PSX Closing Bell: Ride the Lightning

MG News | February 20, 2026 at 01:15 PM GMT+05:00

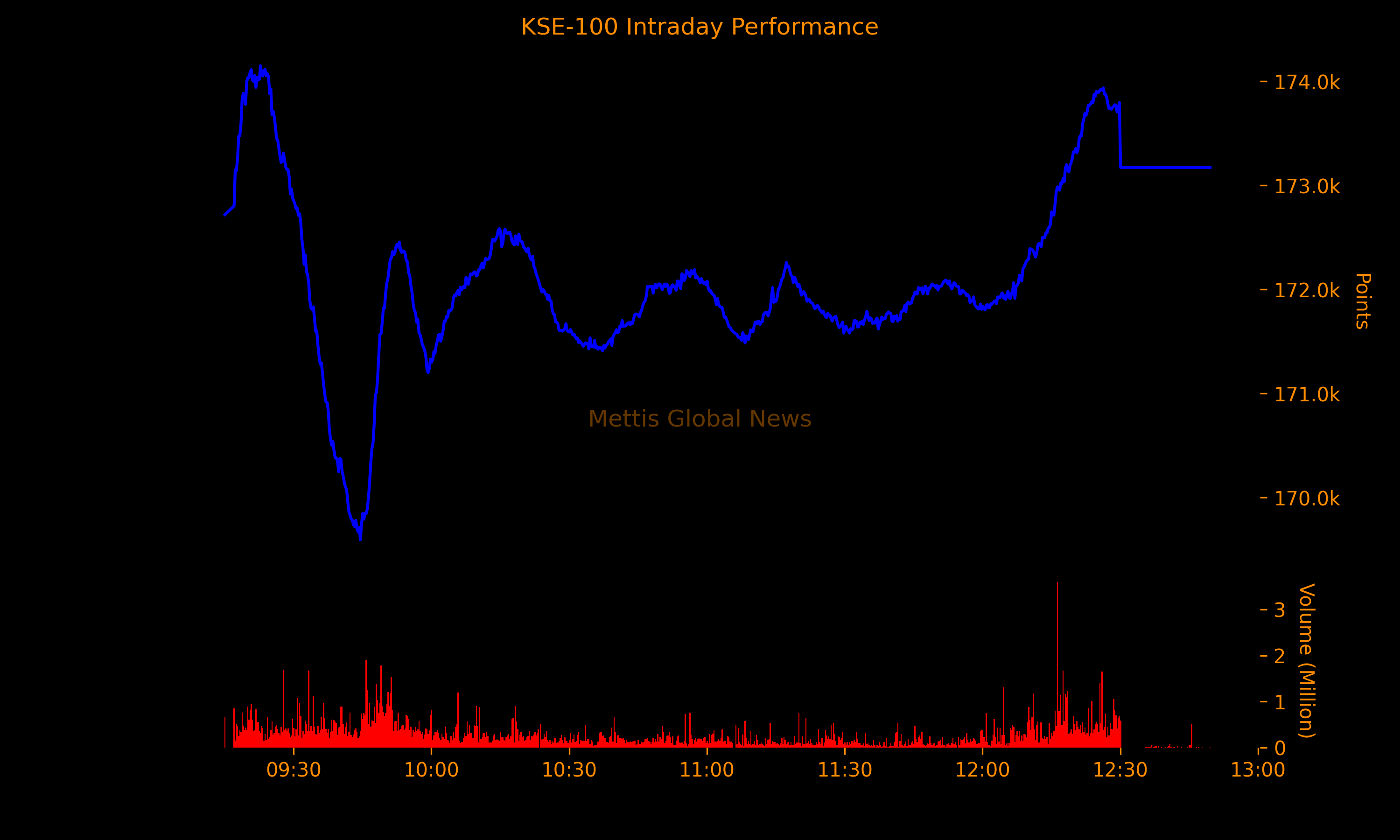

February 20, 2026 (MLN): The KSE-100 Index staged a dramatic comeback on Friday, as investors rushed to pick up blue-chip stocks right after market opening at attractive valuations following recent market turbulence.

The benchmark soared to an intraday high of 174,148.32, before selling pressure dragged it down to a low of 169,592.52, finally closing at 173,169.71, up 999.42 points (0.58%).

Total trading volume reached 245.48 million shares.

Market swings were fueled by heightened global uncertainty. Oil prices jumped amid escalating tensions between the United States and Iran.

US President Donald Trump warned that Tehran had only 10 to 15 days to reach a nuclear deal, while Washington deployed its largest military buildup in the Middle East since 2003.

News reports suggested a possible limited strike to pressure Iran back into negotiations, keeping investors on edge.

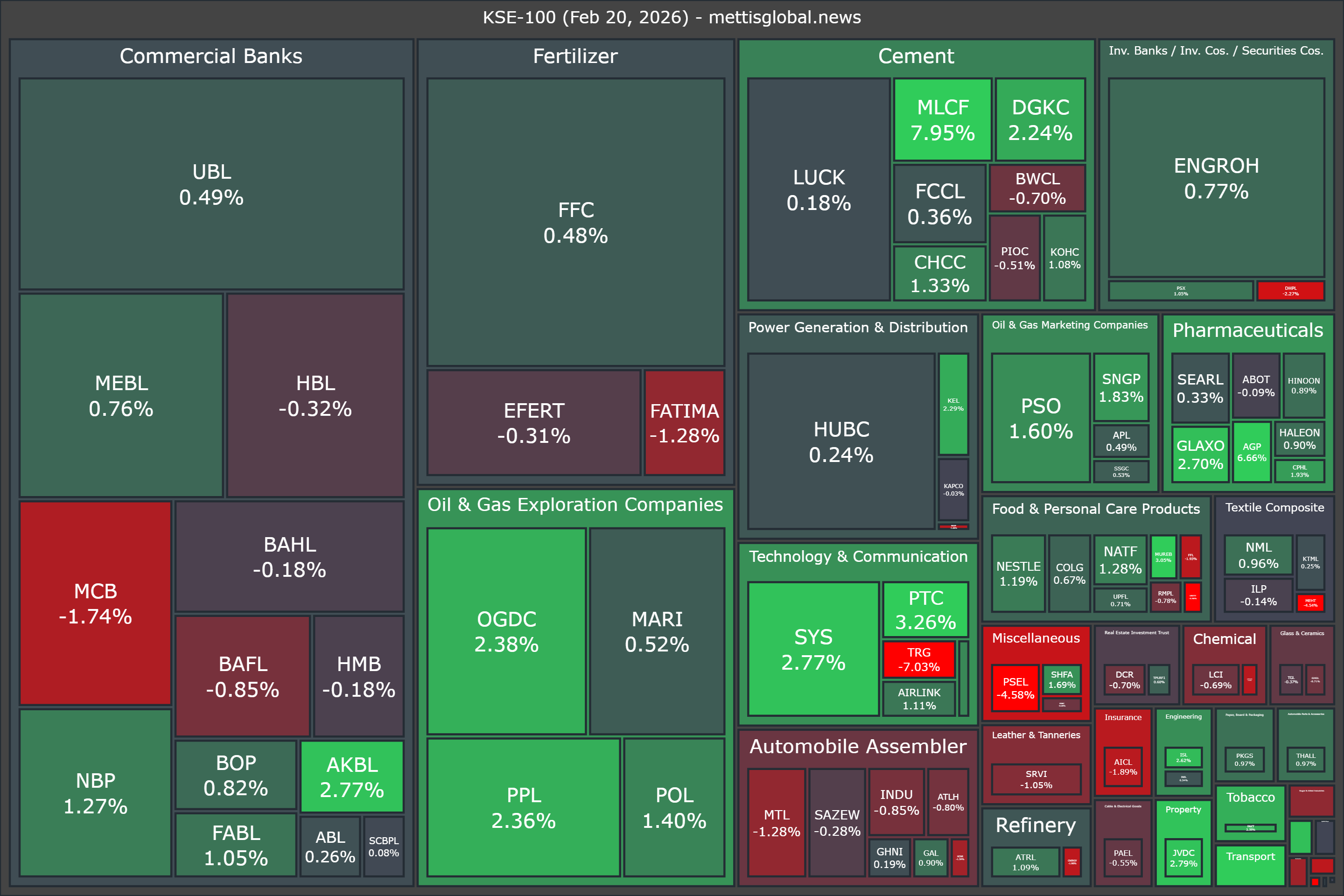

Of the 100 index companies, 58 closed up, 40 closed down, and 2 were unchanged.

Top gainers during the day were MLCF (+7.95%), AGP (+6.66%), PIBTL (+3.26%), PTC (+3.26%), and MUREB (+3.05%).

On the other hand, top losers were SSOM (-9.65%), TRG (-7.03%), PGLC (-5.09%), PSEL (-4.58%), and MEHT (-4.54%).

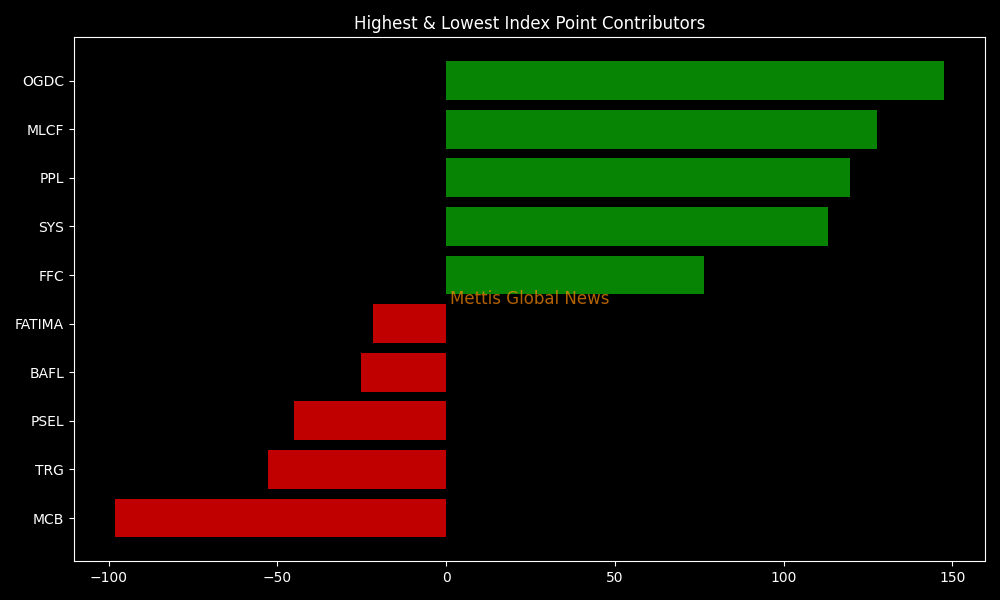

In terms of index-point contributions, companies that propped up the index were OGDC (+147.40pts), MLCF (+127.68pts), PPL (+119.81pts), SYS (+113.24pts), and FFC (+76.41pts).

Meanwhile, companies that dragged the index lower were MCB (-98.00pts), TRG (-52.63pts), PSEL (-45.12pts), BAFL (-25.26pts), and FATIMA (-21.68pts).

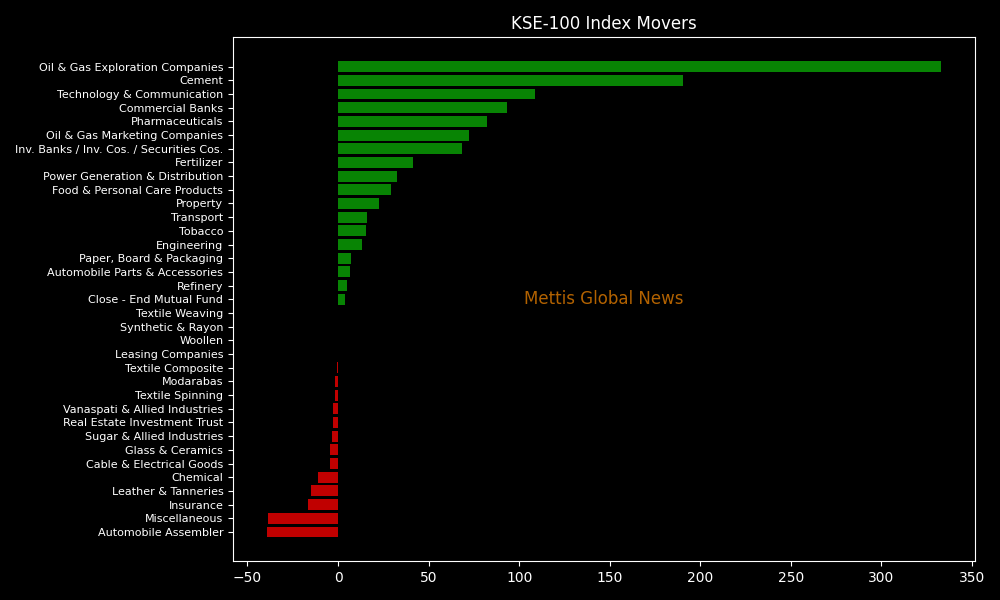

Sector-wise, the KSE-100 Index was supported by Oil & Gas Exploration Companies (+333.15pts), Cement (+190.65pts), Technology & Communication (+108.88pts), Commercial Banks (+93.22pts), and Pharmaceuticals (+82.06pts).

While the index was let down by Automobile Assembler (-39.39pts), Miscellaneous (-38.46pts), Insurance (-16.42pts), Leather & Tanneries (-15.18pts), and Chemical (-11.29pts).

In the broader market, the All-Share Index closed at 103,952.95 with a net gain of 476.31 points or 0.46%.

Total market volume was 537.65 million shares compared to 905.68m from the previous session, while traded value was recorded at Rs23.79 billion, showing a decrease of Rs23.93bn.

There were 279,046 trades reported in 475 companies with 157 closing up, 257 closing down, and 61 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| KEL | 8.03 | 2.29% | 73,134,017 |

| WTL | 1.38 | -1.43% | 46,207,991 |

| BOP | 33.04 | 0.82% | 31,618,879 |

| TSBLR1 | 0.52 | -18.75% | 26,235,092 |

| FNEL | 1.26 | -2.33% | 22,787,240 |

| CNERGY | 7.01 | -1.96% | 19,236,660 |

| PIBTL | 18.68 | 3.26% | 14,846,470 |

| PTC | 59.22 | 3.26% | 13,239,041 |

| NCPL | 71.44 | -2.35% | 13,090,259 |

| HASCOLNC | 19.19 | -2.79% | 10,470,290 |

To note, the KSE-100 has gained 47,542 points or 37.84% during the fiscal year, whereas it has increased 2,428 points or 1.42% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,335.00 | 68,360.00 66,880.00 | 1130.00 1.68% |

| BRENT CRUDE | 71.59 | 72.34 71.35 | -0.07 -0.10% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.30 | 67.03 66.10 | -0.10 -0.15% |

| SUGAR #11 WORLD | 13.70 | 13.74 13.61 | 0.00 0.00% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account