PSX Closing Bell: Red Takes the Lead

MG News | November 11, 2025 at 04:48 PM GMT+05:00

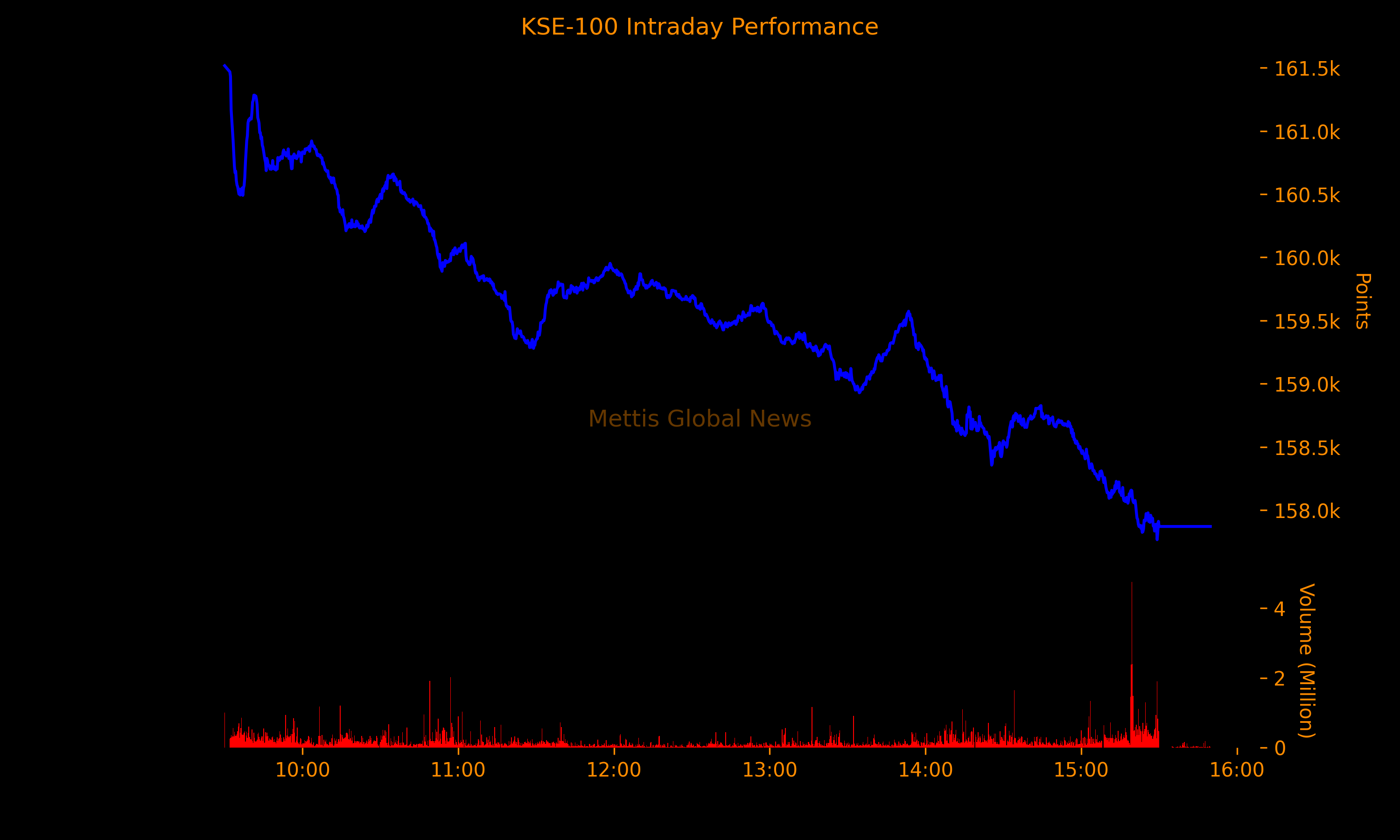

November 11, 2025 (MLN): The benchmark KSE-100 Index concluded Tuesday's trading session at 157,870.50, showing a decrease of 3,667.90 points or 2.27%.

The index traded in a range of 3,750.82 points showing an intraday high of 161,516.74 (-21.66) and a low of 157,765.92 (-3,772.48) points.

Markets reacted negatively to reports of a suicide bombing outside a district court in Islamabad, which claimed at least 12 lives and left several others injured.

The tragic incident raised fears of renewed instability and dampened investor confidence, leading to risk aversion across most sectors.

Additionally, uncertainty surrounding the 27th Constitutional Amendment Bill, presented in the National Assembly today, also contributed to the cautious mood.

While the bill marks a significant step in restructuring Pakistan’s constitutional and defense frameworks, investors adopted a wait-and-see approach amid speculation about its political and institutional implications.

The combination of security incidents, political developments, and structural transitions kept the market under pressure, with volumes thinning as participants preferred to stay on the sidelines.

The total volume of the KSE-100 Index was 291.16 million shares.

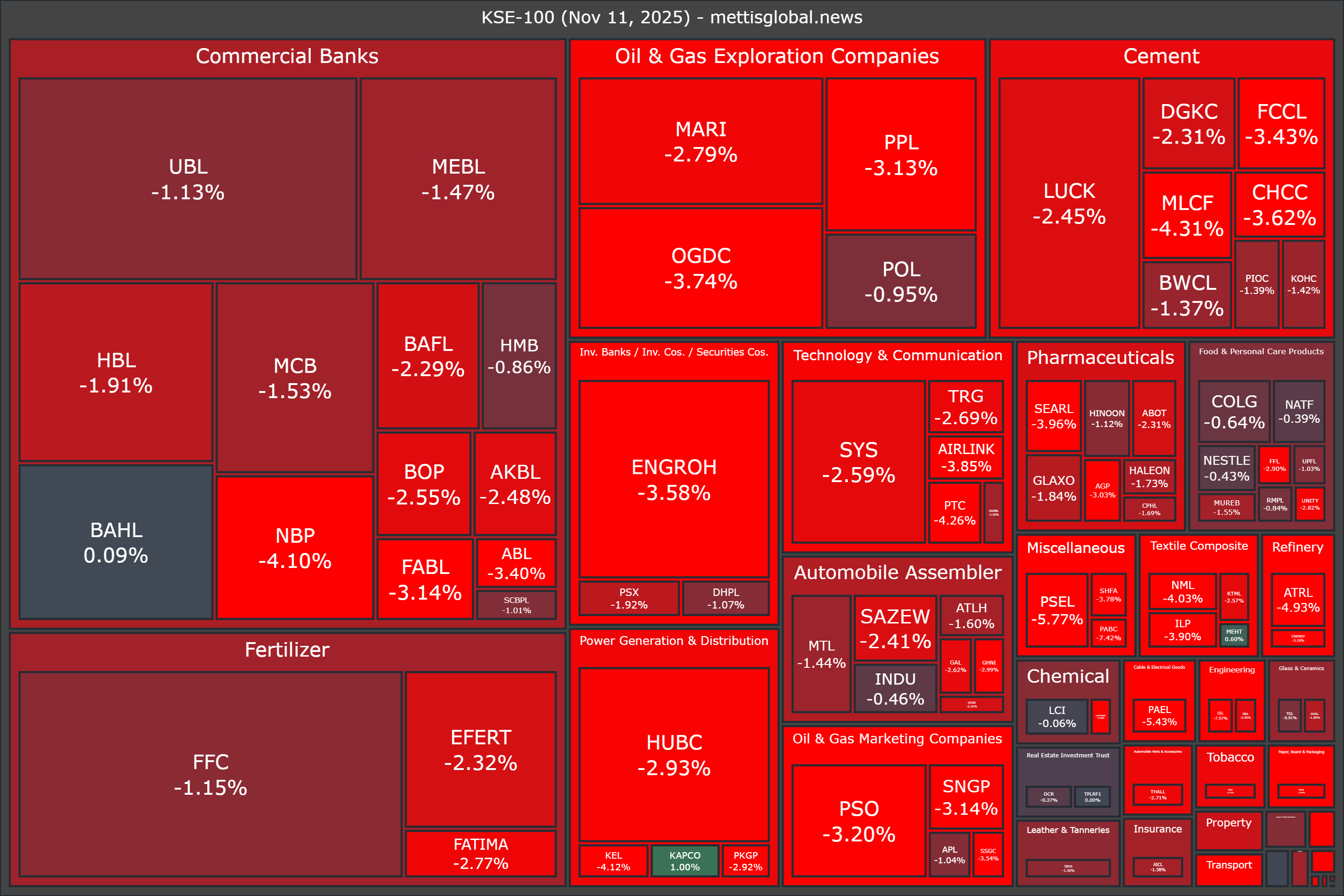

Of the 100 index companies 4 closed up, 94 closed down, while 2 were unchanged.

Top losers during the day were ISL (-7.57%), PABC (-7.42%), YOUW (-6.55%), PSEL (-5.77%), and PAEL (-5.43%).

On the other hand, top gainers were PGLC (+1.62%), KAPCO (+1.00%), MEHT (+0.60%), BAHL (+0.09%), and IBFL (+0.00%).

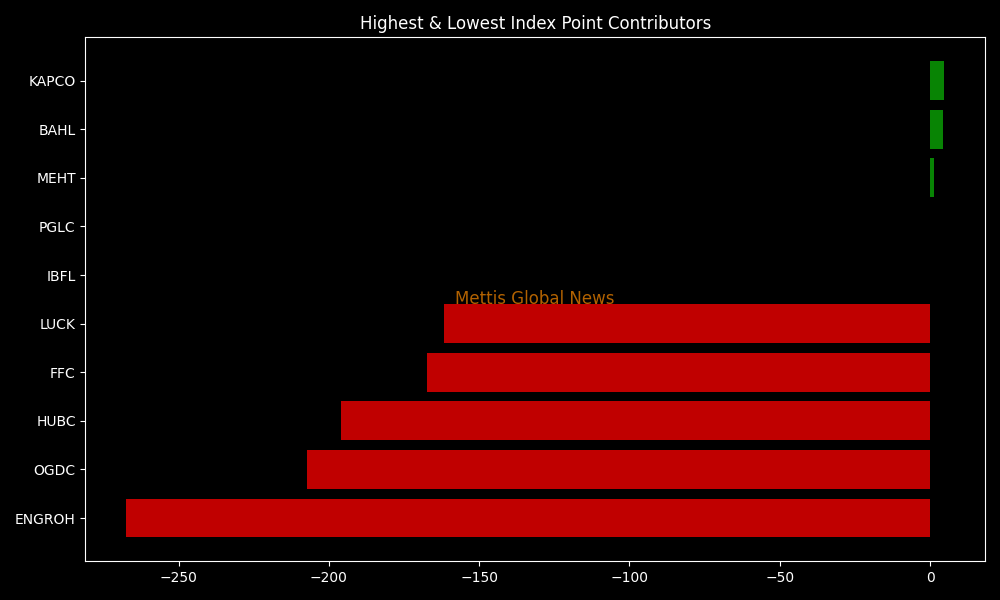

In terms of index-point contributions, companies that dragged the index lower were ENGROH (-267.36pts), OGDC (-207.38pts), HUBC (-196.03pts), FFC (-167.19pts), and LUCK (-161.63pts).

Meanwhile, companies that added points to the index were KAPCO (+4.66pts), BAHL (+4.24pts), MEHT (+1.37pts), PGLC (+0.09pts), and IBFL (+0.00pts).

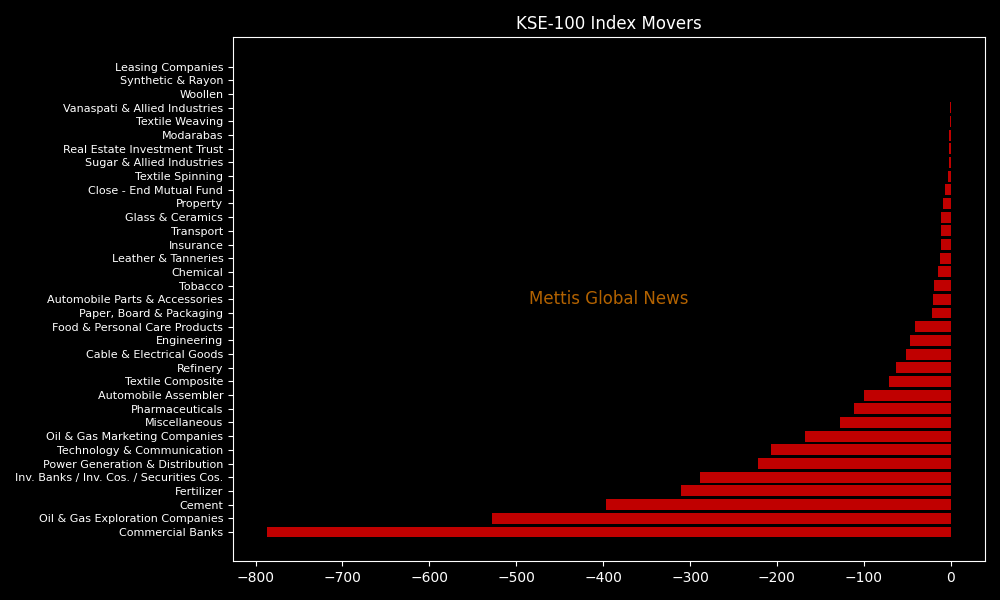

Sector-wise, KSE-100 Index was let down by Commercial Banks (-786.61pts), Oil & Gas Exploration Companies (-528.45pts), Cement (-396.50pts), Fertilizer (-310.28pts), and Inv. Banks / Inv. Cos. / Securities Cos. (-288.21pts).

While the index was supported by Leasing Companies (+0.09pts), Synthetic & Rayon (+0.00pts), Woollen (-0.21pts), Vanaspati & Allied Industries (-0.79pts), and Textile Weaving (-1.08pts).

In the broader market, the All-Share Index closed at 49,605.76 with a net loss of 1,158.63 points or 2.28%.

Total market volume was 836.43 million shares compared to 783.29m from the previous session while traded value was recorded at Rs38.08 billion showing an increase of Rs1.70bn.

There were 420,808 trades reported in 483 companies with 78 closing up, 364 closing down, and 41 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| FNEL | 22.61 | 6.55% | 77,173,809 |

| KEL | 5.12 | -4.12% | 66,868,941 |

| WTL | 1.7 | -3.95% | 46,808,585 |

| BOP | 34.72 | -2.55% | 45,558,123 |

| AMTEXNC | 5.49 | 8.07% | 31,156,638 |

| PIAHCLA | 32.1 | 10.01% | 30,644,804 |

| HASCOLNC | 14.88 | -5.10% | 27,255,907 |

| ICIBL | 6.71 | -4.55% | 23,107,284 |

| PACE | 28.58 | -2.36% | 22,865,881 |

| LOADS | 18.78 | 3.87% | 20,618,194 |

To note, the KSE-100 has gained 32,243 points or 25.67% during the fiscal year, whereas it has increased 42,744 points or 37.13% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,870.50 291.16M | -2.27% -3667.90 |

| ALLSHR | 96,108.46 834.58M | -2.09% -2049.19 |

| KSE30 | 47,843.07 156.10M | -2.30% -1124.44 |

| KMI30 | 226,708.22 102.12M | -2.89% -6752.01 |

| KMIALLSHR | 62,521.18 318.78M | -2.48% -1591.23 |

| BKTi | 43,911.55 60.01M | -1.60% -715.15 |

| OGTi | 30,337.99 14.25M | -3.22% -1009.62 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 105,200.00 | 107,900.00 105,090.00 | -1165.00 -1.10% |

| BRENT CRUDE | 64.47 | 64.58 63.60 | 0.41 0.64% |

| RICHARDS BAY COAL MONTHLY | 85.25 | 85.75 85.25 | -0.75 -0.87% |

| ROTTERDAM COAL MONTHLY | 96.00 | 96.25 96.00 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.46 | 60.58 59.66 | 0.33 0.55% |

| SUGAR #11 WORLD | 14.28 | 14.48 14.20 | 0.08 0.56% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|