PTCL eyes Rs62/share

MG News | November 27, 2025 at 11:42 AM GMT+05:00

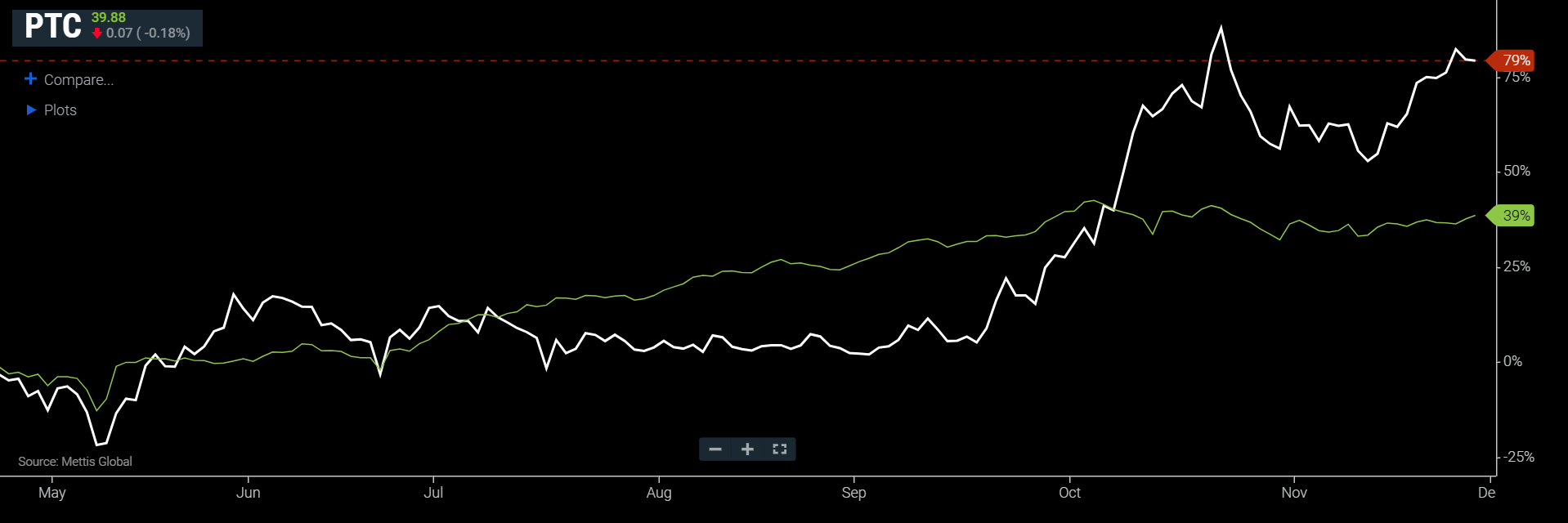

November 27, 2025 (MLN): Pakistan Telecommunication Company Ltd (PSX:PTC) is projected to hit a price target of Rs62 per share, representing a nearly 58% upside from current levels of around Rs39 in the next 12 months.

Chase Securities has highlighted Pakistan Telecommunication

Company Limited (PTCL) as a potential multi-bagger over the next three to five

years, contingent on the approved merger with Telenor Pakistan.

In its latest brokerage report, Chase Securities noted that

PTCL’s acquisition of Telenor Pakistan, completed at a sub-1× EV/Sales

multiple, significantly reduces competitive rivalry in the telecom sector while

creating a clear path for earnings repair through ARPU normalization,

measurable cost takeout, and eventual finance-cost relief.

The brokerage house emphasized that pro-forma figures after

stripping non-core one-offs and incorporating Telenor Pakistan’s contribution suggest

an annual profitability run-rate of Rs19–32 bn, or roughly Rs3.7–6.3 per share.

This reflects a material improvement from legacy PTCL

standalone earnings, which were historically weighed down by episodic charges,

particularly from the UBank clean-up and related credit costs.

Chase Securities highlighted several structural drivers for

the bullish outlook. The merger will expand PTCL’s mobile market share from 14%

to 36%, creating scale and enabling pricing discipline.

The combined entity will own approximately 24,000 towers, of

which around 7,000 overlapping sites could be retired, delivering up to Rs21 bn

in annualized savings.

Additional synergies are expected from IT and BSS

convergence, distribution overlap, and shared procurement, creating a

structurally lower cost per GB and higher EBITDA conversion.

Valuation also underpins the brokerage’s bullish case.

PTCL’s current equity value of $707 million, or roughly $10 per subscriber on a

post-merger basis, sits at the extreme low end globally compared with listed

peers across Asia and Africa, which trade between $42 and $623 per subscriber.

This pricing, combined with disciplined ARPU repair from a

historically low base of $1.1 per month, provides meaningful upside potential.

Chase Securities expects mobile ARPU to rise gradually to Rs525

by 2030, supporting revenue growth alongside data-heavy 4G and FTTH

consumption.

Execution on network

rationalization, IT/BSS convergence, and distribution consolidation will be

critical to realizing this potential, while risks remain from regulatory

conditions, integration delays, and emerging competition such as LEO satellite

broadband.

PTCL is poised to move from a period of earnings repair to a

structural growth trajectory, with EBITDA margins potentially rising to around

40% by late 2025, marking a significant re-rating opportunity for investors.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 177,606.17 271.21M | 2.57% 4455.75 |

| ALLSHR | 106,783.67 449.45M | 2.32% 2420.11 |

| KSE30 | 54,278.90 137.55M | 2.77% 1462.62 |

| KMI30 | 249,546.42 92.38M | 1.70% 4182.76 |

| KMIALLSHR | 68,416.57 262.05M | 1.55% 1043.17 |

| BKTi | 51,993.22 61.73M | 5.51% 2714.56 |

| OGTi | 34,906.80 27.69M | 0.43% 148.93 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,185.00 | 68,570.00 66,910.00 | 320.00 0.47% |

| BRENT CRUDE | 67.70 | 67.87 67.36 | 0.28 0.42% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -0.10 -0.09% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.49 | 62.66 62.04 | 0.16 0.26% |

| SUGAR #11 WORLD | 13.52 | 13.53 13.47 | 0.04 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account