PSX Closing Bell: A Rough Day at the Office

MG News | February 12, 2026 at 04:10 PM GMT+05:00

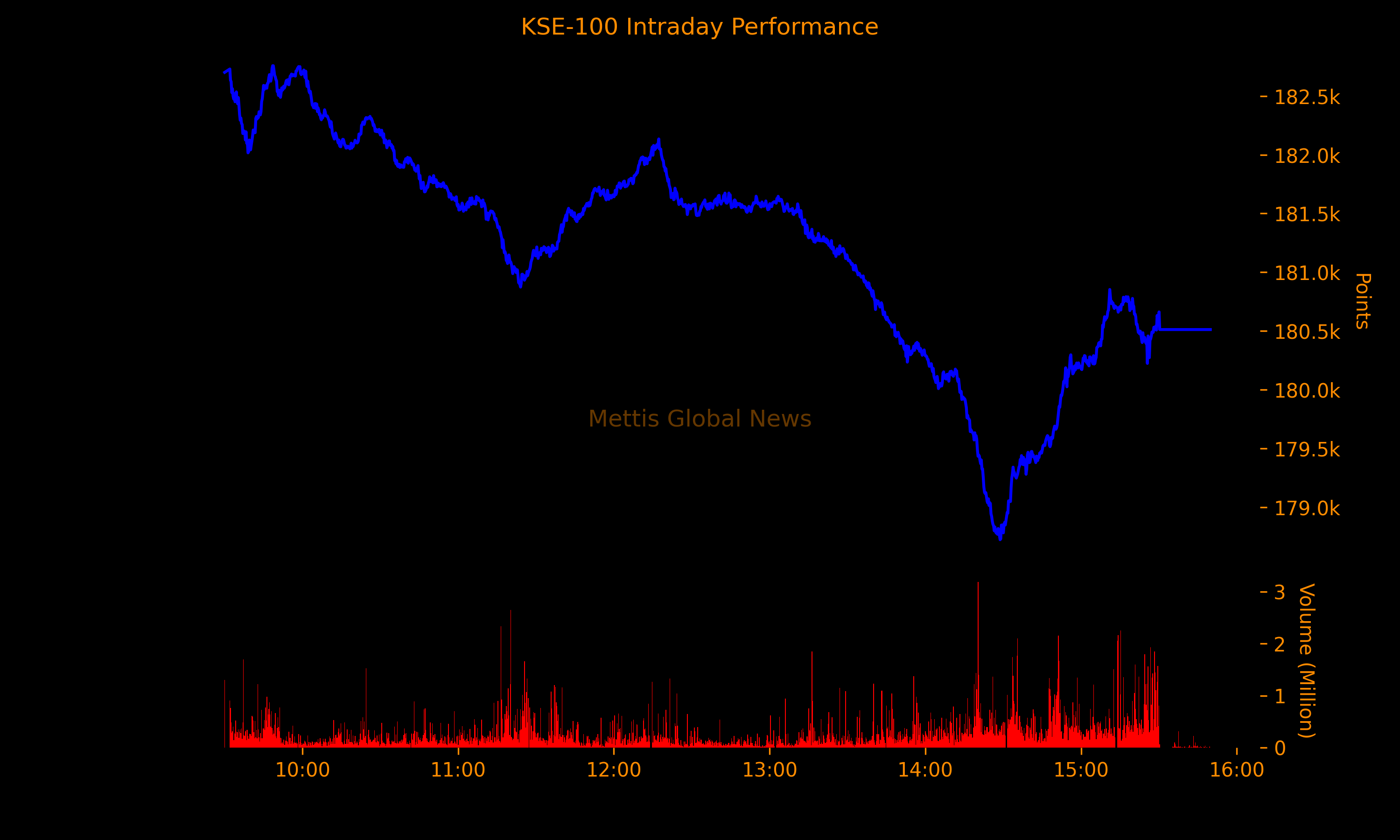

February 12, 2026 (MLN): The benchmark KSE-100 Index concluded Thursday's trading session at 180,512.64, showing a decrease of 2,537.16 points or 1.39%.

The index traded in a range of 4,031.84 points showing an intraday high of 182,757.08 (-292.72) and a low of 178,725.24 (-4,324.56) points.

The decline in the KSE-100 Index was largely attributed to weakening investor sentiment following uncertainty surrounding Barrick Gold Corporation’s $6 billion Reko Diq copper-gold project in Balochistan.

The company’s statement that it is reviewing the project’s development timeline and capital budget due to escalating security risks raised fresh concerns about Pakistan’s ability to retain large-scale foreign investment.

The total volume of the KSE-100 Index was 448.22 million shares.

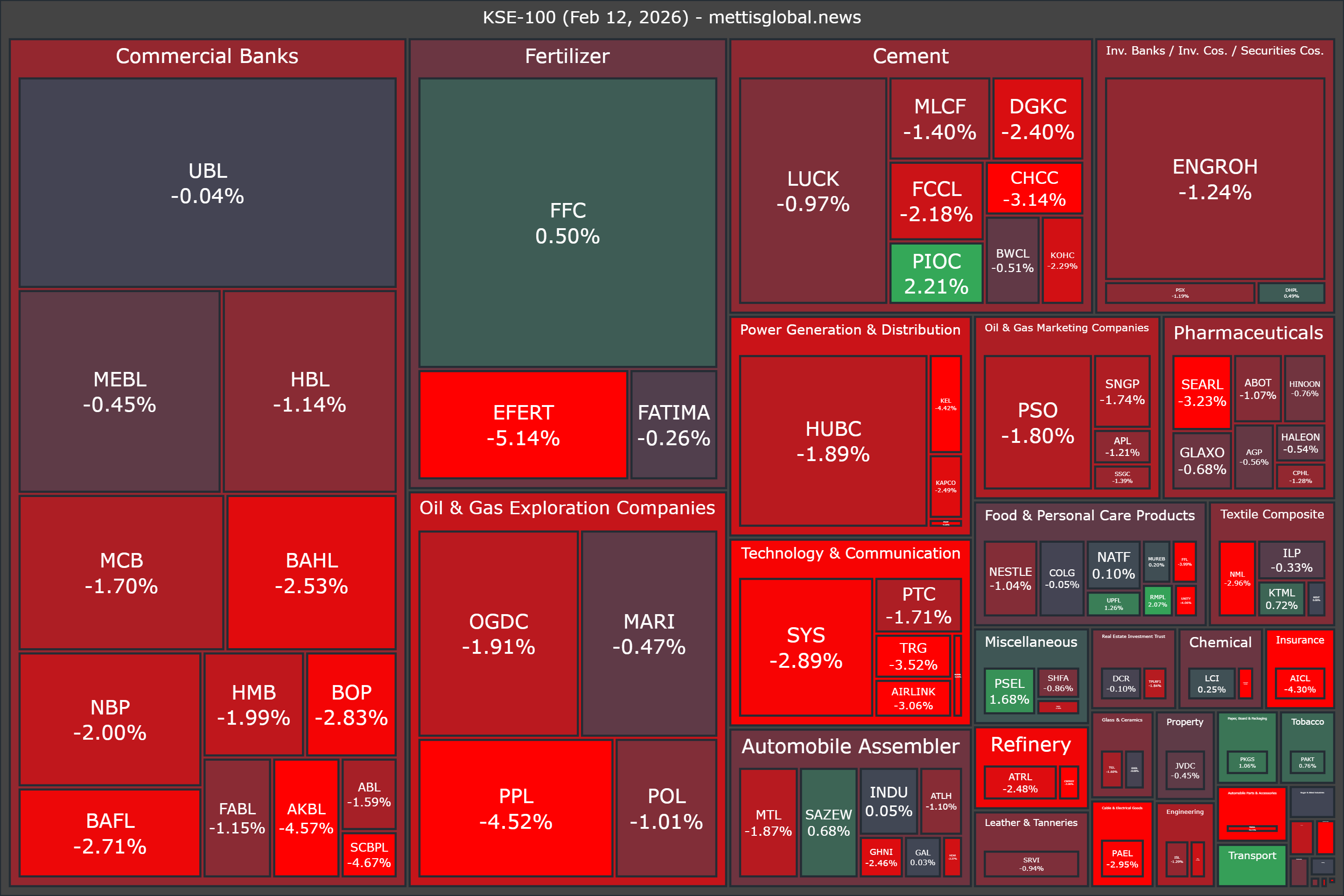

Of the 100 index companies 18 closed up, 80 closed down, while 2 were unchanged.

Top losers during the day were HUMNL (-6.02%), IBFL (-6.00%), EFERT (-5.14%), THALL (-5.11%), and SCBPL (-4.67%).

On the other hand, top gainers were PIOC (+2.21%), RMPL (+2.07%), PIBTL (+2.00%), PSEL (+1.68%), and UPFL (+1.26%).

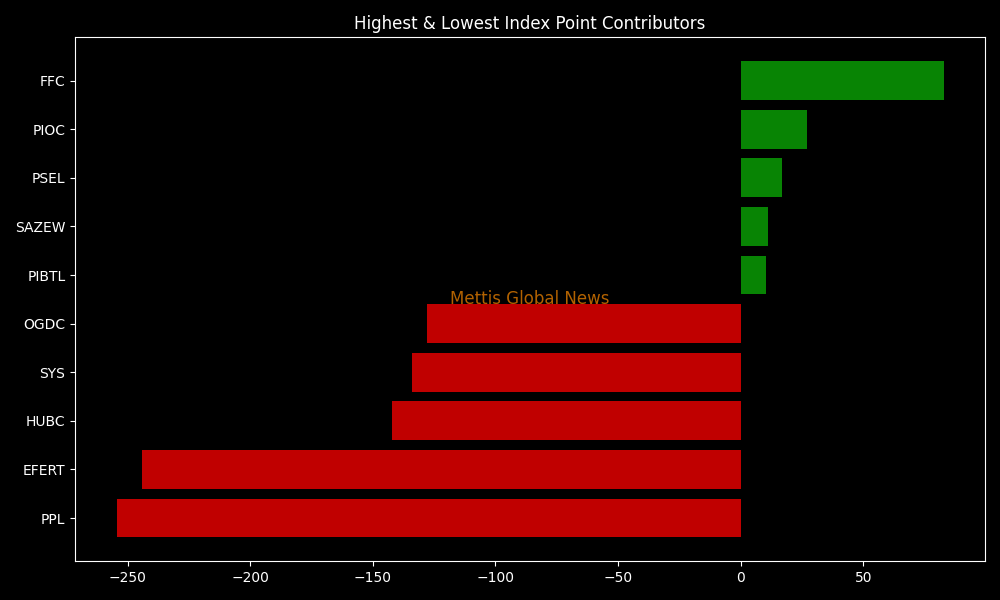

In terms of index-point contributions, companies that dragged the index lower were PPL (-254.51pts), EFERT (-244.14pts), HUBC (-142.09pts), SYS (-133.86pts), and OGDC (-127.89pts).

Meanwhile, companies that added points to the index were FFC (+82.75pts), PIOC (+27.16pts), PSEL (+16.66pts), SAZEW (+11.25pts), and PIBTL (+10.35pts).

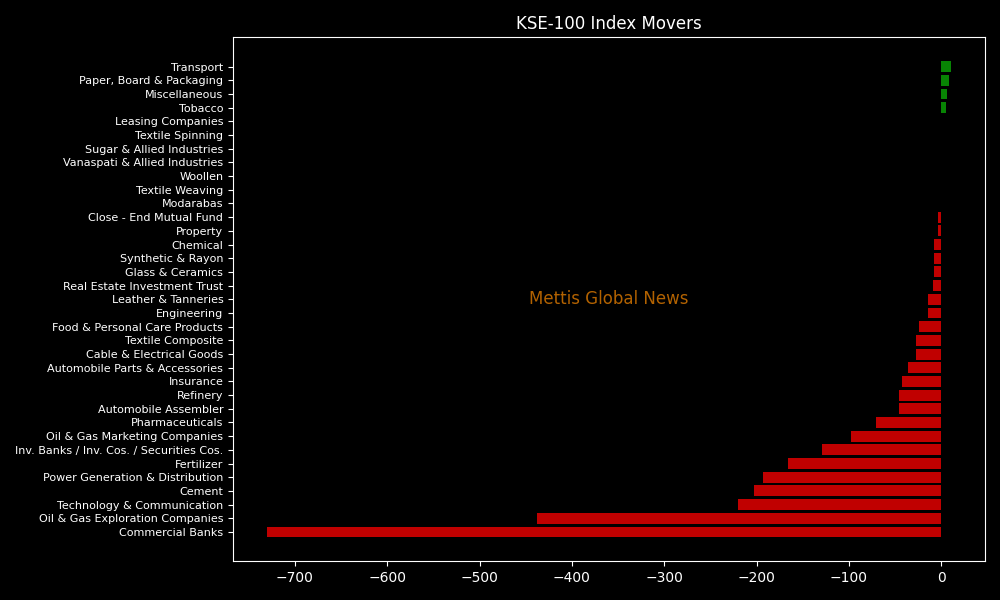

Sector-wise, KSE-100 Index was let down by Commercial Banks (-730.10pts), Oil & Gas Exploration Companies (-437.65pts), Technology & Communication (-220.46pts), Cement (-202.69pts), and Power Generation & Distribution (-192.62pts).

While the index was supported by Transport (+10.35pts), Paper, Board & Packaging (+7.86pts), Miscellaneous (+6.42pts), Tobacco (+5.14pts), and Leasing Companies (+0.07pts).

In the broader market, the All-Share Index closed at 108,400.67 with a net loss of 1,441.29 points or 1.31%.

Total market volume was 874.00 million shares compared to 734.67m from the previous session while traded value was recorded at Rs41.77 billion showing an increase of Rs6.37bn.

There were 441,474 trades reported in 484 companies with 92 closing up, 342 closing down, and 50 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| KEL | 8.22 | -4.42% | 176,912,038 |

| CNERGY | 7.85 | -3.80% | 52,213,728 |

| AMTEXNC | 4.67 | -12.05% | 39,738,759 |

| PIBTL | 19.39 | 2.00% | 31,434,560 |

| FNEL | 1.5 | -3.85% | 30,912,538 |

| WTL | 1.65 | -2.37% | 29,825,599 |

| EPCL | 38.48 | 6.04% | 27,131,007 |

| HASCOLNC | 23.06 | -4.04% | 21,408,228 |

| BECO | 6.02 | 0.17% | 18,619,063 |

| GGL | 22.67 | 0.98% | 18,216,169 |

To note, the KSE-100 has gained 54,885 points or 43.69% during the fiscal year, whereas it has increased 6,458 points or 3.71% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 161,210.68 402.54M | 3.49% 5433.46 |

| ALLSHR | 96,097.29 718.60M | 3.34% 3102.77 |

| KSE30 | 49,781.74 146.66M | 3.95% 1890.99 |

| KMI30 | 230,597.11 158.11M | 4.81% 10582.05 |

| KMIALLSHR | 62,183.27 382.16M | 3.79% 2272.55 |

| BKTi | 46,523.21 43.62M | 2.50% 1134.61 |

| OGTi | 32,678.22 24.62M | 6.68% 2046.87 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 73,115.00 | 73,825.00 72,020.00 | -330.00 -0.45% |

| BRENT CRUDE | 83.35 | 84.74 81.50 | 1.95 2.40% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -9.60 -8.81% |

| ROTTERDAM COAL MONTHLY | 121.50 | 0.00 0.00 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 76.82 | 78.09 74.97 | 2.16 2.89% |

| SUGAR #11 WORLD | 13.72 | 13.80 13.61 | -0.01 -0.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction