Oil prices steady amid mixed global signals

MG News | July 16, 2025 at 03:26 PM GMT+05:00

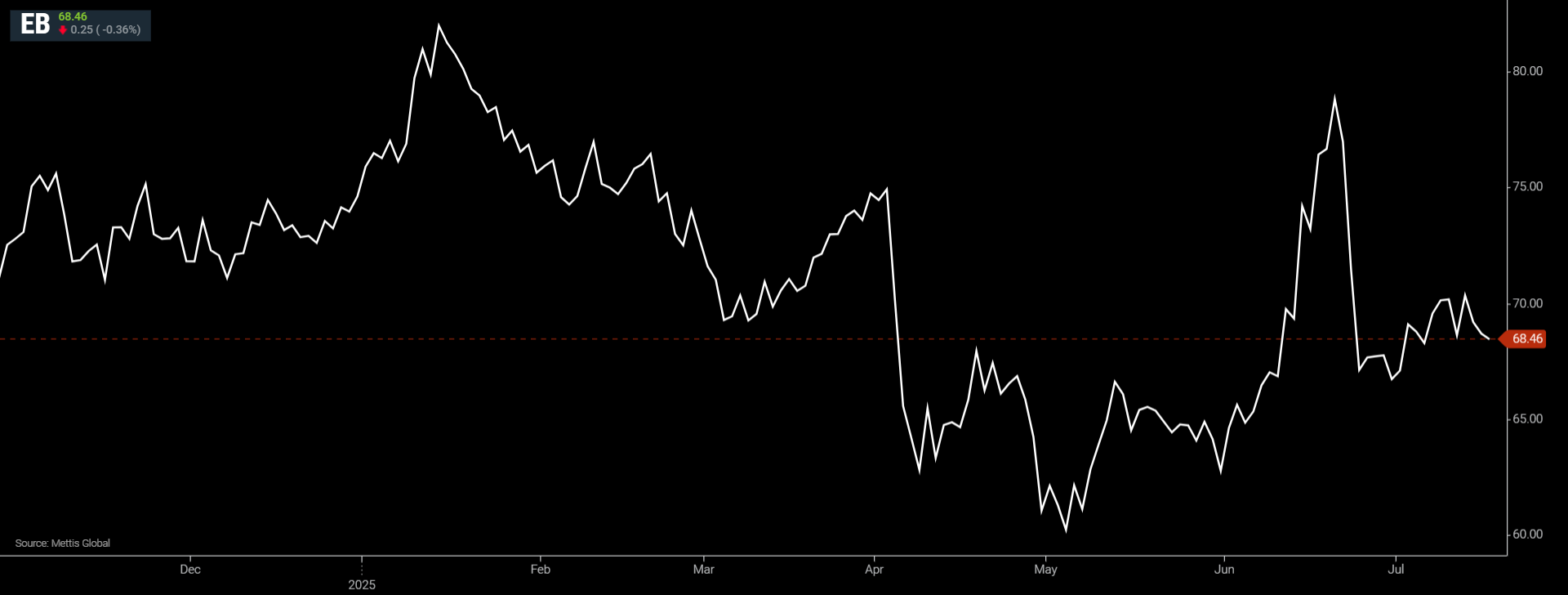

July 16, 2025 (MLN): Oil prices steadied on Wednesday, as signs of stronger

Chinese crude consumption were outweighed by investor caution about the wider

economic impact from U.S. tariffs.

Brent crude futures decreased by $0.25, or 0.36%, to $68.46 per

barrel.

West Texas Intermediate (WTI) crude futures fell by $0.33, or 0.5%, to $66.19 per barrel by [3:20 pm] PST.

U.S. President Donald Trump has threatened to impose a 30%

tariff on European Union imports beginning August 1, a move European officials

claim could severely disrupt trade between the two major economies.

In response, the European Commission is reportedly readying

retaliatory tariffs on U.S. goods worth €72 billion ($84.1bn), should

negotiations falter.

Additionally, Trump warned on Monday of “very severe

tariffs” against Russia within 50 days if a resolution to the Ukraine conflict

is not reached.

Despite the announcement, markets showed little concern for

supply disruptions, with PVM oil analyst Tamas Varga noting that oil continued

drifting lower due to a muted reaction to the latest U.S. stance on Russia.

However, China's improved demand outlook helped limit oil’s

losses, as CNBC reported.

Following maintenance, Chinese state-owned refiners are

increasing output to meet expected higher third-quarter fuel demand and

replenish diesel and gasoline inventories that are at multi-year lows,

according to traders and analysts.

OPEC’s monthly report released Tuesday added further

optimism, projecting stronger global economic performance in the second half of

2025.

It highlighted better-than-expected economic momentum in

Brazil, China, and India, alongside a recovery in the U.S. and EU.

Meanwhile, American Petroleum Institute data showed that

U.S. crude inventories rose by 839,000 barrels for the week ending July 11.

Gasoline and distillate stocks also increased by 1.93

million barrels and 828,000 barrels, respectively.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,174.49 344.20M | 1.01% 1836.37 |

| ALLSHR | 110,725.47 802.30M | 1.02% 1116.66 |

| KSE30 | 56,462.88 128.04M | 0.96% 535.72 |

| KMI30 | 261,050.23 116.63M | 1.37% 3522.37 |

| KMIALLSHR | 71,230.99 382.91M | 1.23% 862.76 |

| BKTi | 53,229.04 40.62M | 1.01% 532.20 |

| OGTi | 38,590.42 18.06M | 1.28% 488.37 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 84,560.00 | 84,945.00 81,210.00 | 160.00 0.19% |

| BRENT CRUDE | 69.83 | 70.21 67.79 | 0.24 0.34% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -0.90 -0.99% |

| ROTTERDAM COAL MONTHLY | 103.70 | 103.70 99.40 | 4.90 4.96% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.74 | 66.11 63.64 | 0.32 0.49% |

| SUGAR #11 WORLD | 14.26 | 14.71 14.15 | -0.44 -2.99% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks