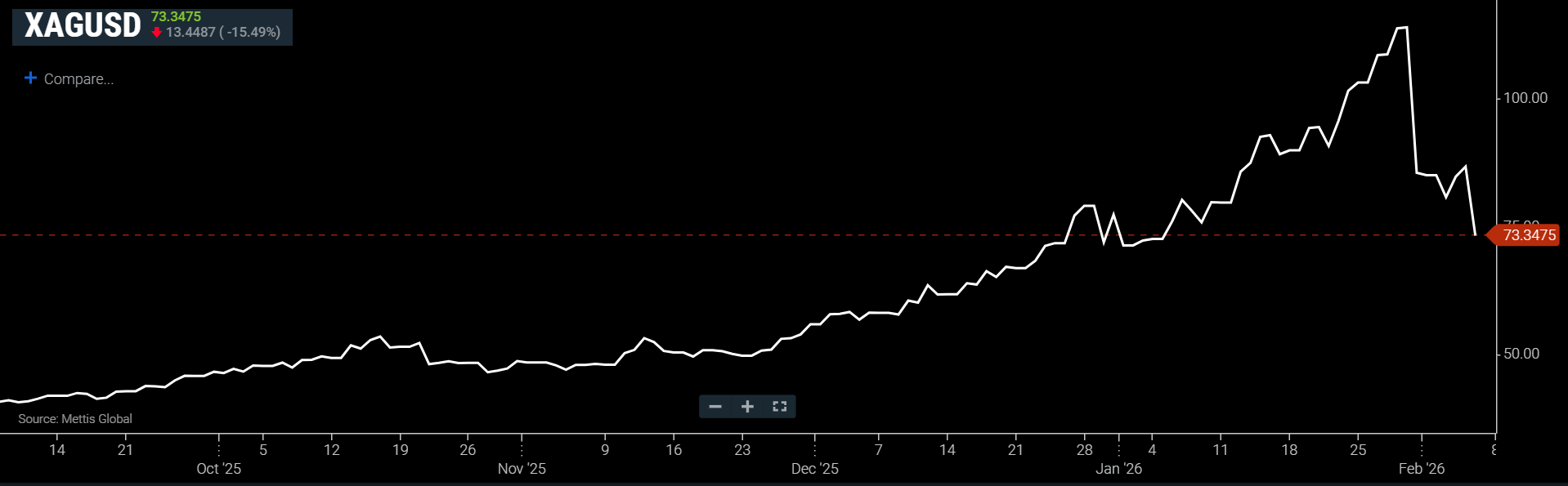

Silver set for $100 peak before cooling off

MG News | February 06, 2026 at 10:33 AM GMT+05:00

February 06, 2026 (MLN): Silver prices could surge to around $100 per ounce by June 2026 before retreating toward $85 by year-end, which reflects a market caught between powerful investment momentum and mounting fundamental constraints.

Currently, spot silver is down 15.49% at $73.3475 an ounce as of [10:22 am] PST, according to data reported by Mettis Global.

A new research report by UBS Switzerland AG and UBS AG

Singapore indicates, this outlook which suggests that while strong investor

inflows and macro-hedging demand may fuel a near-term rally, elevated

volatility and weakening industrial consumption could ultimately pull prices

back as the year progresses, resulting in a pronounced mid-year peak followed

by normalization.

The forecast comes in the wake of an extraordinary

bout of market turbulence in which silver tumbled 26% in a single trading

session, with intraday pullbacks from recent highs nearing 38% moves rarely

seen in decades.

The report notes that this sharp repricing pushed historical

volatility to extreme levels, with one-month volatility climbing above 110%,

prompting CME Group to raise margin requirements for silver futures and emphasizing

the increasingly fragile risk environment for leveraged participants.

The violent swings are partly attributed to the market’s

starting point: silver had risen roughly 2.5x YoY before the correction, even

as traditional bullish drivers such as exchange-traded fund inflows and

speculative net-long futures positions were already beginning to fade.

Regional price dislocations also became evident, with

Chinese silver trading at a notable premium to U.S. and London benchmarks,

while positive swap rates suggested demand was becoming more narrowly

concentrated rather than broad-based.

UBS further links the repricing to shifting macroeconomic

narratives, including easing tail-risk concerns surrounding central bank

independence following leadership changes at the Federal Reserve.

Its projections indicate that maintaining elevated silver

prices would require investment demand to exceed 400 million ounces this year,

against an estimated market deficit of nearly 300 million ounces.

The participation of Asian investors particularly in China is

viewed as a key determinant of near-term price direction, as their response to

recent volatility could either stabilize the market or accelerate further

swings.

At the same time, UBS cautions that heightened uncertainty may trigger additional deleveraging among existing holders, leaving the market vulnerable to further bouts of forced selling.

|

Date |

Forecasts

(USD/oz) |

|

Mar 26 |

105 |

|

Jun 26 |

100 |

|

Sep 26 |

95 |

|

Dec 26 |

85 |

Source: Bloomberg Finance, UBS Note: Forecasts refer to the end of the period.

Beyond investment flows, the report focuses structural

challenges from the industrial side, which accounts for more than half of

global silver demand.

Sustained high prices, the bank notes, are likely to

encourage substitution, efficiency gains and delayed purchasing by

manufacturers, gradually eroding consumption over time.

The combination of elevated option volatility, shifting

positioning dynamics and sensitivity to macroeconomic developments is expected

to keep price movements unusually wide through 2026, which reinforces the bank’s view of a potential

mid-year overshoot followed by year-end normalization.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 72,680.00 | 73,600.00 72,390.00 | -765.00 -1.04% |

| BRENT CRUDE | 83.66 | 83.95 82.13 | 2.26 2.78% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 77.06 | 77.42 75.56 | 2.40 3.21% |

| SUGAR #11 WORLD | 13.71 | 14.07 13.70 | -0.22 -1.58% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction