Oil prices edge up on strong U.S. demand

MG News | June 26, 2025 at 11:39 AM GMT+05:00

June 26, 2025 (MLN): Oil prices inched higher, extending the previous day’s gains, as a larger-than-expected drop in U.S. crude stocks indicated strong demand amid investor caution over the Iran-Israel ceasefire and Middle East stability.

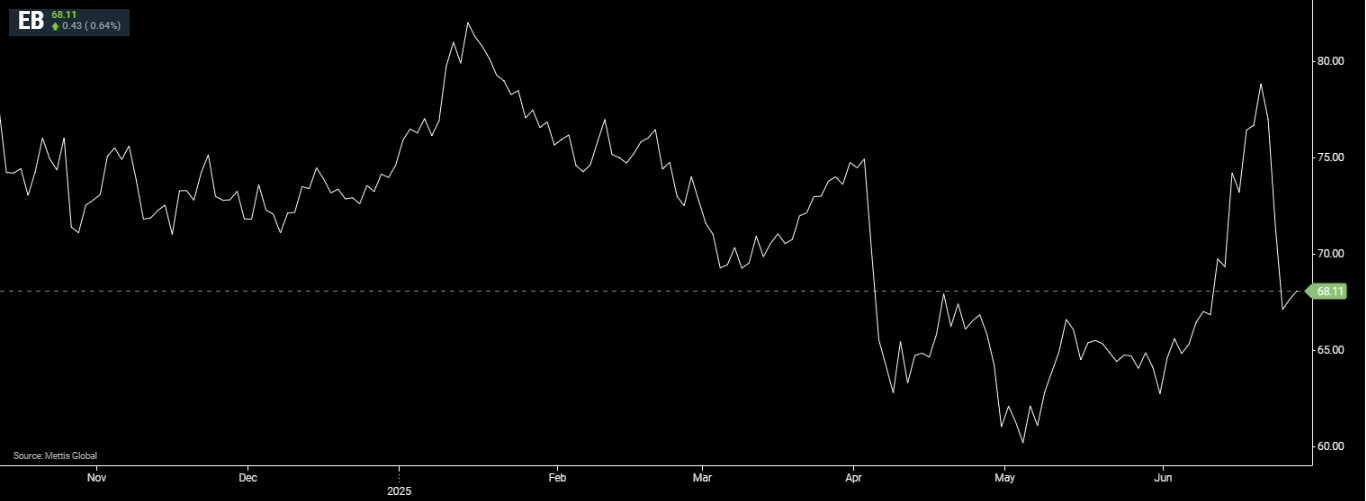

Brent crude futures increased by $0.43, or 0.64%, to $68.11 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.5, or 0.77%, to $65.42 per barrel by [11:40 am] PST.

Oil prices climbed nearly 1% on Wednesday, recovering from early-week losses after data pointed to resilient demand in the United States.

The rebound was supported by a larger-than-expected drawdown in U.S. crude and fuel inventories, signaling strong consumption, as CNBC reported.

According to the Energy Information Administration (EIA), U.S. crude inventories fell by 5.8 million barrels for the week ending June 20, far exceeding analyst expectations of a 797,000-barrel decline.

Gasoline stocks also dropped unexpectedly by 2.1 million barrels, contrary to forecasts of a 381,000-barrel build, with gasoline supplied a key demand indicator rising to its highest level since December 2021.

"Some buyers are favoring solid demand indicated by falling inventories in U.S. weekly statistics," said Yuki Takashima, economist at Nomura Securities.

However, he noted that investors remain cautious, still seeking clarity on the status of the Iran-Israel ceasefire.

Takashima added that market attention is now shifting to the upcoming OPEC+ production decisions and forecasted that WTI crude may return to the $60-$65 range levels seen before the recent conflict.

On the supply front, Igor Sechin, CEO of Russia’s Rosneft, said on Saturday that OPEC+ which includes OPEC and its allies such as Russia could consider advancing its planned output hikes by nearly a year.

Meanwhile, geopolitical developments continue to influence market sentiment.

U.S. President Donald Trump welcomed the rapid de-escalation between Iran and Israel and stated that upcoming talks with Iranian officials may seek a commitment from Tehran to abandon its nuclear ambitions.

Trump also emphasized that while the U.S. has not lifted its "maximum pressure" sanctions on Iran particularly on oil sales there could be a softening in enforcement to support Iran’s post-conflict recovery.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves