Silver lining finally shines through

Sara Ateeq | June 13, 2025 at 04:45 PM GMT+05:00

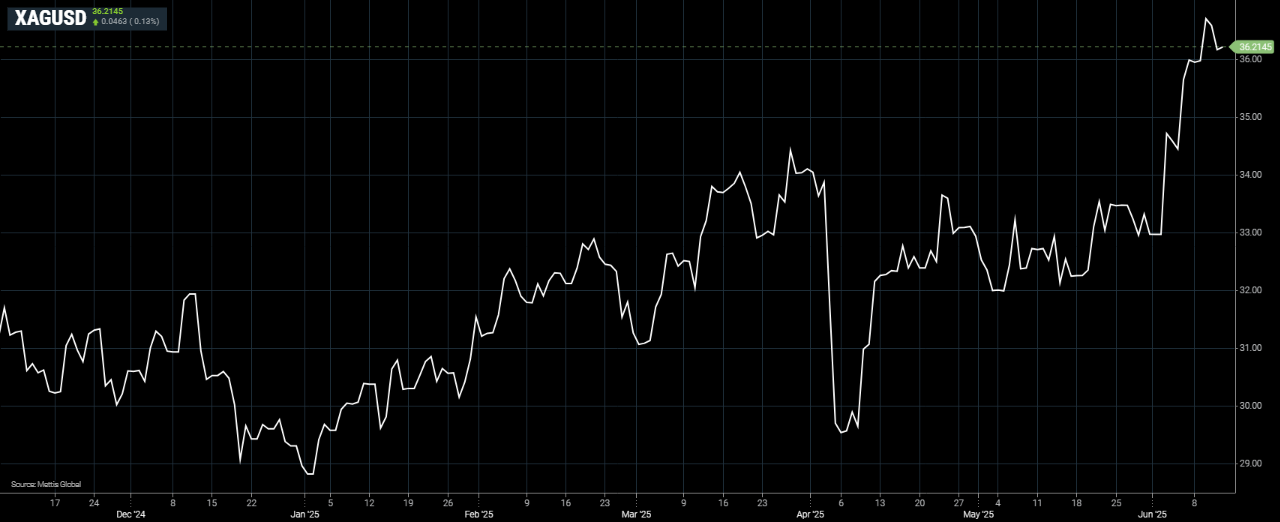

June 13, 2025 (MLN): Silver has finally caught up to the rally that gold sparked

months ago, as it broke through key resistance levels after it previously

lagged despite strong global inflows into precious metals.

The silver spot price stood at $36.21 per troy ounce, up 0.13% or 0.0463 as of 3:40 pm today.

This latest uptick follows a significant move earlier in the week, when on June 9, 2025, silver climbed as high as $36.88 per ounce, its highest level in more than a decade.

Year to date, silver has gained over 20%, firmly

establishing itself as one of the top-performing assets of 2025.

According to Sunil Kashyap, Director at FinMet, this price

momentum suggests that silver could now aim for the $48 to $50 per ounce range,

levels not seen in over 10 years.

Silver serves dual roles as both an industrial metal, used

in products like solar panels, and a defensive precious metal favored by

investors during uncertain times.

The gold-silver ratio, which measures how many ounces of

silver are required to buy one ounce of gold, had surged to 107, far above its

long-term average of 50–60.

With silver on the rise and gold prices stabilizing, the

ratio has now corrected to around 90.

A recent survey by the Silver Institute estimated a 15% gap

between silver supply and demand in 2024 and projected another deficit in 2025.

Meanwhile, platinum has quietly outperformed both gold and

silver, climbing nearly 25% over the past three weeks.

Kashyap described the move as “phenomenal,” highlighting platinum’s surge from around $880 to above $1,220 per ounce.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 178,757.42 411.00M | 3.24% 5607.00 |

| ALLSHR | 107,287.78 668.19M | 2.80% 2924.22 |

| KSE30 | 54,663.05 203.79M | 3.50% 1846.77 |

| KMI30 | 250,635.23 134.53M | 2.15% 5271.57 |

| KMIALLSHR | 68,610.75 384.74M | 1.84% 1237.36 |

| BKTi | 52,663.30 103.74M | 6.87% 3384.64 |

| OGTi | 35,030.37 33.58M | 0.78% 272.50 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,270.00 | 68,570.00 66,910.00 | 405.00 0.60% |

| BRENT CRUDE | 67.75 | 67.87 67.36 | 0.33 0.49% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -0.10 -0.09% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.55 | 62.66 62.04 | 0.29 0.47% |

| SUGAR #11 WORLD | 13.65 | 13.65 13.47 | 0.17 1.26% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account