Weekly Market Roundup

_20260111150937325_2e739b.jpeg?width=950&height=450&format=Webp)

MG News | January 11, 2026 at 08:17 PM GMT+05:00

January 11, 2026 (MLN): The Pakistan Stock Exchange closed the week on a strong footing, with the benchmark KSE-100 Index gaining 5,374.74 points, or 3.00% WoW, to settle at 184,409.67, compared to 179,034.93 at the close of the previous week.

Investor sentiment remained upbeat on expectations of

further monetary easing, supported by an improving external account, ongoing

reform momentum, and relative political stability.

Easing inflation expectations, growing optimism over

potential rate cuts, and sustained participation from institutional investors

continued to underpin market confidence during the week._20260111150950674_4b4ace.jpeg)

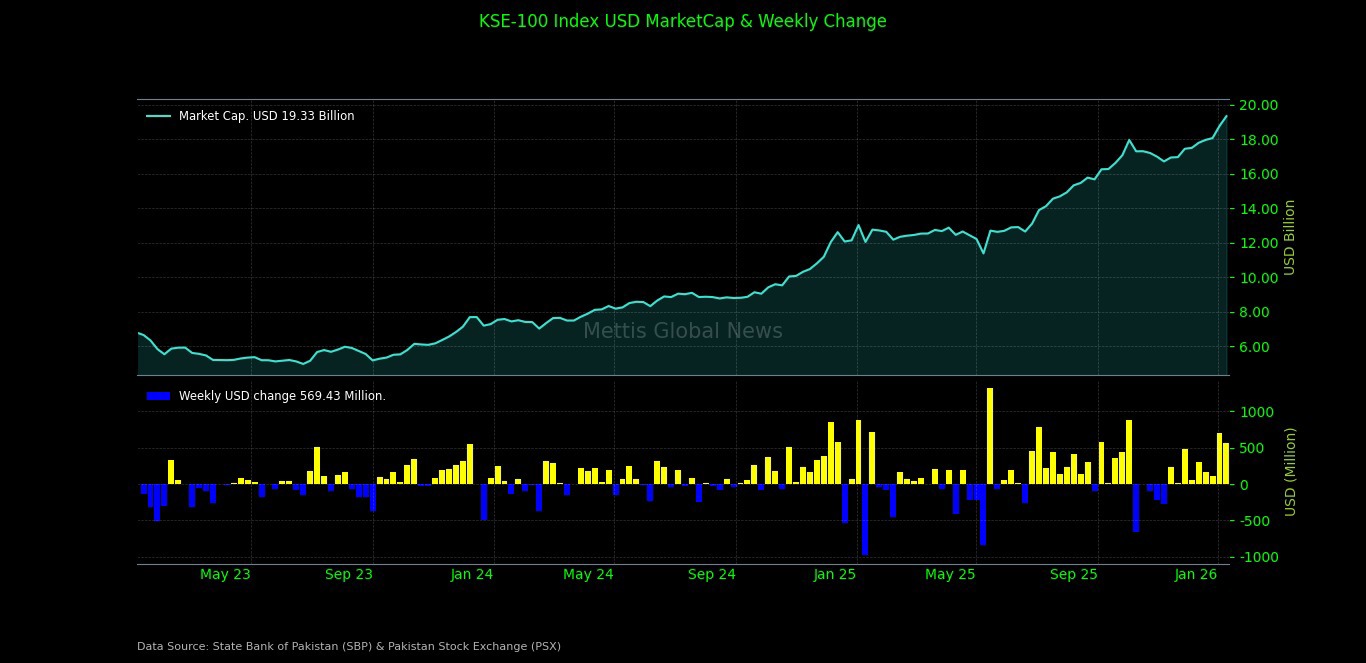

Market Capitalization

In terms of market capitalization, total market cap in rupee

terms increased to Rs5.41 trillion, up from Rs5.26tr last week.

This shows an increase of approximately Rs158 billion,

or 3.00% WoW, largely in line with the benchmark index performance.

In dollar terms, market capitalization rose to $19.33bn

from $18.76bn in the previous week, marking an increase of around $569

million, or 3.03% WoW.

Consequently, USD returns for the week stood at 3.03%,

compared to 3.87% last week, shows continued strength in

foreign-adjusted market gains despite a relatively stable currency._20260111150632021_a166f0.jpeg)

On the macroeconomic front, Pakistan’s weekly SPI inflation

edged up 0.12% WoW

and 3.20% YoY, with price increases seen in wheat flour, chicken,

and garlic, according to PBS.

Food items like tomatoes, potatoes, and onions

recorded notable declines, partially offsetting inflationary pressures.

Pakistan’s remittances rose to $3.59bn

in December 2025, up 12.6% month-on-month and 16.5% year-on-year,

taking 6MFY26 inflows to $19.74bn.

Saudi Arabia and the UAE remained the top sources, with

strong growth also seen from the UK, EU, and Australia.

SBP raised Rs1.087tr

in its latest auction, securing Rs979.3bn through MTBs and Rs108.1bn

via 10-year PIB Floating Rate bonds.

The 1-month MTB saw the highest participation, with

cut-off yields hovering around 10.15–10.20% across tenors.

National Savings Schemes recorded net inflows of Rs21.8bn

in November 2025, down from the previous month, with Regular Income

Certificates leading at Rs5.27bn.

The moderation shows lower dependence on costly domestic

borrowing amid easing inflation and an improving external account.

Pakistan’s central government debt rose 10.2% YoY to Rs77.54tr

in November 2025, driven by continued domestic and external borrowing to

finance the fiscal deficit.

Domestic debt dominated at Rs54.62tr, led by

long-term PIBs, while short-term debt and Naya Pakistan Certificates showed

declines.

The Pakistani rupee posted a marginal appreciation

during the week, strengthening to Rs280.02 per USD on January 09, 2026,

compared to Rs280.11 a week earlier.

The relative stability in the exchange rate continued to

provide mild support to foreign investor returns.

Index Movers

Sector-wise performance was overwhelmingly positive,

with Commercial Banks emerging as the dominant driver of index gains,

contributing a hefty 3,037 points, supported by strong upside in major

banking names.

This was followed by Cement stocks, which added 419

points, while Automobile Assemblers contributed 270 points.

Other notable positive contributors included Pharmaceuticals (+269

points), Insurance (+258 points).

Power Generation & Distribution (+219 points),

and Investment Banks, Investment Companies & Securities Companies

(+168 points).

Further support came from Textile Composite (+163

points), Fertilizer (+111 points), Refinery (+90 points), Food

& Personal Care Products (+78 points), and Oil & Gas Exploration

Companies (+70 points), reflecting broad-based sector participation.

On the downside, Miscellaneous stocks emerged as the

largest drag, shaving off 152 points, followed by Oil & Gas

Marketing Companies (-42 points).

Marginal pressure was also observed in Vanaspati &

Allied Industries, Close-End Mutual Funds, and Leasing Companies._20260111173606372_ef0ec0.jpeg)

Scripwise, MCB Bank emerged as the single largest

contributor to the KSE-100 Index, adding 711 points, followed by United

Bank Limited (UBL) (+655 points) and Habib Bank Limited (HBL) (+554

points).

Other notable contributors included Meezan Bank (MEBL)

(+358 points), Lucky Cement (LUCK) (+297 points), Adamjee Insurance

(AICL) (+258 points), and National Bank of Pakistan (NBP) (+257

points).

Additional upside came from Hub Power Company (HUBC)

(+229 points), Engro Holdings (ENGROH) (+153 points), Bank Alfalah

(BAFL) (+153 points), Sazgar Engineering Works (SAZEW) (+133 points).

Askari Bank (AKBL) (+120 points), and Fauji

Fertilizer Company (FFC) (+103 points), highlighting strong participation

across banking, cement, energy, automobile, and fertilizer stocks.

On the downside, selling pressure was concentrated in select

heavyweight names, with Pak Elektron (PSEL) emerging as the largest

laggard, shaving off 201 points.

This was followed by Pakistan State Oil (PSO) (-93

points), Pakistan Petroleum Limited (PPL) (-84 points), Systems

Limited (SYS) (-63 points), and Oil & Gas Development Company (OGDC)

(-25 points).

Other notable drags included Bank of Punjab (BOP), Kot

Addu Power Company (KAPCO), Engro Fertilizers (EFERT), Dolmen

City REIT (DCR), and Kohat Cement (KOHC), which collectively capped

further upside in the index._20260111151519341_0d09f1.jpeg)

FIPI / LIPI Flows

From an investor flow perspective, foreign investors

remained net sellers, with total FIPI outflows amounting to $42.53m

during the week.

The selling was primarily driven by foreign corporates,

which recorded net selling of $27.95m, followed by overseas

Pakistanis with net outflows of $13.52m.

Foreign individuals also remained net sellers, with

outflows of $1.05m.

In contrast, local investors absorbed the entire foreign

selling, as Local Institutional Portfolio Investors (LIPI) posted

net buying of $42.53m.

Buying was led by mutual funds, which emerged as the

largest net buyers with inflows of $71.47m, showing strong institutional

confidence in the market outlook.

This was partially offset by net selling from banks/DFIs

(-$56.25m), insurance companies (-$6.85m), and individual investors

(-$4.58m), while companies and broker proprietary trading provided additional

support._20260111173844901_e24a97.jpeg)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,409.67 393.48M | -0.61% -1133.34 |

| ALLSHR | 110,382.58 1,026.61M | -0.45% -501.36 |

| KSE30 | 56,593.88 158.22M | -0.71% -404.12 |

| KMI30 | 259,208.41 213.19M | -0.87% -2263.77 |

| KMIALLSHR | 70,710.78 493.25M | -0.60% -427.51 |

| BKTi | 53,774.72 51.55M | -0.55% -299.43 |

| OGTi | 36,045.04 14.71M | -0.59% -214.34 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,645.00 | 0.00 0.00 | 240.00 0.27% |

| BRENT CRUDE | 63.02 | 63.92 61.83 | 1.03 1.66% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -1.25 -1.42% |

| ROTTERDAM COAL MONTHLY | 95.30 | 98.65 95.30 | -2.90 -2.95% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.78 | 0.00 0.00 | -0.34 -0.58% |

| SUGAR #11 WORLD | 14.89 | 14.99 14.78 | -0.08 -0.53% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260109104659598_eb8e43.jpg?width=280&height=140&format=Webp)