Big industry output grows 10% YoY in November

Hafiz Muhammad Abdullah Hashim | January 16, 2026 at 04:18 PM GMT+05:00

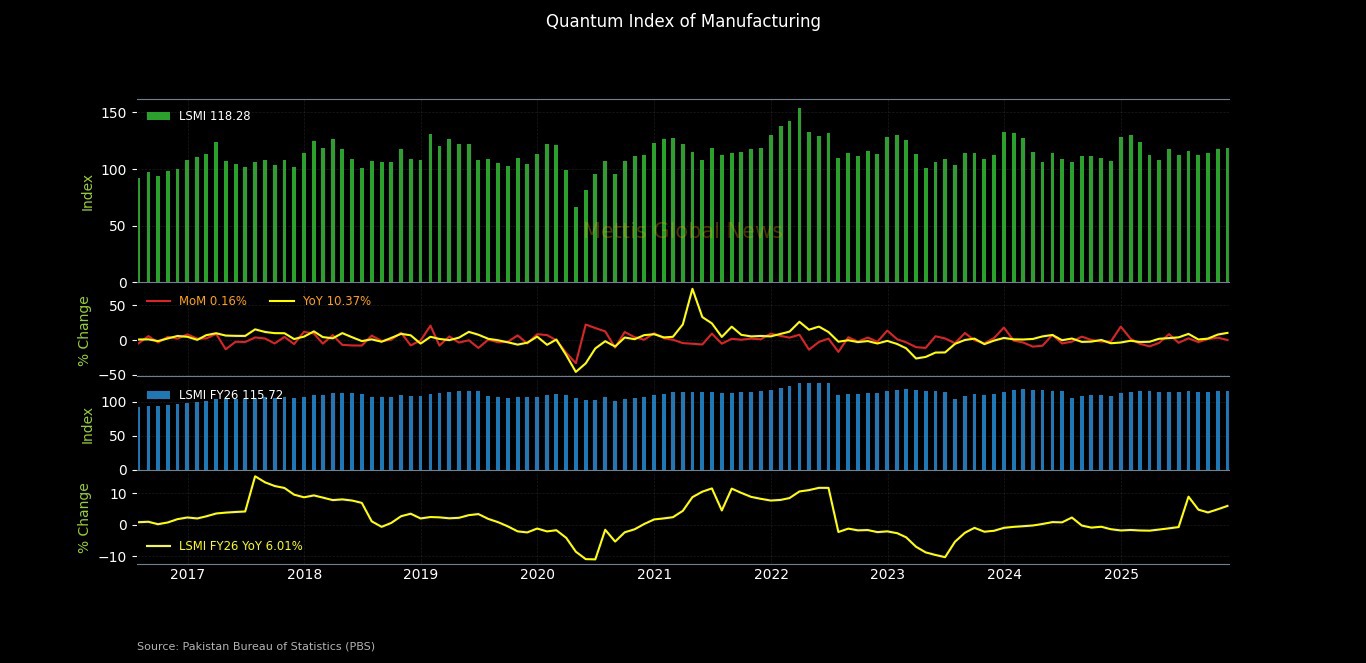

January 16, 2026 (MLN): Pakistan's large-scale manufacturing sector sustained its

recovery trajectory in November 2025, with the Quantum Index of Manufacturing

(QIM) reaching 118.28, showing continued industrial momentum amid exceptional

performances in automobiles, petroleum products and garments.

According to provisional data with base year 2015-16, Large

Scale Manufacturing Industries (LSMI) output grew 10.37% year-on-year (YoY) in

November 2025, while posting a modest 0.16% month-on-month (MoM) increase

compared to October 2025.

On a cumulative basis, the sector recorded a 6.01% growth during July–November FY26, with the QIM averaging 115.72, up from 109.65 in the same period last year.

The automobile sector led the growth trajectory with a

remarkable 61.35% increase in November and a cumulative 75.15% surge during

July-November FY26.

Petroleum products posted robust growth of 43.66% YoY in

November, contributing significantly with an 18.06% cumulative increase.

The garments sector showed strong momentum with 18.43%

monthly growth and 7.14% cumulative expansion.

Cement production grew 8.74% in November, with a substantial

13.47% cumulative increase for the five-month period.

Beverages recorded exceptional growth of 32.61% in November, while textile products showed steady improvement with 2.52% monthly growth.

Growth of Major Manufacturing Items

|

Manufacturing Sector |

Weight% |

% Change Nov-25 |

% Change Jul-Nov 2025-26 |

|

Cotton Yarn |

8.88 |

0.68 |

1.92 |

|

Cotton Cloth |

7.29 |

0.15 |

0.24 |

|

Garments |

6.08 |

18.43 |

7.14 |

|

Petroleum Products |

6.66 |

43.66 |

18.06 |

|

Fertilizers |

3.93 |

1.22 |

0.43 |

|

Cement |

4.65 |

8.74 |

13.47 |

|

Iron & Steel |

3.45 |

(5.99) |

(3.8) |

|

Automobile |

3.1 |

61.35 |

75.15 |

Sectoral Contributions

The main contributors toward the overall 6.01% cumulative

growth were automobiles (1.77% points), petroleum products (1.29), garments

(1.24), cement (0.78), food (0.47), and textiles (0.32). Conversely,

pharmaceuticals (-0.34) and iron & steel products (-0.17) weighed on

overall growth.

The sustained growth momentum in Pakistan's manufacturing sector shows improving economic conditions and strengthening domestic demand, particularly in the automobile and construction-related industries.

However, challenges persist in certain segments, indicated the need for targeted policy interventions to ensure broad-based industrial recovery.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,132.10 429.92M | 3.39% 5159.10 |

| ALLSHR | 93,566.86 763.32M | 2.62% 2388.00 |

| KSE30 | 48,302.97 218.66M | 4.27% 1976.50 |

| KMI30 | 220,798.52 207.58M | 4.07% 8628.34 |

| KMIALLSHR | 59,988.53 433.51M | 2.75% 1606.15 |

| BKTi | 46,193.08 61.76M | 4.26% 1887.06 |

| OGTi | 30,193.10 21.94M | 3.73% 1086.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,565.00 | 69,160.00 68,160.00 | 100.00 0.15% |

| BRENT CRUDE | 82.03 | 82.77 81.28 | 0.63 0.77% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -7.85 -7.32% |

| ROTTERDAM COAL MONTHLY | 124.15 | 139.50 124.15 | 5.35 4.50% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 74.94 | 75.70 74.37 | 0.38 0.51% |

| SUGAR #11 WORLD | 13.95 | 14.20 13.91 | 0.04 0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance