Oil prices slip as fed rate cut sparks economic concerns

MG News | September 18, 2025 at 02:26 PM GMT+05:00

September 18, 2025 (MLN): Oil prices fell for the second straight session on Thursday, as the Federal Reserve’s expected interest rate cut shifted market attention toward worries over the U.S. economy and rising supply levels.

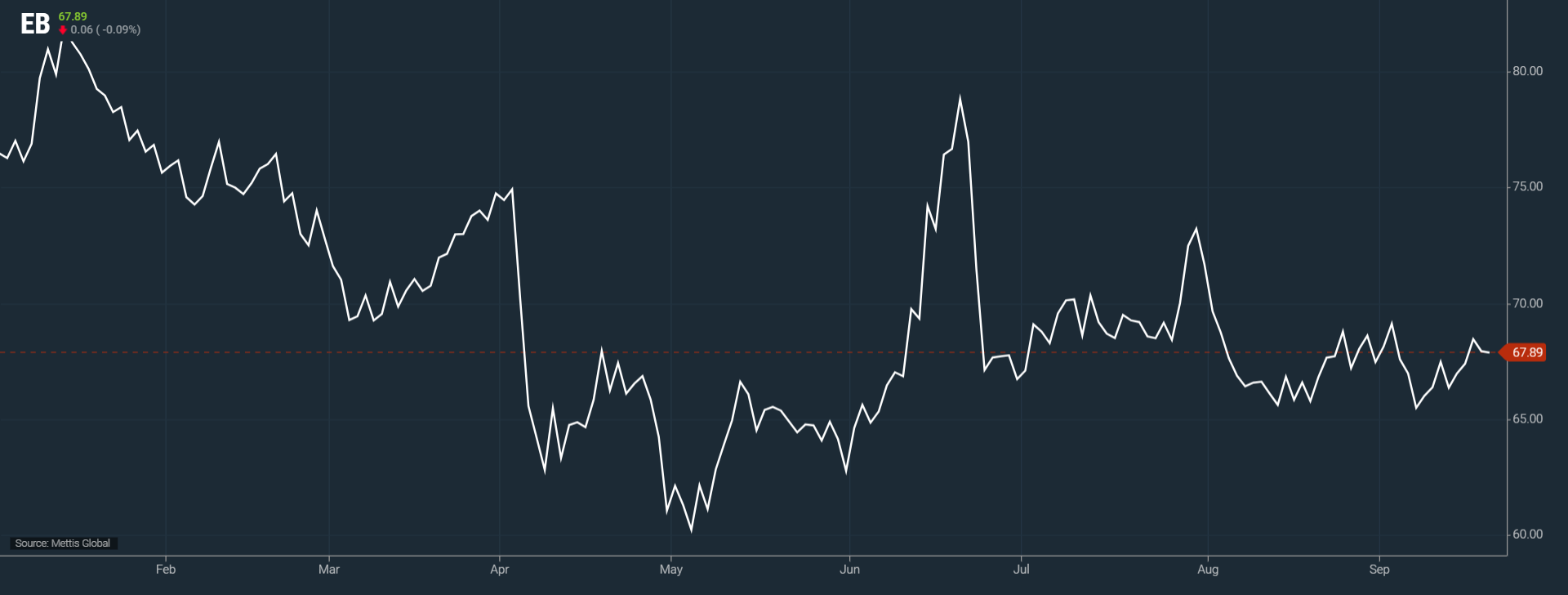

Brent crude futures went up by $0.06, or 0.09%, to $67.89

per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.12, or 0.19%, to $63.93 per barrel by [2:20 am] PST.

The Federal Reserve reduced its policy rate by 25 basis

points on Wednesday and signaled that it plans to gradually cut borrowing costs

through the rest of the year, in response to signs of weakness in the labor

market.

While lower borrowing costs generally support oil demand

and lift prices, analysts noted that the Fed’s move and the prospect of two

additional cuts this year were already factored in.

“The key market focus wasn’t just the rate cut, but

Powell’s gloomy tone,” said Priyanka Sachdeva, senior market analyst at Phillip

Nova.

“He highlighted a deteriorating jobs market and stubborn

inflation, making the cut appear more like a safeguard than a growth driver.”

Claudio Galimberti, chief economist and global director

of market analysis at Rystad Energy, wrote in a client note that the Fed’s

stance suggested policymakers view unemployment as a bigger risk to the economy

than inflation.

Oil markets also came under pressure from persistent

oversupply and subdued fuel demand in the United States, the world’s largest

consumer.

According to data released Wednesday by the Energy

Information Administration, U.S. crude inventories dropped sharply last week as

net imports hit a record low and exports rose to their highest in nearly two

years.

However, distillate stockpiles climbed by 4m barrels, far

above expectations of a 1m barrel increase, fueling concerns over demand and

weighing on prices.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,495.00 | 90,760.00 89,800.00 | 895.00 1.00% |

| BRENT CRUDE | 63.80 | 63.94 63.72 | 0.05 0.08% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.29 60.05 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes