Barclays sees more upside for AI stocks in long term

MG News | June 22, 2023 at 03:07 PM GMT+05:00

June 22, 2023 (MLN): Any pullback in artificial intelligence-related stocks is a reason to buy as valuations aren’t overly expensive despite their stunning gains this year, Barclays Plc strategists say as reported by Bloomberg.

“We think any retracement would present a tactical opportunity rather than a structural collapse of the trade because multiples have not risen to historical extremes,” the Barclays team including Venu Krishna and Emmanuel Cau wrote in a note, referring to the sector’s price-to-earnings ratio.

“The expanding AI economy should help its primary beneficiaries grow into their valuations over the longer term.”

The strategists’ call is at odds with growing concerns that the frenzy around AI this year, which helped lift the S&P 500 into a bull market in June has run too hot.

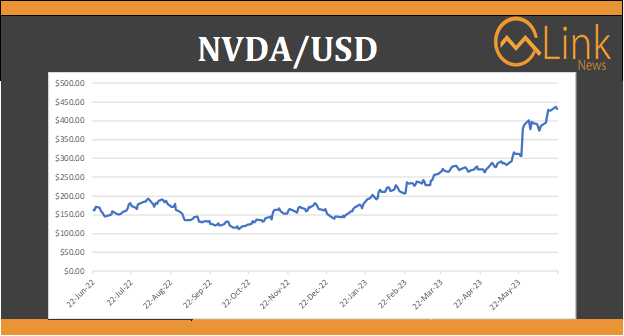

Nvidia Corp. whose market capitalization surged to a record $1 trillion due to its AI exposure is still trading at a price-to-earnings ratio below a peak for the Covid rebound.

NVDA Stock Price Daily time-frame

The rally has drawn comparisons with the dot-com bubble of 2000, when the market was driven by a similarly narrow breadth of technology-related stocks before a crash.

But Barclays strategists say the outlook this time is likely to be different as “leadership is concentrated in profitable businesses, rather than speculative ones.”

“In addition, we view AI as a tech accelerant akin to, and potentially far more potent than, the digital transformation sparked by Covid, which we believe is likely to provide support to longer-term multiple expansion,” the strategists said.

Still, they warned that the outperformance of US stocks at an index level now carries a higher price tag.

A near-record valuation premium and index concentration warrants diversification into international equities, they said. Last year, Cau correctly predicted a short-term bounce in equities on the back of defensive positioning.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 185,057.83 215.80M | 0.48% 883.35 |

| ALLSHR | 111,198.99 737.64M | 0.43% 473.52 |

| KSE30 | 56,808.99 106.85M | 0.61% 346.11 |

| KMI30 | 262,806.58 83.35M | 0.67% 1756.35 |

| KMIALLSHR | 71,591.94 246.19M | 0.51% 360.96 |

| BKTi | 53,634.85 44.18M | 0.76% 405.81 |

| OGTi | 38,885.41 12.11M | 0.76% 294.99 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 78,620.00 | 79,660.00 74,785.00 | -5485.00 -6.52% |

| BRENT CRUDE | 66.41 | 68.83 65.45 | -2.91 -4.20% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -4.75 -5.01% |

| ROTTERDAM COAL MONTHLY | 102.50 | 102.50 100.25 | -0.90 -0.87% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.28 | 64.74 61.39 | -2.93 -4.49% |

| SUGAR #11 WORLD | 14.26 | 14.35 14.13 | -0.01 -0.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI