Pakistan’s short-term FX liabilities reach over $32bn

MG News | October 01, 2025 at 05:20 PM GMT+05:00

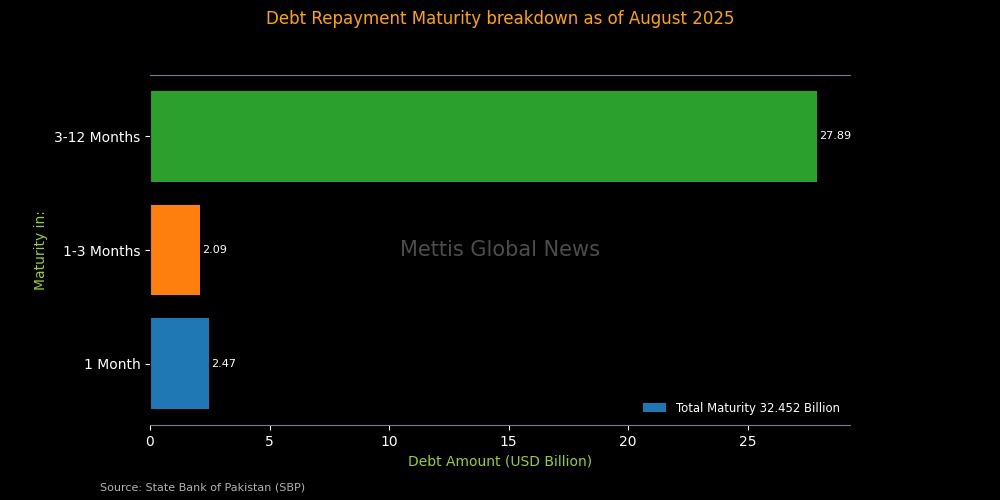

October 01, 2025 (MLN): Due to maturing foreign currency loans,

securities, and deposits, Pakistan's foreign currency assets are expected to

see a net outflow of $32.45 billion, according to the latest liquidity report

released by the State Bank of Pakistan (SBP).

The total outflow is

categorised based on residual maturity, with the most pressing concern being

the more than three months up to one-year segment, which accounts for a

substantial $27.89bn.

Meanwhile, outflows of $2.47bn are due within the next month, and an additional $2.09bn is payable between the one-to-three-month window.

The principal outflows

amount to $28.73bn, of which $25.06bn falls in the more than three-month up to

one-year maturity range. Interest payments add another $3.72bn to the financial

burden.

Aggregate short and long

positions in forwards and futures indicate a net shortfall of $2.01bn.

Short positions dominate at

$2.2bn, while long positions provide partial offset at (+197).

These figures underline the

near-term strain on Pakistan’s external account, which emphasises the critical

need for continued inflows, timely rollovers, and prudent management of

external liabilities to preserve reserve adequacy.

Foreign currency reserves

in convertible currencies led the asset composition at $11.62bn, representing

the largest single component of the reserves. The central bank holds 2.082m

fine troy ounces of gold, valued at $7.14bn.

The reserve structure

includes $11.39bn in total currency and deposits distributed across various

institutions.

Of this amount, $6.57

billion is held with other national central banks, the Bank for International

Settlements, and the International Monetary Fund. Another $4.81bn sits with

banks headquartered outside the reporting country, while $13.48m is held with

banks headquartered in the reporting country but located abroad.

The portfolio includes

$234.53 million in securities, with issuers headquartered in the reporting

country but located abroad. The central bank maintains $29.7m in Special

Drawing Rights through its IMF reserve position.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes