Silver heads for best year in over seven decades

MG News | December 29, 2025 at 10:20 AM GMT+05:00

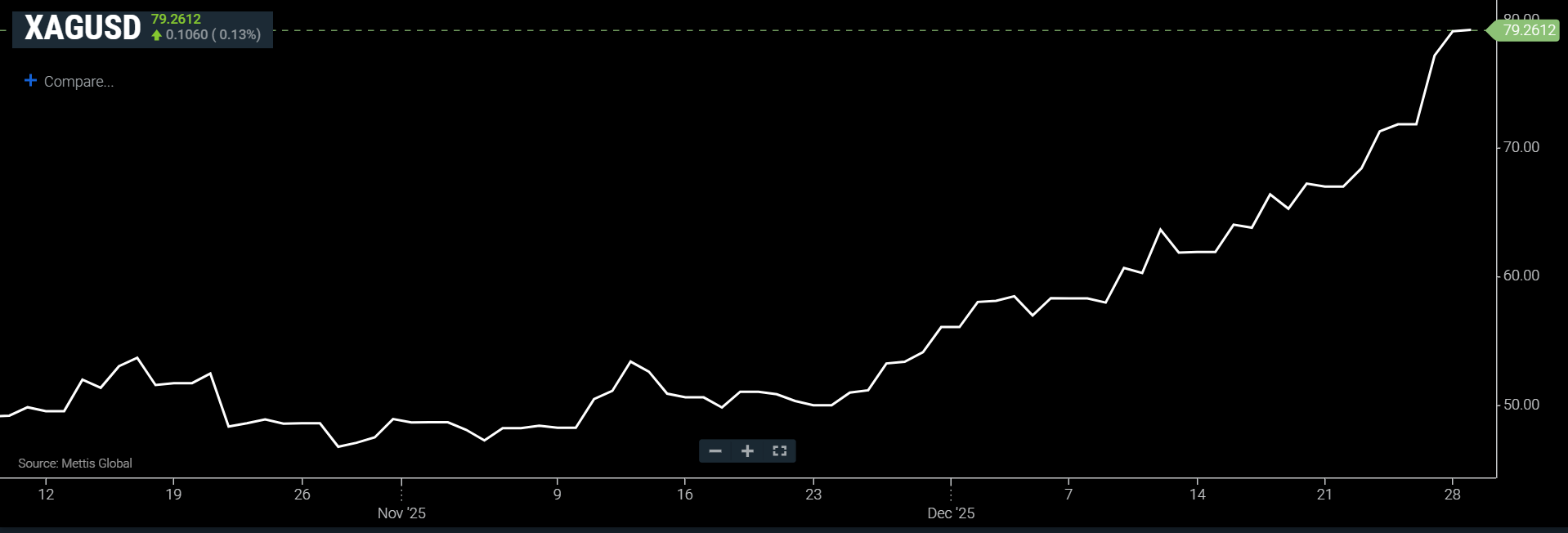

December 29, 2025 (MLN): Silver surged to unprecedented levels,

vaulting past $80 an ounce, as a frenetic rally driven by speculative demand

collided with ongoing supply constraints.

Prices swung sharply during Monday’s session, plunging below

the prior close after the initial spike before stabilizing later in the day,

according to Bloomberg.

Spot silver was up 0.13%% at $79.26 an ounce as of [10:15 am] PST, according to data reported by Mettis Global.

The rally has been reinforced by a softer US dollar and

escalating geopolitical uncertainty, factors that have fueled strong investor

interest across the precious metals complex.

Gold and platinum have also climbed to record highs during

the broader upswing.

Market excitement intensified over the weekend after Tesla

chief executive Elon Musk weighed in on concerns about China’s export policies,

remarking on X that silver plays a critical role in numerous industrial

applications.

His comment added to already elevated investor enthusiasm,

despite noting that China’s latest measures do not represent a meaningful

policy shift.

Beijing’s export rules, announced by the Ministry of

Commerce in late October, largely extend existing restrictions.

While China is one of the world’s largest silver producers mainly as a byproduct of base-metal mining it

is also the biggest global consumer, meaning exports account for a relatively

small share of its output.

Silver’s rapid ascent up more than 40% this month alone puts

it on track for its strongest annual gain since records began in the early

1950s.

The move caps a powerful year for precious metals, supported

by aggressive central-bank buying, steady inflows into exchange-traded funds,

and a series of interest-rate cuts by the US Federal Reserve.

Lower interest rates have boosted the appeal of non-yielding

assets like silver, and traders are increasingly positioning for additional

monetary easing in 2026, extending momentum into the year ahead.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,659.16 182.43M | 0.73% 1258.43 |

| ALLSHR | 104,073.06 371.26M | 0.57% 589.10 |

| KSE30 | 53,137.99 76.81M | 0.77% 403.93 |

| KMI30 | 247,798.12 91.83M | 0.91% 2232.78 |

| KMIALLSHR | 67,723.17 167.18M | 0.73% 489.47 |

| BKTi | 47,947.64 21.25M | 0.10% 49.54 |

| OGTi | 34,181.70 6.51M | 1.01% 343.20 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,575.00 | 90,990.00 87,975.00 | 2615.00 2.97% |

| BRENT CRUDE | 61.32 | 61.45 60.87 | 0.68 1.12% |

| RICHARDS BAY COAL MONTHLY | 87.50 | 0.00 0.00 | 1.05 1.21% |

| ROTTERDAM COAL MONTHLY | 94.50 | 0.00 0.00 | -0.70 -0.74% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.36 | 57.52 56.91 | 0.62 1.09% |

| SUGAR #11 WORLD | 15.17 | 15.28 15.08 | -0.12 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|