Will Crude touch $100 per barrel?

MG News | June 17, 2025 at 10:36 AM GMT+05:00

June 17, 2025 (MLN): Oil prices have surged by up to 9% in recent days amid escalating Middle East tensions, but analysts say a climb to $100 per barrel remains unlikely due to stable demand, ample global reserves, and strategic buffers held by major consumers like the U.S. and China.

As the Iran-Israel conflict enters its fifth day, energy markets are closely watching the outcome of the G-7 Summit scheduled for today a meeting seen as pivotal for determining the near-term trajectory of crude prices, according to a report issued by Sherman Research.

Analysts believe the summit may lead to a diplomatic push, compelling both nations toward peace talks, which could ease market jitters.

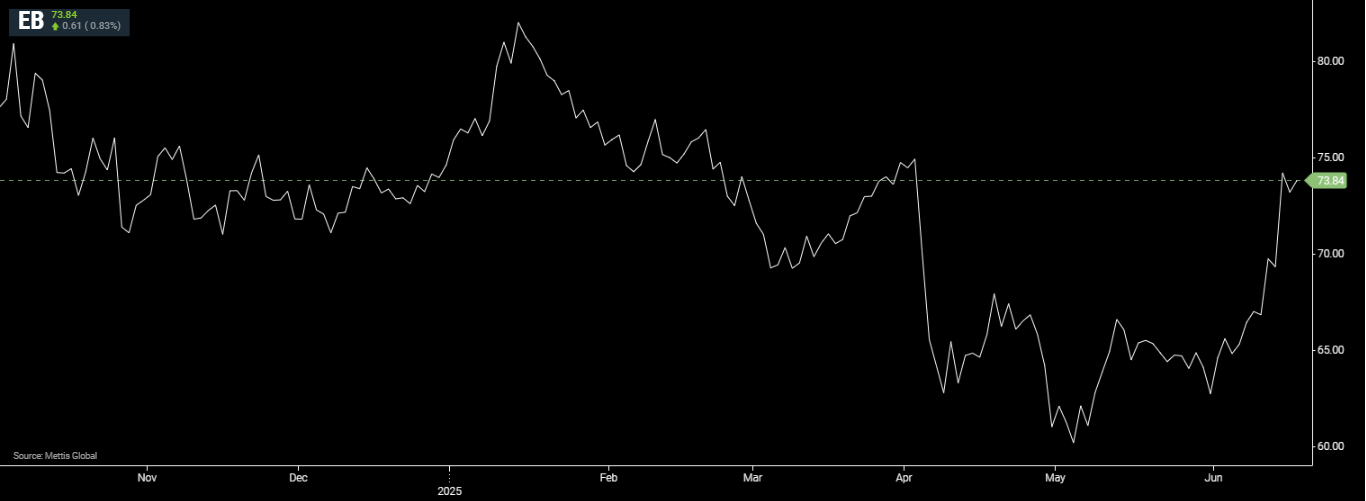

The latest escalation began with significant Israeli strikes on Iran early Friday, triggering an 8–9% rally across major crude benchmarks, including Arab Light, Brent, and WTI. Arab Light, a key import for Pakistan, surged 9% to $75.4 per barrel.

Though this marks a notable spike, Arab Light has stayed relatively stable through the year, while WTI has closed its earlier $10 per barrel gap and is now trading near parity.

Analysts caution that unless a substantial disruption occurs particularly at the Strait of Hormuz, which facilitates about 20% of global oil trade prices are expected to remain under $75 per barrel.

This outlook is reinforced by the combined strategic petroleum reserves of China and the U.S., totaling roughly 2 billion barrels.

These stockpiles, built during a period of weak demand, provide an estimated 12–13 weeks of import cover, acting as a key stabilizer against any supply shock.

Market sentiment is further tempered by expectations that OPEC, which has been curbing output by 5–6% of global demand, could ramp up production if prices remain elevated, especially to regain ground lost to non-OPEC producers.

While Iran’s share in global crude exports is only around 3–4% (approximately 1.5–1.7 million barrels per day), any serious supply disruption at key chokepoints like Hormuz could still send prices well above current levels, possibly testing triple digits.

This is the current price of crude oil, with Brent futures trading at $73.84 per barrel after a $0.62 (0.85%) increase, and West Texas Intermediate (WTI) at $72.34 per barrel, up by $0.57 (0.79%) as of 10:30 AM PST.

Pakistan’s Energy Outlook

For Pakistan, the impact of rising oil prices remains manageable at least for now.The country’s energy import bill for FY25 is estimated at $16bn,

assuming an average crude price of $80 per barrel.

If prices hover at current levels, the bill for FY26 is expected to remain largely unchanged.

Additionally, since domestic energy

prices (gas and electricity) were revised upwards when crude was trading around

$90–95, there may be limited pressure on the circular debt.

Oil Marketing Companies (OMCs) could benefit from the

current rally, with reduced inventory losses improving 4QFY25 earnings.

Refining margins (GRMs) are currently strong, hovering

around $10 per barrel the highest since February 2024 though a correction is

expected.

For exploration and production (E&P) firms, the price

rally is unlikely to bring a major earnings impact.

While risks remain, the prevailing sentiment among energy analysts is that without a serious supply disruption, oil prices will likely stabilize keeping the $100 per barrel mark out of reach, at least in the short term.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,130.43 110.30M |

0.14% 190.56 |

| ALLSHR | 84,547.42 316.46M |

-0.06% -52.96 |

| KSE30 | 41,488.92 40.37M |

0.28% 115.24 |

| KMI30 | 191,023.80 39.04M |

-0.02% -46.18 |

| KMIALLSHR | 55,647.87 141.16M |

-0.16% -90.20 |

| BKTi | 38,075.94 10.21M |

-1.08% -413.81 |

| OGTi | 27,744.20 4.53M |

-0.16% -43.95 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,605.00 | 118,610.00 117,255.00 |

1865.00 1.60% |

| BRENT CRUDE | 68.95 | 69.09 68.81 |

0.24 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.84 | 67.01 66.73 |

0.32 0.48% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks