Oil prices slip after hitting two-week highs

MG News | July 09, 2025 at 11:31 AM GMT+05:00

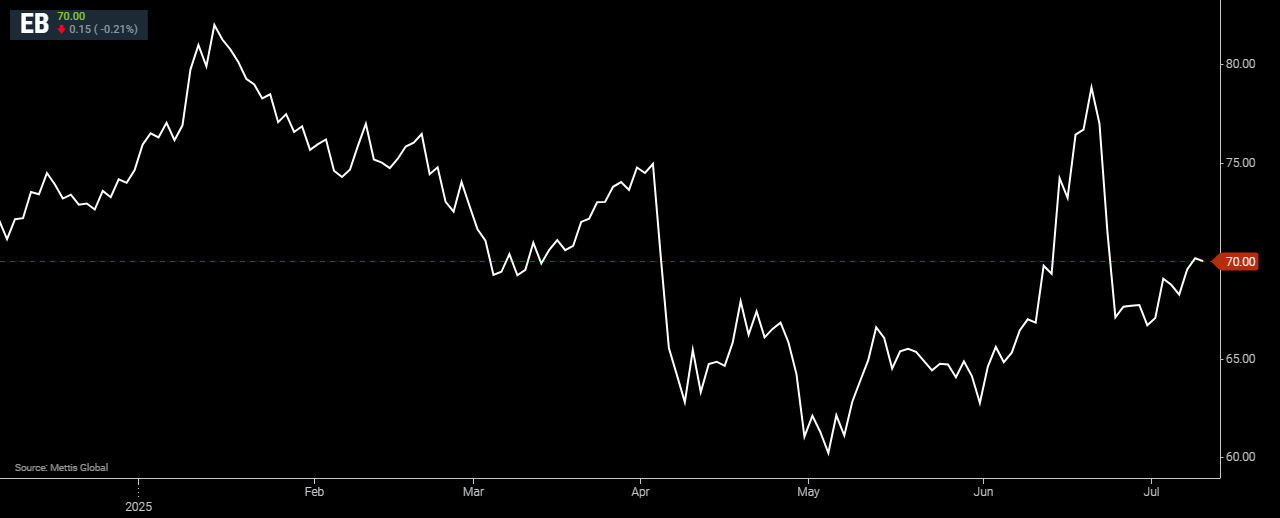

July 09, 2025 (MLN): Oil prices edged slightly lower on Wednesday after

rising to two-week highs in the previous session, as investors were watching

new developments on U.S. tariffs and trying to gauge their impact.

Brent crude futures decreased by $0.15, or 0.21%, to $70 per

barrel.

West Texas Intermediate (WTI) crude futures fall by $0.25, or 0.37%, to $68.08 per barrel by [11:30 am] PST.

U.S. President Donald Trump delayed the implementation of new tariffs, moving the previous Wednesday deadline to August 1, a date he emphasized would be final, stating, “No extensions will be granted.”

The delay gave hope to major trade partners such as Japan, South Korea, and the European Union, raising the possibility that agreements to ease duties could still be reached.

However, smaller exporters like South Africa were left confused and

businesses remained uncertain about the direction of future trade policy.

Trump also announced a 50% tariff on imported copper and

signaled upcoming levies on semiconductors and pharmaceuticals, widening the

scope of his global trade offensive that has already shaken markets worldwide.

While the widening tariff regime raised fears of a potential hit to global oil demand, strong travel expectations in the U.S. offered some support.

According to data from the AAA, a record 72.2 million Americans

were expected to travel more than 50 miles over the Fourth of July weekend,

buoying demand sentiment.

On the supply front, the U.S. Energy Information Administration (EIA) cut its oil production forecast for 2025, as CNBC reported.

In its monthly short-term energy outlook released Tuesday, the EIA projected U.S. oil output at 13.37m barrels per day (bpd) for 2025, down from the earlier estimate of 13.42m bpd, citing reduced activity amid declining prices.

The 2026

forecast remained unchanged at 13.37m bpd.

Meanwhile, OPEC+ is expected to approve another substantial production increase for September, following the recent decision to raise output by 548,000 bpd in August.

This includes the unwinding of voluntary cuts by eight members and an increase in the UAE's production quota.

However, analysts note that actual output rises have so far been smaller than

official figures, with most of the additional supply coming from Saudi

Arabia.

Geopolitical tensions also continued to influence oil prices.

A drone and speedboat attack off Yemen killed four seafarers aboard the Liberian-flagged, Greek-operated bulk carrier Eternity C, marking the second such incident in a day after months of relative calm.

The escalation added to concerns, placing a floor under oil prices despite broader market volatility.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,174.49 344.20M | 1.01% 1836.37 |

| ALLSHR | 110,725.47 802.30M | 1.02% 1116.66 |

| KSE30 | 56,462.88 128.04M | 0.96% 535.72 |

| KMI30 | 261,050.23 116.63M | 1.37% 3522.37 |

| KMIALLSHR | 71,230.99 382.91M | 1.23% 862.76 |

| BKTi | 53,229.04 40.62M | 1.01% 532.20 |

| OGTi | 38,590.42 18.06M | 1.28% 488.37 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 84,560.00 | 84,945.00 81,210.00 | 160.00 0.19% |

| BRENT CRUDE | 69.83 | 70.21 67.79 | 0.24 0.34% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -0.90 -0.99% |

| ROTTERDAM COAL MONTHLY | 103.70 | 103.70 99.40 | 4.90 4.96% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.74 | 66.11 63.64 | 0.32 0.49% |

| SUGAR #11 WORLD | 14.26 | 14.71 14.15 | -0.44 -2.99% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks