PSX Closing Bell: Breakdown

MG News | April 27, 2022 at 03:02 PM GMT+05:00

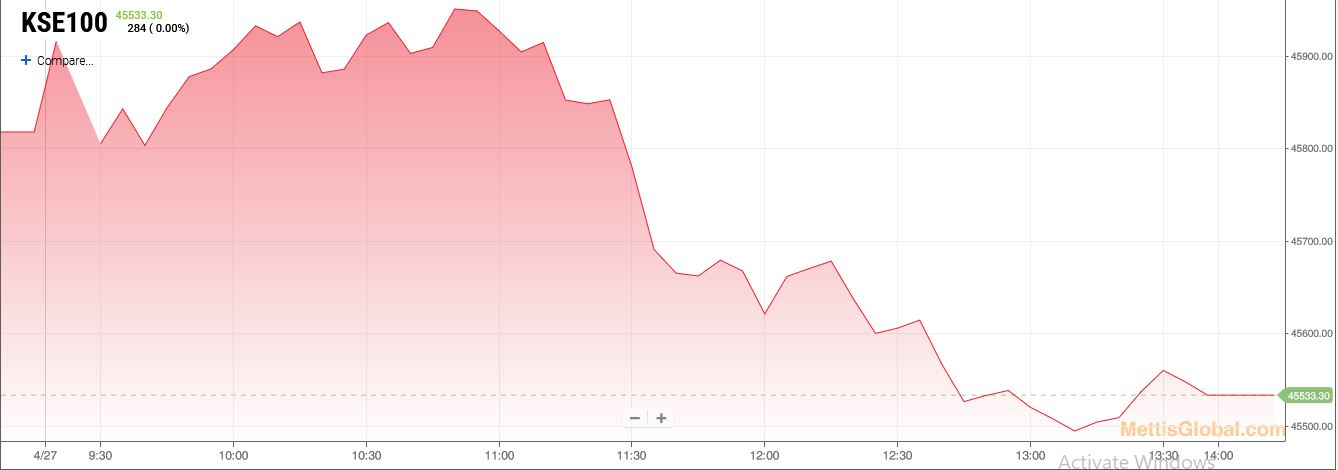

April 27, 2022 (MLN): The capital market endured another volatile session on Wednesday as selling pressure was observed across the board, leading the KSE-100 Index close in red.

This bearish session is due to the yield in secondary market that crossed 14%, hinting the policy rate hike in the next meeting and shift in asset allocation simultaneously, a research report by Ismail Iqbal Securities said.

The KSE-00 index ended the trading session on Wednesday with a 284.38 point or 0.62 percent decline to close at 45,533.30.

The Index traded in a range of 472.63 points or 1.03 percent of previous close, showing an intraday high of 45,956.62 and a low of 45,483.99.

Of the 92 traded companies in the KSE100 Index 33 closed up 56 closed down, while 3 remained unchanged. Total volume traded for the index was 122.99 million shares.

Sector wise, the index was let down by Fertilizer with 107 points, Technology & Communication with 62 points, Cement with 40 points, Chemical with 35 points and Inv. Banks / Inv. Cos. / Securities Cos. with 33 points.

The most points taken off the index was by FFC which stripped the index of 83 points followed by SYS with 43 points, DAWH with 35 points, EPCL with 27 points and HUBC with 26 points.

Sectors propping up the index were Commercial Banks with 37 points, Refinery with 34 points, Glass & Ceramics with 3 points, Tobacco with 1 points and Miscellaneous with 1 points.

The most points added to the index was by CNERGY which contributed 22 points followed by HMB with 19 points, BAHL with 10 points, MCB with 9 points and ATRL with 7 points.

All Share Volume increased by 13.62 Million to 223.82 Million Shares. Market Cap decreased by Rs.56.05 Billion.

Total companies traded were 331 compared to 324 from the previous session. Of the scrips traded 116 closed up, 186 closed down while 29 remained unchanged.

Total trades increased by 7,889 to 87,098.

Value Traded decreased by 0.64 Billion to Rs.5.58 Billion

| Company | Volume |

|---|---|

| Cnergyico PK | 63,683,022 |

| Pakistan Refinery | 26,165,000 |

| G3 Technologies | 11,275,500 |

| Pak Elektron | 10,168,000 |

| Telecard | 8,995,500 |

| Hum Network | 7,991,000 |

| Worldcall Telecom | 7,125,000 |

| Lotte Chemical Pakistan | 6,403,000 |

| K-Electric | 4,226,500 |

| Ghani Global Holdings | 3,617,500 |

| Sector | Volume |

|---|---|

| Refinery | 93,735,139 |

| Technology & Communication | 30,156,484 |

| Chemical | 26,217,325 |

| Cable & Electrical Goods | 11,372,800 |

| Food & Personal Care Products | 8,279,595 |

| Commercial Banks | 7,991,896 |

| Cement | 7,377,400 |

| Power Generation & Distribution | 6,314,437 |

| Fertilizer | 4,997,513 |

| Miscellaneous | 4,189,105 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,435.06 161.93M | -0.26% -380.24 |

| ALLSHR | 91,554.64 664.24M | -0.13% -118.48 |

| KSE30 | 45,069.28 78.72M | -0.30% -137.16 |

| KMI30 | 210,256.36 101.15M | -0.04% -75.78 |

| KMIALLSHR | 60,703.10 367.88M | 0.03% 17.23 |

| BKTi | 41,394.54 19.61M | -1.45% -608.81 |

| OGTi | 29,943.45 7.95M | -0.16% -48.00 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 111,005.00 | 111,160.00 108,845.00 | 95.00 0.09% |

| BRENT CRUDE | 67.25 | 68.73 67.11 | -1.55 -2.25% |

| RICHARDS BAY COAL MONTHLY | 92.00 | 0.00 0.00 | 1.80 2.00% |

| ROTTERDAM COAL MONTHLY | 100.40 | 100.40 100.40 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.27 | 64.76 63.13 | -1.53 -2.36% |

| SUGAR #11 WORLD | 16.42 | 16.51 16.31 | 0.02 0.12% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)

Private Sector Credit

Private Sector Credit