PSX Closing Bell: A Study in Scarlet

MG News | August 24, 2021 at 05:59 PM GMT+05:00

August 24, 2021 (MLN): Domestic equities witnessed selling pressure throughout the day today amid rollover week as the benchmark KSE-100 Index recorded a negative close of 284 points to settle at 47,829 level.

Despite several positive news on economic front, as Pakistan received $2.75 billion from IMF under new SDR allocation today which took country’s total forex reserves to above $27bn (highest ever) and recent survey of OICCI, revealed that Pakistan's Business Confidence Index rose dramatically from -50% to 9%, improving 59ppts, investors prefer to remain sidelined.

The profit taking in today’s session was observed owing to geopolitical uncertainty over the Afghan issue as according to news report, Taliban warned that there would be consequences if the United States and its allies try to remain in Afghanistan beyond next week, a note by Topline Securities said.

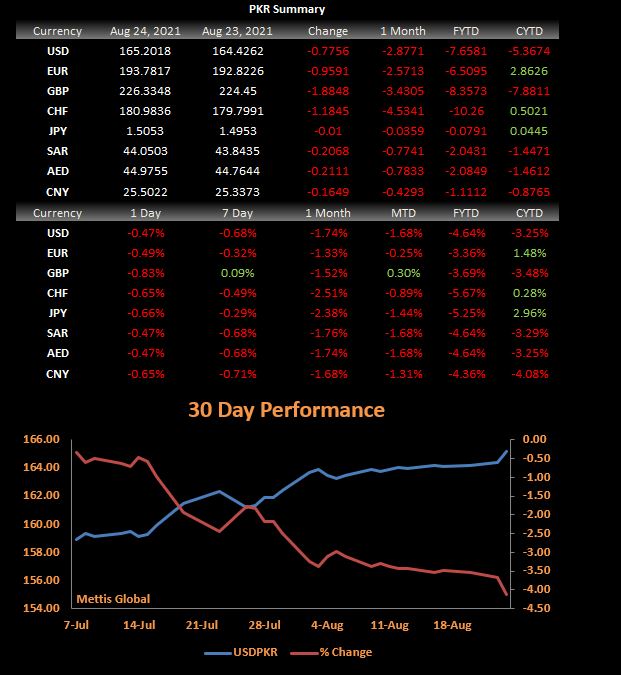

Moreover, the dollar also continues its upward trajectory and traded above Rs165, a level last seen in September 2020, also kept investors sentiments in check.

Besides, PSO and ENGRO announced their financial results today as per which PSO witnessed a large positive swing in its consolidated net profits worth Rs29.56 billion (EPS: Rs62.63) against a huge loss of Rs14.76bn (LPS: Rs23.47), while ENGRO reported a remarkable 84% YoY increase in net profits to Rs29bn compared to Rs15.79bn earned in the corresponding period last year.

The Index traded in a range of 386.67 points or 0.80 percent of previous close, showing an intraday high of 48,126.20 and a low of 47,739.53.

Of the 95 traded companies in the KSE100 Index 30 closed up 62 closed down, while 3 remained unchanged. Total volume traded for the index was 129.48 million shares.

Sector wise, the index was let down by Cement with 64 points, Fertilizer with 60 points, Commercial Banks with 60 points, Oil & Gas Marketing Companies with 52 points and Oil & Gas Exploration Companies with 36 points.

The most points taken off the index was by ENGRO which stripped the index of 50 points followed by PSO with 41 points, MEBL with 33 points, PPL with 29 points and LUCK with 28 points.

Sectors propping up the index were Miscellaneous with 37 points, Power Generation & Distribution with 17 points, Chemical with 12 points, Transport with 5 points and Automobile Assembler with 3 points.

The most points added to the index was by PSEL which contributed 37 points followed by HUBC with 22 points, MTL with 7 points, ARPL with 6 points and PIBTL with 5 points.

All Share Volume decreased by 2.74 Million to 394.95 Million Shares. Market Cap decreased by Rs.40.19 Billion.

Total companies traded were 483 compared to 494 from the previous session. Of the scrips traded 171 closed up, 297 closed down while 15 remained unchanged.

Total trades decreased by 16,618 to 132,709.

Value Traded decreased by 1.18 Billion to Rs.13.68 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 43,692,000 |

| Telecard | 30,990,500 |

| Ghani Global Holdings | 25,683,500 |

| The Bank of Punjab | 22,736,500 |

| Azgard Nine | 18,776,500 |

| Hum Network | 14,900,000 |

| Dewan Cement | 11,779,500 |

| Thatta Cement Company | 8,932,500 |

| Byco Petroleum Pakistan | 7,233,500 |

| Unity Foods | 7,142,595 |

| Sector | Volume |

|---|---|

| Technology & Communication | 105,738,517 |

| Cement | 36,810,498 |

| Commercial Banks | 34,422,837 |

| Chemical | 32,990,150 |

| Food & Personal Care Products | 30,556,025 |

| Textile Composite | 26,326,250 |

| Miscellaneous | 14,275,600 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 14,218,789 |

| Power Generation & Distribution | 14,074,383 |

| Cable & Electrical Goods | 9,746,800 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,750.00 | 119,440.00 118,260.00 | 455.00 0.38% |

| BRENT CRUDE | 71.97 | 73.17 71.75 | -0.54 -0.74% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 68.67 | 69.79 68.45 | -0.54 -0.78% |

| SUGAR #11 WORLD | 16.40 | 16.58 16.40 | -0.19 -1.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|