Oil jumps as Middle East tensions escalate

MG News | June 23, 2025 at 02:45 PM GMT+05:00

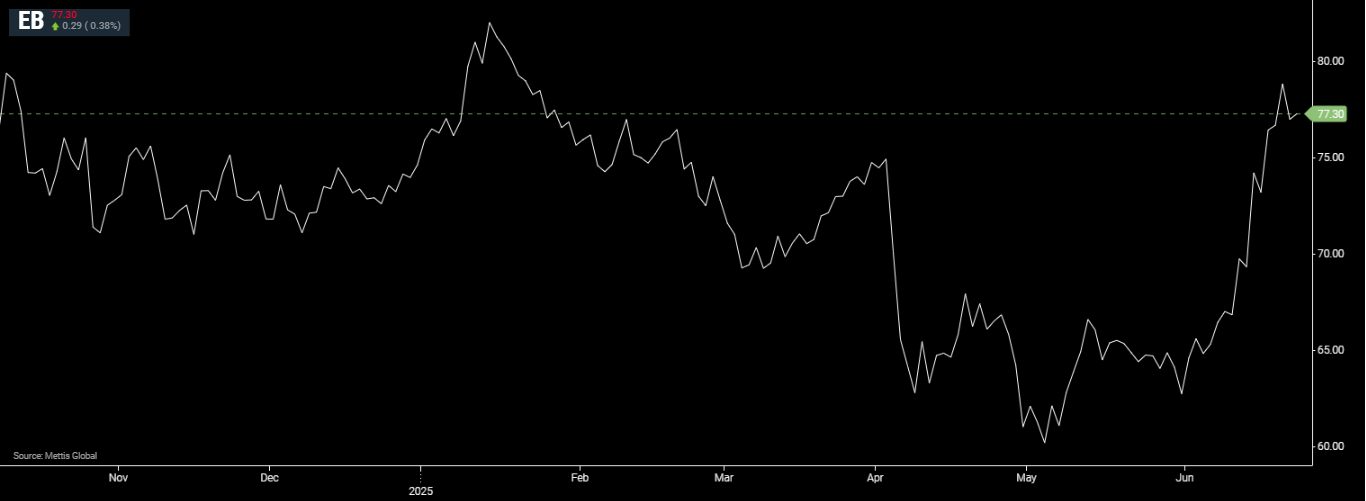

June 23, 2025 (MLN): Oil prices surged to their highest levels since January on Monday, driven by mounting supply concerns after the United States joined Israel in launching strikes on Iran’s nuclear facilities over the weekend.

Brent crude futures increased by $0.29, or 0.36%, to $77.31 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.27, or 0.37%, to $74.11 per barrel by [2:40 pm] PST.

The spike followed U.S. President Donald Trump's confirmation that American forces had “obliterated” key Iranian nuclear sites over the weekend in a joint operation with Israel.

The move marks a major escalation in the ongoing regional conflict, with Tehran vowing retaliation, as CNBC reported.

As OPEC’s third-largest crude producer, Iran plays a critical role in global energy markets.

Traders are now bracing for the possibility that Iran could disrupt traffic through the Strait of Hormuz a strategic chokepoint for about 20% of the world’s oil supply.

Iranian state media reported that the country’s parliament had approved a motion to close the strait, a threat Iran has made before but never acted upon.

“The risks of damage to oil infrastructure have multiplied,” said June Goh, senior analyst at Sparta Commodities, warning that even with alternative pipelines, a Hormuz closure would significantly curtail exports.

She added that many shippers are likely to avoid the region amid growing security concerns.

Goldman Sachs, in a recent note, projected that Brent could temporarily spike to $110 per barrel if flows through Hormuz are halved for a month.

However, the bank maintained that a large-scale supply disruption remains unlikely, citing strong global efforts to avoid such an outcome.

Since the conflict erupted on June 13, Brent has climbed 13% and WTI around 10%. Still, analysts caution that the current risk premium may be short-lived unless supply is tangibly disrupted.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,878.01 102.41M |

-0.05% -61.86 |

| ALLSHR | 84,378.37 284.43M |

-0.26% -222.02 |

| KSE30 | 41,409.23 37.26M |

0.09% 35.55 |

| KMI30 | 190,430.14 35.58M |

-0.33% -639.83 |

| KMIALLSHR | 55,514.74 126.90M |

-0.40% -223.33 |

| BKTi | 38,131.60 9.49M |

-0.93% -358.15 |

| OGTi | 27,614.07 3.42M |

-0.63% -174.07 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,440.00 | 118,465.00 117,255.00 |

1700.00 1.46% |

| BRENT CRUDE | 69.03 | 69.09 68.81 |

0.32 0.47% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.96 | 67.00 66.73 |

0.44 0.66% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks