PTC eyes Rs65/share as Telenor deal promises synergies

MG News | October 09, 2025 at 01:36 PM GMT+05:00

October 9, 2025 (MLN): Pakistan

Telecommunication Company Ltd (PSX:PTC) could see its fair value rise above

Rs65 per share following the acquisition of Telenor Pakistan, as improving

profitability, synergy gains and favorable financing terms strengthen the

earnings outlook.

According to a report by Topline

Securities, the Rs108 billion transaction structured on a cash-free and

debt-free basis appears increasingly well-timed amid easing global interest

rates and improving sector fundamentals.

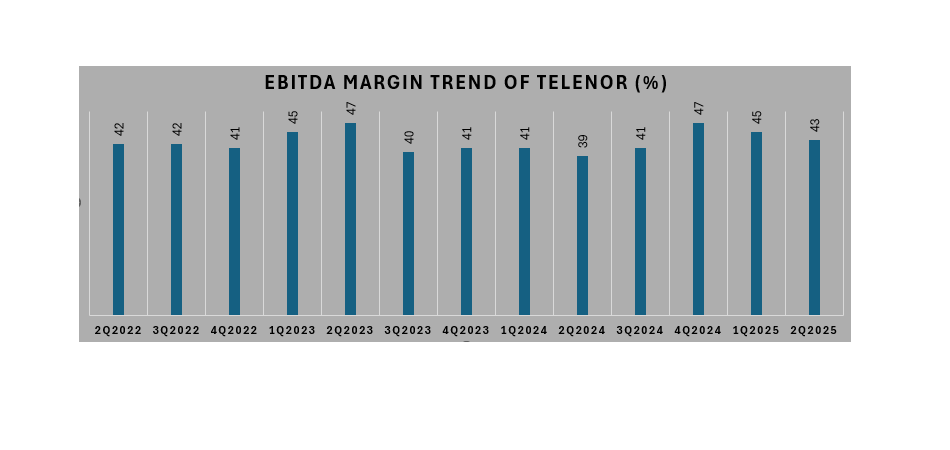

With Telenor’s earnings before interest, tax, depreciation and amortization (EBITDA) already up over 15–16% since the deal was negotiated and its average revenue per user (ARPU) climbing more than 30%, the acquisition is expected to deliver strong earnings accretion for PTC.

PTC estimated incremental EPS impact

from the transaction:

|

|

Year 1 |

Year 2 |

Year 3 |

|

EBITDA |

55,000 |

60,500 |

66,550 |

|

Less depreciation* |

7,200 |

7,560 |

7,938 |

|

Less finance Cost |

10,378 |

11,452 |

11,036 |

|

Less exchange loss |

6,768 |

6,918 |

6,247 |

|

Profit Before tax |

30,654 |

34,570 |

41,330 |

|

Tax @ 39% |

11,955 |

13,482 |

16,119 |

|

PAT |

18,699 |

21,088 |

25,211 |

|

No of Shares (mn) |

5,100 |

5,100 |

5,100 |

|

EPS |

3.7 |

4.1 |

4.9 |

Source: Topline Research

The deal values Telenor Pakistan at an

enterprise value (EV)/EBITDA multiple of 2.25x, well below international and

regional averages.

Globally, telecom companies trade at

EV/EBITDA multiples of around 6.7x, while emerging and frontier markets are

currently at a 25% discount, translating into a fair multiple of roughly 5x for

Pakistan.

Telenor Pakistan had reported revenue of Rs112 bn and EBITDA of Rs48bn for the 12 months ending September 2023, which has since risen to over Rs55bn.

Source: Telenor.com, Topline Research

ARPU has also grown sharply from Rs195 in September 2023 to Rs255 by June 2025.

This improvement, combined with a

lower interest rate environment, strengthens the financial case for PTC, which

plans to fund the acquisition through a US$400 million seven-year debt facility

arranged by the International Finance Corporation (IFC) in partnership with

Silk Road Fund (SRF) and British International Investment (BII).

Topline estimated that the transaction

could contribute between Rs3.7 and Rs4.9 per share to PTC’s earnings over the

first three years, assuming annual EBITDA of Rs55bn and financing costs at SOFR

plus 5%, similar to other IFC-backed projects such as the Pakistan

International Bulk Terminal (PIBTL).

The report also highlighted the

potential for a sizeable bargain gain on the acquisition, as Telenor Pakistan’s

non-current assets excluding deferred tax and contract costs are valued at

around Rs160–170 bn on its parent company’s balance sheet, significantly above

the agreed enterprise value of Rs108bn.

Post-acquisition, PTC’s consolidated

EBITDA is expected to rise to approximately Rs135 bn, while total net debt

would increase to Rs322bn, including Rs113bn related to the Telenor

acquisition.

Following completion, the merged

Ufone–Telenor entity will command around 35% of Pakistan’s mobile market,

becoming the second-largest player after Jazz.

With Ufone’s strong urban presence and

Telenor’s extensive rural and northern coverage, PTC is expected to achieve

nationwide reach, improved ARPUs, and long-term efficiency gains through

network consolidation, shared infrastructure and reduced overheads.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes