 billion. That's according to an article S&P Global Ratings published titled "COVID-19 Now Threatens More Damage to Asia-Pacific."

Asia-Pacific's outlook has darkened mainly due to the global spread of the coronavirus.

"Household spending in Japan and Korea are set to weaken further and slower growth in the U.S. and Europe will add to external headwinds," said Shaun Roache, Asia-Pacific chief economist at S&P Global Ratings. "China's return to work is proceeding at a glacial pace as local officials remain cautious about a renewed upturn in infections."

The coronavirus epidemic is not expected to inflict permanent damage to the labour force or the capital stock. This means the region's economies should be employing as many people and producing as much output by the end of 2021 as they would have done in the absence of the virus.

"Still, even a U-shaped recovery will mean a regional economic loss of about $211 billion that will weaken balance sheets. Some economic activities will be lost forever, especially for the service sector," Mr. Roache said. This loss will be distributed across the household, non-financial corporate, financial, and sovereign sectors. The more that governments step in to cushion the blow with public resources, the more the burden will be shifted to the public sector.

We now expect China to grow at just 4.8% in 2020 before rebounding strongly by 6.6% in 2021. "We make a very important assumption in our China forecast--that the government shows flexibility with the growth target and steps lighter on the stimulus gas pedal compared to past downturns," Roache noted.

The hardest-hit economies remain Hong Kong, Singapore, and Thailand where people flows and supply chain channels are large. It is no surprise that here we also see the most robust fiscal policy response which will cushion the blow but not sharp downturns. We expect Hong Kong's economy to contract by -0.8% in 2020, Singapore's to flat line, and Thailand's expansion to slow to 1.6%.

Australia is also quite vulnerable, with growth in 2020 expected to touch 1.2%, by our new forecast, well below trend. "Australia's most-disrupted sectors employ a large share of workers which will weaken both the labor market and consumer confidence," Roache said. Services account for almost 80% of employment with accommodation and catering, sensitive to tourism and discretionary consumer spending, alone making up over 7%. We expect the Reserve Bank of Australia to cut rates once more to 0.25%.

Local coronavirus transmission in Japan and Korea add a new, highly uncertain dimension to problems in these economies. Households are likely to respond to a greater risk of infection by avoiding public spaces, which will depress spending on discretionary goods and services. In Japan and Korea, we estimate that discretionary consumption accounts for about 25% of GDP. We now anticipate Japan's economy will contract -0.4% and Korea's growth to slow to 1.1%.

Asia's emerging markets such as Indonesia, Malaysia, the Philippines, and India appear somewhat insulated, with less exposure to China and global supply chains. However, the outlook could get worse, very quickly for two reasons. If low reported cases are due, in part, to minimal testing, then the viral spread is still possible and could overwhelm weak healthcare infrastructure. Financial conditions could also tighten quickly.

"If investors ask for a much higher risk premium for emerging market assets, policymakers will have much less space to cut interest rates and boost public spending," Mr Roache said. This could add to downward pressures on growth.

Press Release

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

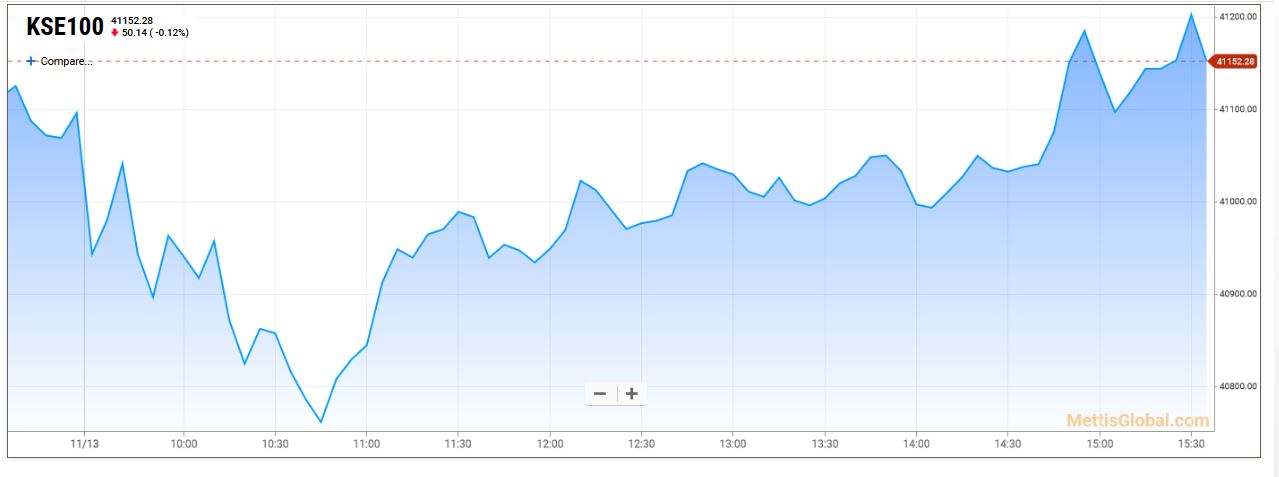

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|