Oil prices flat with sanctions, tariff fears in focus

MG News | July 21, 2025 at 02:04 PM GMT+05:00

July 21, 2025 (MLN): Oil prices were little changed on Monday as

traders assess the impact of new European sanctions on

Russian oil supply while they also worry about tariffs possibly

weakening fuel demand as Middle East producers are raising output.

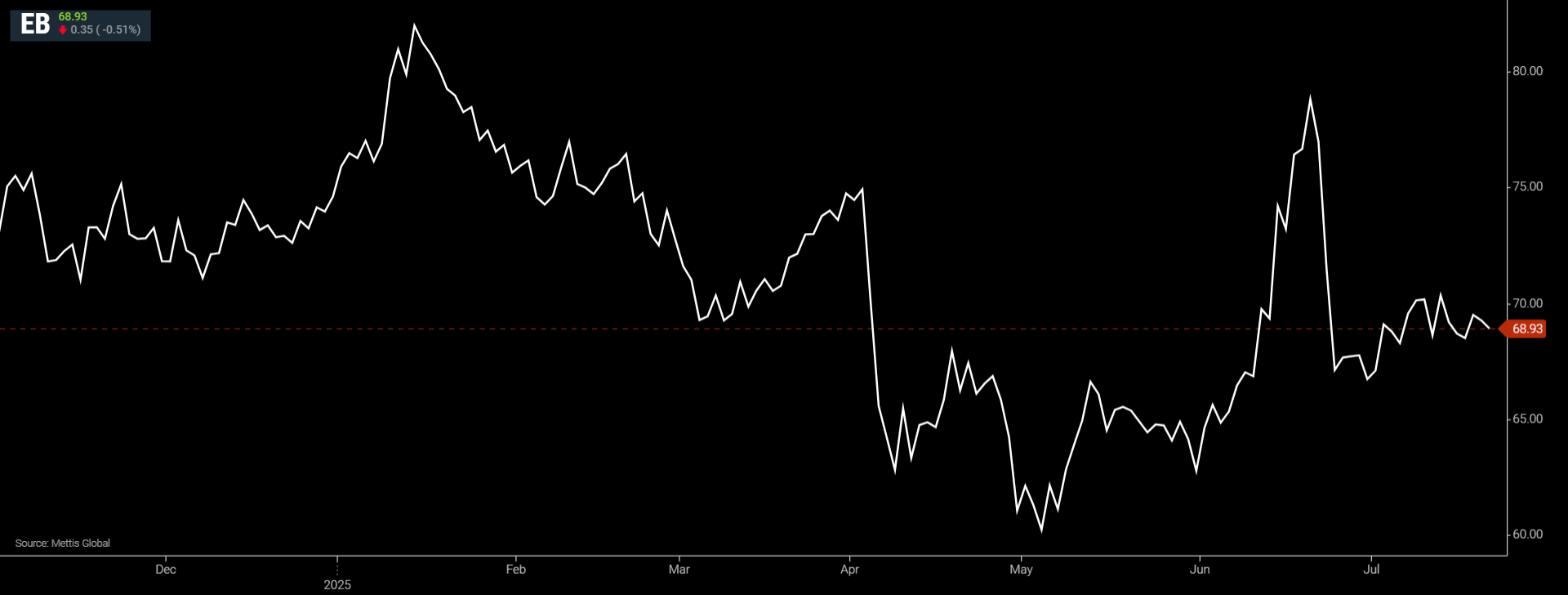

Brent crude futures decreased by $0.35, or 0.51%, to $68.93 per

barrel.

West Texas Intermediate (WTI) crude futures fell by $1.6, or 2.38%, to $65.74 per barrel by [2:05 pm] PST.

The European Union endorsed on Friday the 18th

package of sanctions against Russia over the conflict in Ukraine, which also

targeted India’s Nayara Energy, an exporter of oil products refined from

Russian crude.

Kremlin spokesperson Dmitry Peskov said on Friday that

Russia had built up a certain immunity to Western sanctions, as CNBC reported.

The EU sanctions followed U.S. President Donald Trump’s

threats last week to impose sanctions on buyers of Russian exports unless

Russia agrees a peace deal in 50 days.

ING analysts said the lack of reaction from oil markets

showed that the market is not convinced by the effectiveness of these

sanctions.

“However, the part of the package likely to have the biggest

market impact is the EU imposing an import ban on refined oil products

processed from Russian oil in third countries,” the analysts led by Warren

Patterson said.

“But clearly, it will be challenging to monitor crude oil

inputs into refineries in these countries and, as a result, enforce the ban.”

Iran, another sanctioned oil producer, is due to hold nuclear talks in Istanbul with Britain, France and Germany on Friday, an Iranian Foreign Ministry spokesperson said on Monday.

That follows warnings by

the three European countries that a failure to resume negotiations would lead

to international sanctions being re-imposed on Iran.

In the U.S., the number of operating oil rigs fell by two to

422 last week, the lowest since September 2021, Baker Hughes said on Friday.

U.S. tariffs on European Union imports are set to kick in on

August 1, although U.S. Commerce Secretary Howard Lutnick said on Sunday he was

confident the United States could secure a trade deal with the bloc.

“U.S. tariff concerns will continue to weigh in the lead up

to August 1 deadline, while some support may come from oil inventory data if it

shows tight supply,” IG market analyst Tony Sycamore said.

“It feels very much like a $64-$70 range in play for the

week ahead.”

Brent crude futures have traded between a low of $66.34 a

barrel and a high of $71.53 after a ceasefire deal on June 24 halted the 12-day

Israel-Iran war.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,174.49 344.20M | 1.01% 1836.37 |

| ALLSHR | 110,725.47 802.30M | 1.02% 1116.66 |

| KSE30 | 56,462.88 128.04M | 0.96% 535.72 |

| KMI30 | 261,050.23 116.63M | 1.37% 3522.37 |

| KMIALLSHR | 71,230.99 382.91M | 1.23% 862.76 |

| BKTi | 53,229.04 40.62M | 1.01% 532.20 |

| OGTi | 38,590.42 18.06M | 1.28% 488.37 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 84,560.00 | 84,945.00 81,210.00 | 160.00 0.19% |

| BRENT CRUDE | 69.83 | 70.21 67.79 | 0.24 0.34% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -0.90 -0.99% |

| ROTTERDAM COAL MONTHLY | 103.70 | 103.70 99.40 | 4.90 4.96% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.74 | 66.11 63.64 | 0.32 0.49% |

| SUGAR #11 WORLD | 14.26 | 14.71 14.15 | -0.44 -2.99% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks