Weekly Market Roundup

_20260118095848021_9532f9.jpeg?width=950&height=450&format=Webp)

MG News | January 18, 2026 at 03:06 PM GMT+05:00

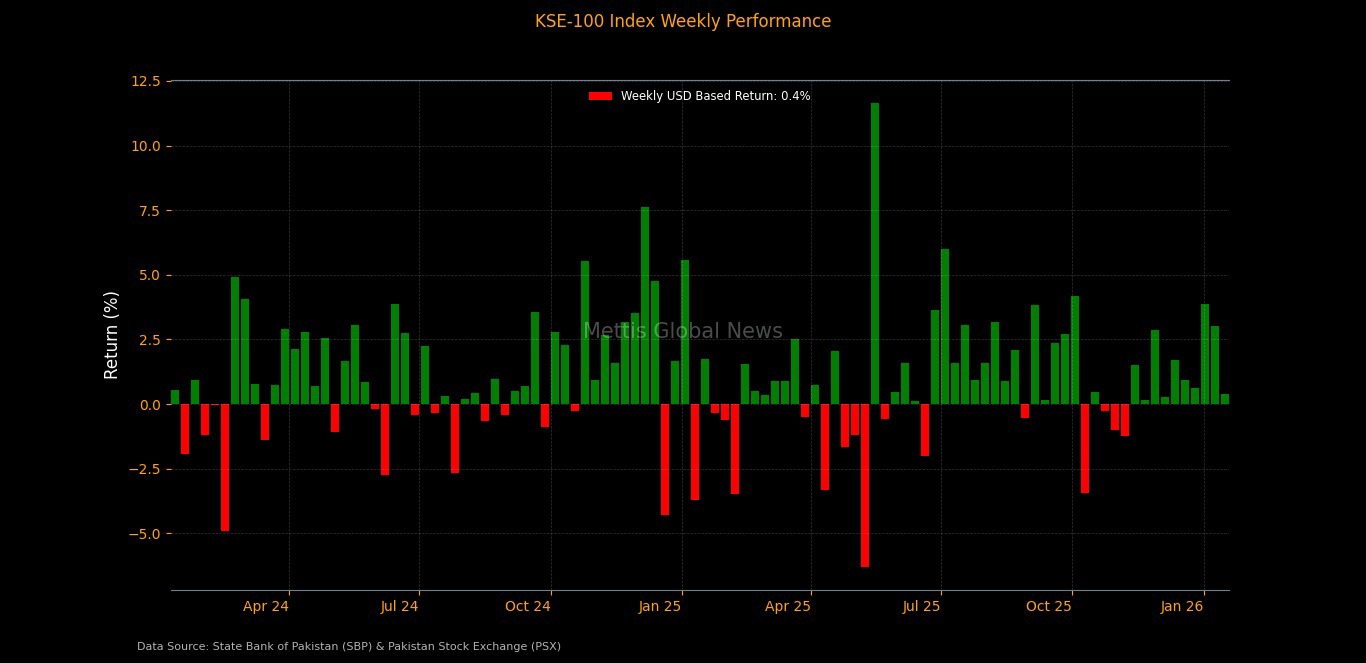

January 18, 2026 (MLN): The Pakistan Stock

Exchange closed the outgoing week on a marginally positive note, with the

benchmark KSE-100 Index gaining 689.16 points, or 0.37% WoW,

to settle at 185,098.83, compared to 184,409.67 at the close of

the previous week.

Market mood drew additional support from the federal

government’s move to maintain existing fuel prices for the upcoming fortnight

beginning January 16, 2026.

The price of High Speed Diesel has been retained at Rs257.08

per litre, while petrol continues to be sold at Rs253.17 per litre.

Internationally, concerns linked to the prospect of US

action against Iran and the resulting implications for global markets subsided

after Washington scaled back its posture by pulling out a portion of its

military personnel from bases across the Middle East.

Market Capitalization

In terms of market capitalization, total market cap in rupee

terms increased to Rs5.43 trillion during the week, up from Rs5.41tr

last week.

This represents an increase of approximately Rs20.0

billion, or 0.37% WoW, broadly mirroring the movement in the

benchmark index.

In dollar terms, market capitalization rose to $19.41bn

from $19.33bn in the previous week, marking an increase of around $76.5

million, or 0.40% WoW._20260118095835997_06bd36.jpeg)

Consequently, USD returns for the week stood at 0.40%,

compared to 3.03% last week, indicating moderation in foreign-adjusted

gains amid a relatively stable exchange rate.

On a macroeconomic front, automobile financing rose

marginally by 0.33% MoM to Rs319.1bn

in December 2026, marking a sharp 35.5% YoY increase, while overall consumer

financing grew 15% YoY to Rs997.9bn, SBP data showed.

SBP data showed Roshan Digital Accounts received $213m

in inflows during December 2025, raising cumulative inflows to $11.7bn, while

net repatriable liability increased by $43m to $2.23bn as $170m was repatriated

or utilized locally.

Pakistan’s large-scale manufacturing output rose

10.37% YoY in November 2025, with LSMI growth led by automobiles, petroleum

products and garments, lifting cumulative July–November FY26 growth to 6.01%,

official data showed.

The SBP raised

Rs546bn through its latest fixed-rate PIB auction, with cut-off yields

ranging between 10.19% and 11%, as strong demand was seen for 3-year and

10-year bonds while bids for the 15-year zero-coupon bond were rejected.

The Pakistani rupee posted a slight appreciation against the

US dollar during the week, strengthening to Rs279.95 per USD on January 16,

2026, compared to Rs280.02 a week earlier.

The continued stability in the exchange rate provided modest

support to foreign investor returns and helped contain external volatility

during the consolidation phase in equities.

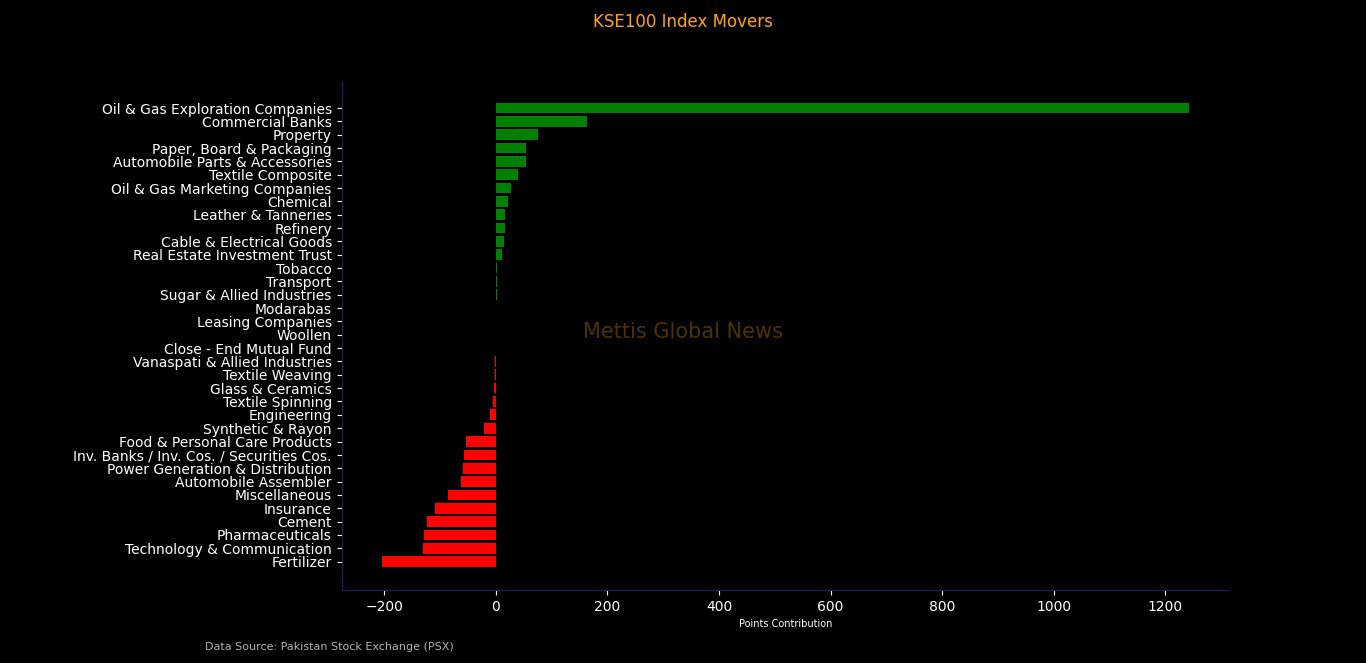

Index Movers

Sector-wise performance was mixed, with Oil & Gas

Exploration Companies emerging as the dominant driver of index gains,

contributing a substantial 1,242 points, supported by strong upside in

key exploration names.

This was followed by Commercial Banks, which added 163

points, while Property stocks contributed 75 points. Other

notable positive contributors included Paper, Board & Packaging (+53

points), Automobile Parts & Accessories (+53 points), Textile

Composite (+41 points), Oil & Gas Marketing Companies (+27 points),

and Chemical (+22 points).

Additional support came from Refinery (+16 points), Cable

& Electrical Goods (+15 points), and Real Estate Investment Trusts

(+11 points).

On the downside, Fertilizer stocks emerged as the

largest drag, shaving off 204 points, followed by Technology &

Communication (-130 points), Pharmaceuticals (-129 points), Cement

(-124 points), and Insurance (-110 points).

Further pressure was observed in Power Generation &

Distribution (-58 points), Investment Banks / Investment Companies /

Securities Companies (-56 points), Food & Personal Care Products

(-53 points), and Automobile Assemblers (-62 points), which

collectively capped broader market upside.

Scripwise, Oil & Gas Development Company Limited

(OGDC) emerged as the single largest contributor to the KSE-100 Index,

adding 789 points, followed by Pakistan Petroleum Limited (PPL)

with 558 points.

Among banks, National Bank of Pakistan (NBP) added 213

points, while Askari Bank (AKBL) contributed 210 points, and Meezan

Bank (MEBL) added 105 points.

Other notable gainers included Atlas Honda Limited (ATLH)

(+144 points), Pakistan Telecommunication Company Limited (PTC) (+116

points), JDW Sugar Mills (JVDC) (+75 points), Nishat Mills Limited

(NML) (+60 points), Pakistan State Oil (PSO) (+56 points), and FATIMA

Fertilizer (+56 points).

On the downside, selling pressure was concentrated in

heavyweight names, with Systems Limited (SYS) emerging as the largest

laggard, shaving off 209 points.

This was followed by Fauji Fertilizer Company (FFC)

(-184 points), United Bank Limited (UBL) (-180 points), MCB Bank

(-164 points), and Sazgar Engineering Works (SAZEW) (-145 points).

Other notable drags included Adamjee Insurance (AICL),

Engro Holdings (ENGROH), Lucky Cement (LUCK), HBL, Indus

Motor (INDU), and Pakistan Elektron (PSEL), which collectively

limited further upside in the index.

FIPI / LIPI Flows

From an investor flow perspective, foreign investors

remained net sellers, with total FIPI outflows amounting to $10.78m

during the week.

The selling was primarily driven by foreign corporates,

which recorded net selling of $14.20m, while foreign individuals

posted marginal net outflows of $0.01m. This was partially offset by overseas

Pakistanis, who emerged as net buyers with inflows of $3.44m.

In contrast, local investors absorbed the entire foreign

selling, as Local Institutional Portfolio Investors (LIPI) recorded

net buying of $10.78m.

Buying was led by individual investors with net

inflows of $16.09m, followed by mutual funds ($12.79m), companies

($6.59m), and broker proprietary trading ($5.28m). This was partially

offset by net selling from banks/DFIs (-$23.50m) and insurance

companies (-$15.84m), while NBFCs and other organizations provided marginal

support._20260118095818765_6f0c1b.jpeg)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 73,895.00 | 74,120.00 67,615.00 | 5430.00 7.93% |

| BRENT CRUDE | 81.48 | 84.48 80.30 | 0.08 0.10% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 74.87 | 77.23 73.28 | 0.31 0.42% |

| SUGAR #11 WORLD | 13.71 | 14.07 13.70 | -0.22 -1.58% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg_20260127052750720_42cc2c.jpeg?width=280&height=140&format=Webp)

MTB Auction

MTB Auction