PayPak widens footprint but still lags in usage

Nilam Bano | December 03, 2025 at 09:30 AM GMT+05:00

December 03, 2025 (MLN): Pakistan’s national payment scheme PayPak accounts for over 25% of the country’s 53 million debit cards, yet its usage stands at only 6%.

This gap is prompting regulators to push banks toward wider adoption of co-badged cards to strengthen domestic digital payments and reduce reliance on foreign networks, said a press release issued yesterday.

Speaking at an industry event, State Bank of Pakistan (SBP) Governor Jameel Ahmad said the sharp gap between PayPak’s issuance and its usage stems from limited e-commerce and international acceptance, modest marketing efforts, and the perception of PayPak as a low-value product.

He stressed that addressing these structural constraints is essential for making Pakistan’s national scheme sustainable and competitive.

Ahmad pointed to growing momentum in co-badged partnerships.

He cited the new Faysal Bank–Mastercard–PayPak card and last month’s PayPak–UnionPay arrangement as examples of models that let consumers make international and e-commerce payments.

These partnerships keep domestic transactions settled within Pakistan, reducing dependence on foreign payment networks.

Reflecting on PayPak’s development since 2016, he said the scheme was created to provide an affordable and localized solution for a digitizing economy.

However, he added, its low usage signals the need for stronger marketing visibility, broader acceptance, and better customer engagement to unlock its potential.

The Governor urged 1Link, PayPak’s operator, to adopt a long-term strategy focused on technology upgrades, fraud and cybersecurity improvements, dispute resolution mechanisms, and incentives for both merchants and consumers.

He said these steps are vital to building trust and accelerating adoption.

Ahmad reaffirmed SBP’s commitment to a secure, interoperable, and inclusive digital payments ecosystem, supported by a regulatory framework that ensures innovation, competition, and consumer protection.

He noted that co-badging collaborations reflect the benefits of mutually aligned partnerships that expand consumer choice, strengthen infrastructure, and support Pakistan’s digital transformation.

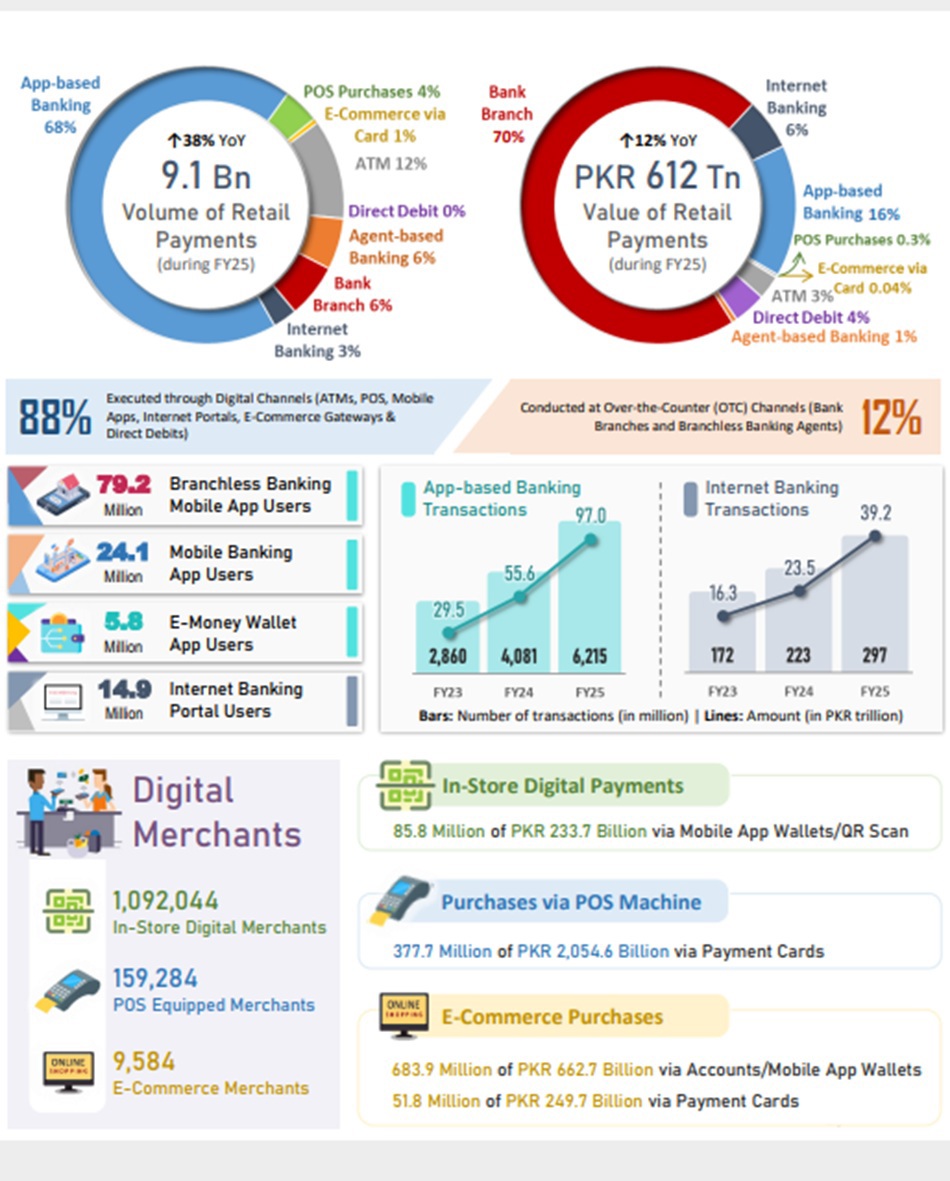

According to the State Bank of Pakistan’s Annual Payment Systems Review FY25, e-banking transactions grew 46% in volume to around 3 billion and 39% in value to Rs223 trillion.

This growth indicates that consumers are rapidly embracing digital channels for everyday financial activity, even as core challenges, such as PayPak’s low usage and limited acceptance on e-commerce platforms, continue to weigh on the national payments infrastructure.

Point-of-sale (POS) adoption also strengthened during the year, driven by rising merchant onboarding and incentives offered by acquiring banks.

The number of POS terminals nationwide increased to over 131,000, while POS transactions climbed to 211 million, representing annual growth of 23% in volume and 33% in value to Rs3.6 trillion.

This expansion shows progress toward building a more card-friendly retail environment, although electronic payments still account for only a small fraction of Pakistan’s overall retail activity.

The report also noted that international card schemes continue to dominate usage, reinforcing concerns about reliance on foreign networks and associated settlement costs.

ATM usage remained stable, highlighting the continued importance of cash in Pakistan’s payment habits.

The ATM network expanded to 18,245 machines, processing 635 million withdrawals worth Rs9.6 trillion during the year, an increase of 15% in volume and 13% in value.

Meanwhile, cash deposit machines and CRMs recorded 275 million deposits worth Rs5.6 trillion, reflecting growing consumer comfort with automated channels for basic banking services.

These trends demonstrate a gradual but uneven transition toward a digital-first ecosystem, where electronic payments are rising, but cash continues to play a dominant role.

The overall picture presented by SBP data suggests a payments system transitioning, but not yet transformed.

While digital payments are growing rapidly, PayPak’s low usage compared with its issuance points to gaps in Pakistan’s retail payment system.

Authorities see co-badged cards as a practical step to boost adoption, enhance local settlements, and reduce reliance on foreign networks.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,039.27 48.73M | -0.36% -603.01 |

| ALLSHR | 100,951.26 148.27M | -0.23% -228.62 |

| KSE30 | 50,719.83 21.61M | -0.55% -280.34 |

| KMI30 | 239,062.68 19.67M | -0.60% -1445.83 |

| KMIALLSHR | 65,777.35 44.54M | -0.32% -209.16 |

| BKTi | 45,275.70 4.23M | -0.35% -158.65 |

| OGTi | 32,898.24 2.95M | -0.14% -47.74 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 93,300.00 | 93,640.00 91,405.00 | 1845.00 2.02% |

| BRENT CRUDE | 62.47 | 62.57 62.18 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 1.10 1.22% |

| ROTTERDAM COAL MONTHLY | 99.40 | 99.55 96.45 | 1.85 1.90% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.67 | 58.73 58.37 | 0.03 0.05% |

| SUGAR #11 WORLD | 14.97 | 15.07 14.72 | 0.21 1.42% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance